Table of Contents

We continue to explore the landscape of cryptocurrency exchange trading and investing to determine what will best suit the Libertas Bella community.

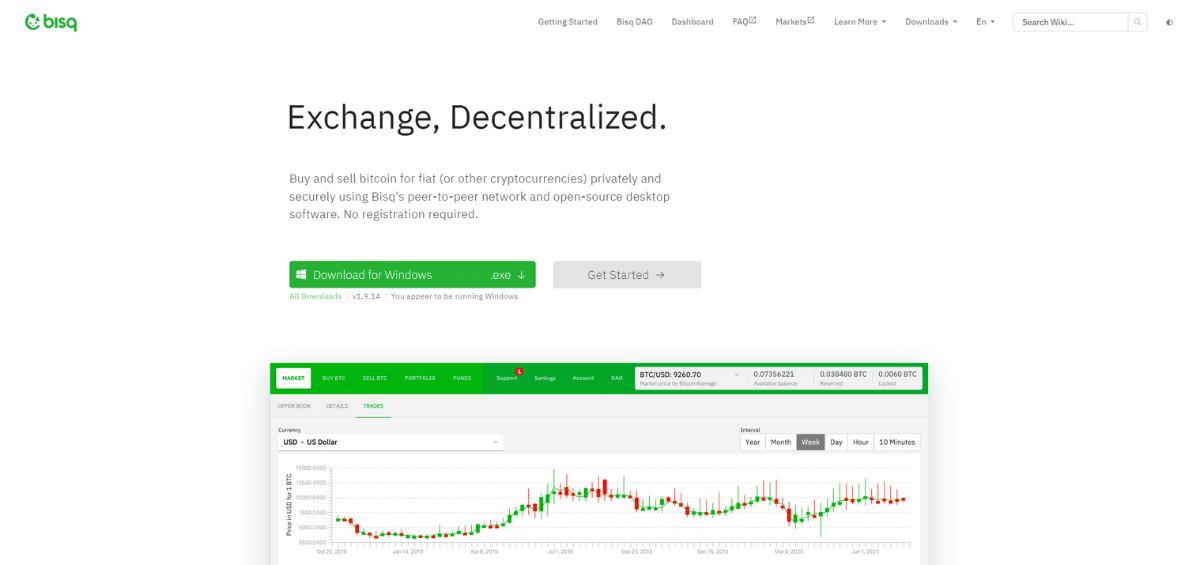

Bisq is a desktop software protocol that delivers a fully peer-to-peer (P2P) decentralized exchange trading network. After several weeks of testing the available options, our verdict is a definite Yes.

The Bisq platform offers a solid entry point into the world of peer-to-peer crypto trading and decentralized crypto exchanges. A clean interface is married with a series of how-to guides that make the world of open-source private and anonymous exchange much less intimidating.

Let’s examine the benefits of the Bisq peer-to-peer network and highlight a few limitations that we uncovered.

Bisq Overview

| Rating | |

| Security And Safety | 9 |

| Necessary Requirements | 10 |

| Pricing And Fees | 5 |

| Deposit and Withdrawal Methods | 7 |

| Customer Support | 7 |

Who Bisq Is Best For?

