Table of Contents

Bitcoin has proven to be far from a fad after consistently proving no coiners wrong for over a decade. With the Bitcoin price looking up again, we checked out Swan Bitcoin, a bitcoin-only accumulation platform that enables users to store value in Bitcoin.

After a thorough deep dive into the platform, we say yes to Swan Bitcoin. The platform deserves your attention if you’re trying to own some Bitcoin and also if you’re on the fence about the concept of cryptocurrencies.

Unlike the typical crypto exchange which acts as a centralized entity by retaining custody of user assets, Swan Bitcoin offers something unique. Something that most people in the industry probably didn’t know they needed.

Stick around as we explore this platform and breakdown the benefits that lie in store for you.

Swan Bitcoin Overview

We will rate the platform’s various features on a scale of 1-10 based on our experience interacting with it.

| Rating | |

| Security And Safety | 9 |

| Necessary Requirements | 8 |

| Pricing And Fees | 8 |

| Deposit and Withdrawal Methods | 8 |

| Customer Support | 8 |

Who Swan Bitcoin Is Best For?

Newbies

A newbie who wants to venture into crypto will typically buy crypto from one of the top exchanges, and park their coins there before figuring out their next move.

There won’t be much hand holding or attention given to the newbie, because your usual exchange is full of customers holding different assets.

Swan Bitcoin being a bitcoin-only platform gives undivided attention to new users thanks to their interactive onboarding approach.

They also have crypto experts onboard that can help educate users by breaking down the industry and market.

Private clients

Another thing you rarely see with the typical crypto exchange is the provision of private client services.

This isn’t a jab against your everyday crypto exchange since most of them offer a wide array of assets and services. This tends to spread their attention too thin.

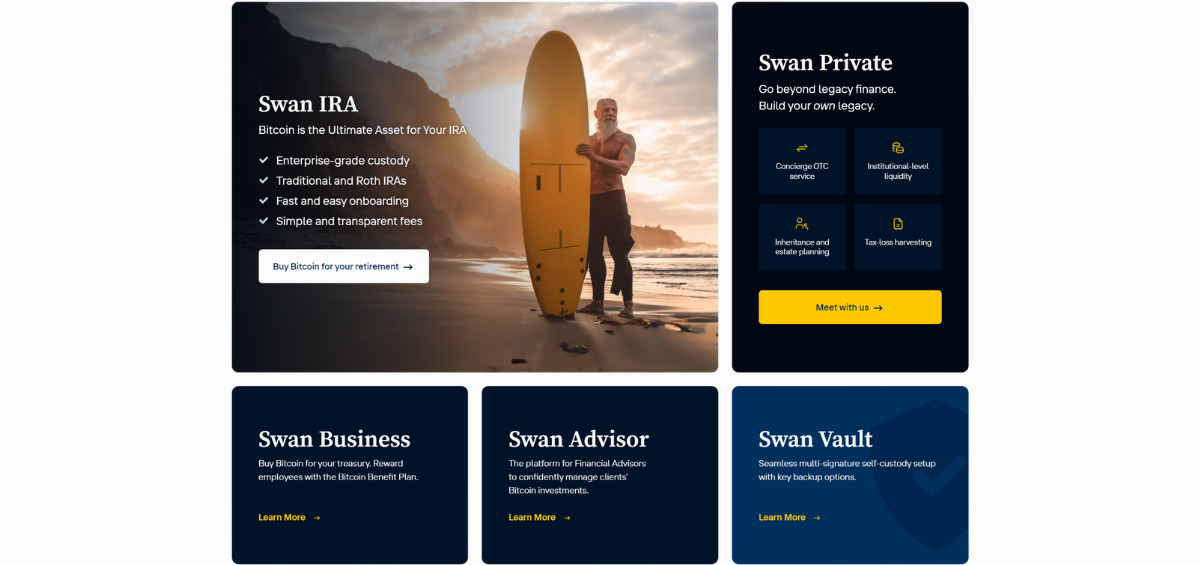

Swan Bitcoin on the other hand, has private client provision where clients can get expert advice on how to handle their bitcoin.

A dedicated account representative is available to help clients navigate the platform while also helping them set up their accounts.

High net-worth individuals

Swan’s bitcoin-only mission affords them the time and leg room to set up a business suit offering that caters to rich individuals.

With so much anti bitcoin sentiment among most old money high-net worth individuals such as Warren Buffet, the provision can help break the ice and lead to new capital inflows.

Swan Bitcoin offers high-net worth clients custody advice, as well as, a guideline on how to buy large amounts of bitcoin.

Enterprises

Thanks to their offline cold storage wallets, the platform can attract not only business suite clients, but also enterprises with large amounts to put away.

Enterprises get a similar value package to that of their high net-worth clients, with custody advice, as well as, account setup advice on offer.

Swan bitcoin helps enterprises and rich individuals build generational wealth with bitcoin.

Savers

Even with all the new investment opportunities being touted by financial experts and influencers, there are people who prefer to keep it simple.

They want their stash stored away in a safe place the old-fashioned way. Swan Bitcoin would be great for such individuals because the platform enables them to save in BTC instead of going through the hassle of buying and selling.

The platform enables and encourages dollar cost averaging. This arrangement involves users setting up a daily, weekly or monthly savings plan.

With the value of BTC expected to grow as years go by, saving in bitcoin could be the best move a saver can make.

Who Swan Bitcoin Is Not For

Altcoiners

Swan is a bitcoin-only platform, so people looking to buy, sell or hold altcoins are better off looking at other exchanges.

Ethereum enthusiasts and speculators for instance, should check out platforms like Binance and Coinbase.

No coiners

People who do not believe in bitcoin and the entire cryptocurrency industry ecosystem, are better off checking out other platforms.

eToro would be a viable alternative because they can access stocks, indices and forex pairs on the platform.

Peer to peer traders

Swan Bitcoin is similar to most crypto exchanges in that it acts as a centralized entity.

At the same time, the platform is different from your usual exchange because it does not support peer to peer trading.

Think of Swan Bitcoin as a smart savings account where you get to stash BTC instead of fiat currency. This way your stash is protected against inflation and gets to appreciate in value as BTC goes up.

No-KYC users

Swan is a regulated platform that requires user details before an account is verified. It collects the information it requires to open a licensed trust account and temporarily holds this information until user accounts are verified.

Upon verification, user details such as social security numbers, and bank details are deleted from the database leaving only a user’s name and email address.

Users that are not okay with this and would rather not reveal any details at all should check out no-kyc platforms like Kraken.

Swan Bitcoin Features Explained

Security and Safety

Swan bitcoin has made impressive moves to protect user funds from hacks and exploits. The first green flag is the platform’s heavy focus on user control of funds.

Prime Trust custody

Thanks to Swan’s collaboration with BitGo, bitcoins will be stored with BitGo under the user’s name, making the user the sole legal owner of the assets.

That means legal protection incase of trouble, and also liquidity protection with BitGo known for holding billions of dollars worth of cryptocurrency.

This is a departure from the norm, where exchanges retain custody and users lack direct control.

Cold storage wallets

Cold storage wallets have become popular among exchanges after the FTX debacle and Swan has been keen on it. Accounts are secured using one-time passcodes instead of email and password logins to ensure safety.

Military-grade data protection

The platform’s first line of defense here is to keep minimal user data. Necessary data is encrypted with military-grade AES-256 standard, while transaction traffic is protected with industry-standard TLSv1.2 encryption.

This ensures that the transfer of coins can only happen with user authorization.

Swan’s track record

There hasn’t been any official case of Swan being hacked directly, so it’s difficult to advise on whether you would get your money back if that were to happen.

We can only trust the solid security measures they have put in place to reduce and almost eradicate the possibility of hacks and exploits.

Swan however, was mentioned in a hack incident that occurred back in September to one of its custody partners, Fortress.

They took to X to deny any reports of Swan user funds being affected by the hack. Swan then confirmed that user funds were safe in BitGo insured cold wallets.

Proof of reserves?

Swan encourages self-custody to defeat liquidity risk and custody risk. Huge amounts of user funds are also held by custody partner BitGo, a company that holds over $64 billion worth of digital assets.

This negates the need for Swan to declare proof of reserves.

Opening An Account With Swan Bitcoin

Setting up your Swan account is easy and straightforward. Go to SwanBitcoin.com and enter your email address to receive a verification link.

Clicking the link will take you to a page that will require your residential details and phone number.

Click the link sent on SMS to your phone and follow the prompts that follow before agreeing to partner agreement terms. Following these steps will activate your account. You will then be ready to make BTC deposits.

Once your account is live, you can do instant deposits (ACH) of $10 worth of BTC minimum, with a daily maximum deposit of $50,000. This daily maximum gets reset on a 24-hour rolling basis.

Recurring buys also have a minimum buy of $10 with daily recurring buys capped at $1428 a day, and $10,000 weekly and monthly.

Wire transfer and direct deposit conversions are capped at $1 minimum and $100,000 maximum whether it’s daily, weekly or monthly.

Pricing & Fees

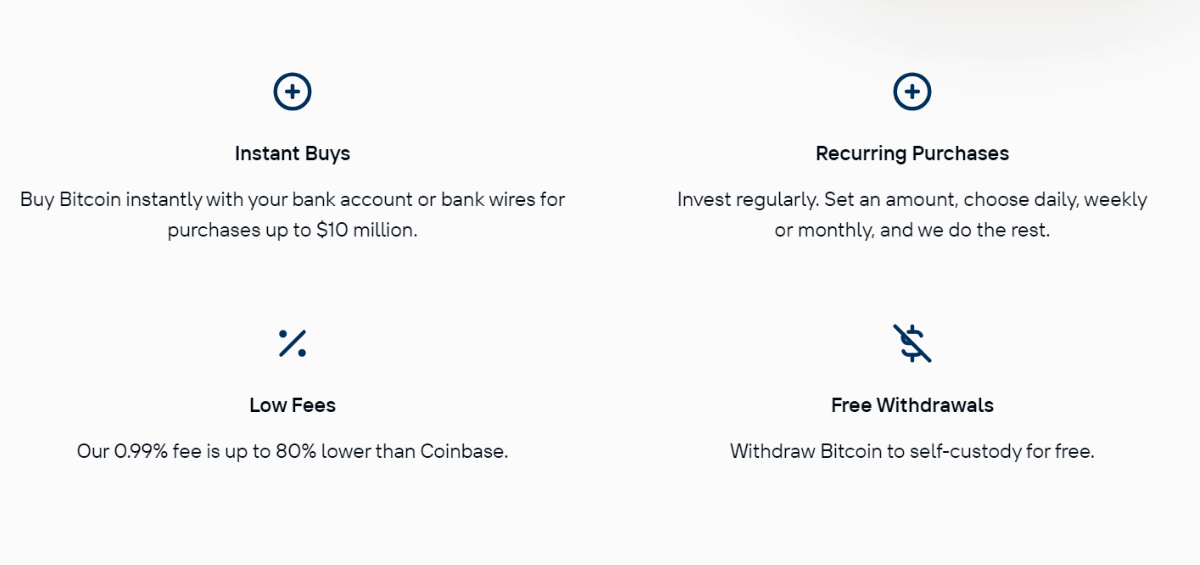

Swan charges bitcoin fees of 0.99% for bitcoin purchases with no charges on withdrawals. That is all. You can fund your account via direct deposits or international wire transfers.

Deposit Methods

The platform is open to a variety of deposit methods. Users can opt to deposit funds via wire transfers, direct deposits or ACH payments.

They can do this using several fiat currencies which includes the most prominent ones such as USD, Euro, GBP, AUD and CAD.

Depositing funds into a crypto exchange can be intimidating especially after the FTX debacle of 2022.

Swan stores your crypto in trusted cold storage wallets, so you don’t have to worry about a run on the exchange when other custodial exchanges go through liquidity issues.

Withdrawal Methods

Withdrawing from Swan is a different experience compared to withdrawing from other exchanges. Your BTC is held by a regulated trust company like BitGo which has a $250 million insurance policy.

This means the withdrawal process has to pass some background checks. To protect your account from fraudulent activity, the trust company puts your coins on lock and also adds an extra layer of protection known as a “locking period”.

This means you first have to unlock your coins before proceeding with withdrawal. Your coins unlock in different time periods depending on your bitcoin purchasing method. Here is a table that breaks it all down.

| Bitcoin Purchase Method | Locking Period |

| wires, direct deposit, BTC deposits & referral BTC | 24 hours |

| instant ACH < $2,500 | 10 days for most customers; 5 days for long-standing customers |

| instant ACH ≥ $2,500 | 30 days for most customers; 10 days for long-standing customers |

| recurring ACH < $2,500/month | 10 days |

| recurring ACH ≥ $2,500/month | 30 days |

| gifts | 30 days |

When your coins are under lock, you cannot access them until the locking period has elapsed. This does not mean that your bitcoin is handicapped in any way.

Your coins still get to gain or lose value according to market prices.

Swan Bitcoin recommends users withdraw their coins into a Bitcoin wallet for maximum security. The withdrawal methods available are “manual” and “auto”.

Both processes require users to set up a bitcoin wallet before proceeding to withdraw after the lock period has elapsed. You can find the step-by-step process of withdrawals using either method here.

Switching Between Currencies and Blockchains

Since Swan is a BTC investment platform, it does not offer a direct cash-out option that switches your coins to fiat currency.

It is not a crypto onramp service like Moonpay, Binance or Coinbase. Switching your coins to fiat or other cryptos can only happen if you transfer them to another wallet. You can do this in three steps;

Swan to different wallet

Transfer the coins from your Swan account to a different account in another exchange such as Coinbase, that supports crypto-fiat conversions. This makes your coins accessible and ready to be converted to cash.

Place sell order

Once the coins are transferred to a different exchange, place a sell order for the amount of BTC you want to convert. The exchange will match your order with a buyer and the fiat proceeds will reflect in your account.

Withdraw

With fiat money now available in your account, you can withdraw money from the exchange into your bank account.

This process may involve varying amounts of withdrawal fees depending on the crypto exchange you use.

History Of Downtime

Swan has had a history of downtime which has led to mass speculation. The company has been quick to dismiss any talk of liquidity difficulties.

The company attributed the outage in July last year, to an extended maintenance period where user funds had been transferred to their custody partners at the time, in Fortress and BitGo trust company.

Such outages are not common though and the exchange has not received any negative press since then.There have also been no reported cases of BTC losses, even during the outage period last year.

Customer Support

Swan Bitcoin has a help center that caters to customer needs in a comprehensive way. The help center covers a wide array of relevant topics when providing answers to customer queries.

One of the quickest ways to contact a customer support team member is to submit a help request online by filling this form. These queries are responded to within 24 hours.

Users can also get help through email at [email protected] and also via Chatbot where a support representative is on hand to answer customer queries.

There is also a Swan support center for complex issues and a Twitter/X account for customers to reach out to social media.

The customer support team is present, responsive and helpful with decent response times as per our experience.

Alternatives

Swan Bitcoin is a decent exchange/bitcoin accumulator, but how does it compare to peer platforms that offer bitcoin to customers?

One of Swan’s biggest competitors is BitcoinIRA which offers users the chance to save and grow wealth with BTC through a tax-advantaged IRA. This is how they compare.

| SWAN | BITCOINIRA | |

| Investments Options | Bitcoin | Bitcoin and 60+ crypto asset securities |

| Deposit/Funding Fee | None | 5.99% of the deposit amount |

| Trading Fee | 0.99% | 2% |

| Custody Fee | 0.25% per year, assessed monthly for balances > $100,000; $20/month for balances < $100,000 | 1% per year |

| Overall Rating | ⭐⭐⭐⭐ | ⭐⭐⭐ |

| Signup | Swan | BitcoinIra |

When it comes to charges Swan Bitcoin offers the best deal compared to its competitors.

Percentage Fee on Purchase Of:

| $50 | $150 | $500 | $1,500 | ||

| Swan | Any Buy | 0.99% | 0.99% | 0.99% | 0.99% |

| River Financial | One Time Buy | 1.20% | 1.20% | 1.20% | 1.20% |

| Recurring Buys | 0% (after several orders) | 0% (after several orders) | 0% (after several orders) | 0% (after several orders) | |

| Coinbase | One Time Buy | 3.98% | 1.99% | 1.49% | 1.49% |

| Gemini | One Time Buy | 3.98% | 1.99% | 1.49% | 1.49% |

| CashApp | One Time Buy | 2.24% | 2.01% | 1.75% | 1.50% |

Source: whatismoney.info

Conclusion

Think of Swan Bitcoin as a bitcoin accumulator more than a crypto exchange. You can treat it like an OG savings account but for Bitcoin only.

The difference is, instead of a slow interest rate that might be eaten up by inflation, your account value grows or dips depending on Bitcoin’s price action.

With the BTC price expected to grow as we look into the future, a bitcoin stash could be the best retirement package to gift yourself.

The exchange has the lowest trading fees compared to its top rivals and has a unique private-client service offering, that serves high net-worth individuals and enterprises.

Regular retailer clients also get a dedicated account executive at their service, so personalized services are not only for the rich.

Frequently Asked Questions

What Services Does Swan Bitcoin Offer for Crypto Users?

Swan Bitcoin is an investment platform that offers asset management services, focussing only on bitcoin.

It enables clients to buy or sell crypto and also offers crypto custody services.

Personalized services are also offered with account executives on deck to help set up accounts and advice on market moves.

How Does Swan Bitcoin Protect Its Users and Their Assets?

Swan Bitcoin works with custody partners like BitGo, to ensure client funds are stashed away safely. BitGo has a crypto insurance facility worth over $250 million, this helps keep investors at peace when interacting with Swan.

Investor funds are also kept offline in cold wallets for safety, with investor data encrypted with military-grade AES-256. User traffic is also encrypted using industry-standard TLSv1.2.

What Are the Costs Associated with Using Swan Bitcoin?

Buying bitcoin through Swan can be up to 80% cheaper compared to buying BTC through other exchanges.

The transaction charges are at 0.99% for all bitcoin buys.