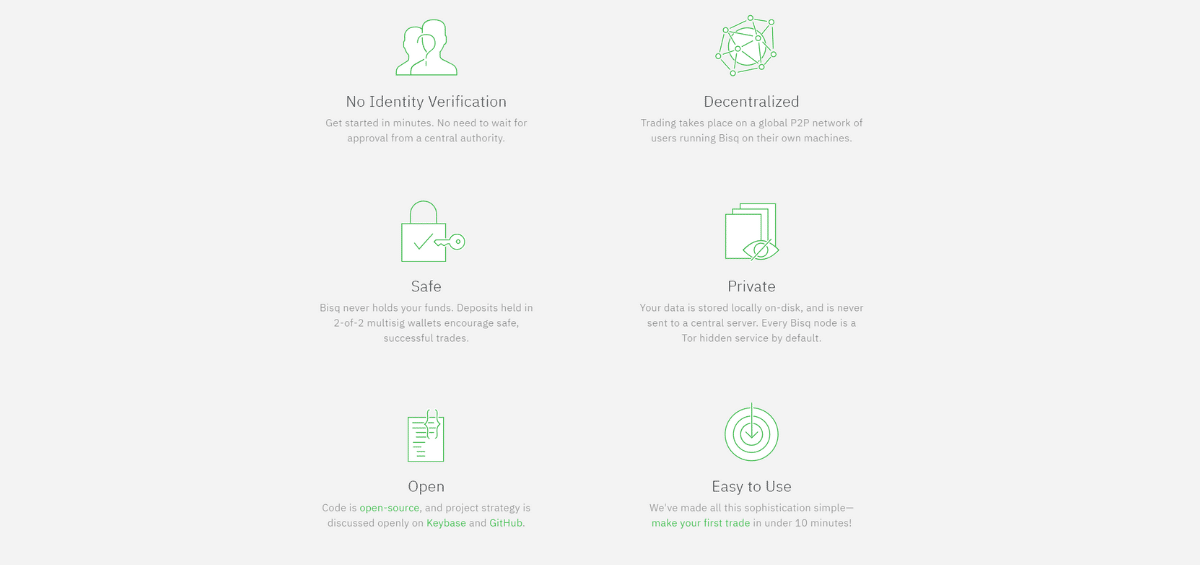

The Bisq network is designed for users who value the privacy, anonymity and control over their data and funds that full decentralization offers. Its distributed network is also censorship resistant for those concerned about government shutdown or bank interference.

A clean and user-friendly interface makes Bisq a suitable place for beginners to get started in the world of hands-on self-custody crypto trading, but its protocol-based universe is also perfectly suited for the highest levels of P2P building and trading.

Novice users – those with at least a basic knowledge of Bitcoin and preferably P2P marketplaces – will find a “Getting Started” area to learn the specifics of Bisq.

Clear sections describe the 4-step start-up process, with links for deeper explanation. Each of the 4 steps also comes with a 2-minute video tutorial.

- Download and Install Bisq

- Backup Keys, Write Down Seed Words

- Create a Payment Account

- Do a Trade

This opening guide also serves as a great general introduction into the world of self-custody P2P trading, including how seed words and data directory backups work.

A Bisq wiki is also provided which presents a concise overview of where to find more information and have all questions answered either on site or through the many community channels.

After downloading and opening the Bisq service on your computer (a fairly lengthy one-minute process to connect to the Bitcoin Mainnet via Tor), users immediately enter the order book and trading screen.

Compared to the larger centralized exchanges, this is a very stripped-down but clear interface with tabs for Buy, Sell, Portfolio, Funds, Support, Settings, Account and DAO (decentralized autonomous organization).

We particularly like the first notice that new users will see under Account. A text prompt fully describes how to get started, how to handle security, and a reminder that all data is stored on your computer and is not handled by Bisq.

Buy and sell areas open up the P2P marketplace and prompt users to create an offer.

Whether or not you ultimately choose Bisq as your single trading source, newer users will now possess the requisite skills to understand and grow toward more advanced trading.

Experienced users who already understand the value of trading bitcoin and altcoins privately in a P2P marketplace will gravitate to Bisq for that feature alone.

More advanced users will also likely have a larger stash of crypto to draw from and will benefit from high starting limits on altcoins of 2 BTC.

The array of fiat options also can correspond with higher-than-normal starting limits allowed by centralized exchanges.

Developers and others who would like to dabble in running their own seed nodes will find a robust community of like-minded people to contribute to the network.

There is a compensation program for seed node operators of at least 200 BSQ – the Bisq native token – to start and 50 BSQ monthly.

Who Bisq Is Not For?

Bisq should not be used in areas where crypto remains illegal, including Ghana, Lesotho, Sierra Leone, Egypt, Libya, Morocco and Bolivia. Full list here.

Absolute beginners

While we still recommend that first-time Bitcoin devotees investigate and utilize the free Bisq wiki to gain an education, the absolute beginner who has not yet acquired any Bitcoin will be hampered by the security deposit requirement to begin trading.

The overwhelming amount of autonomy in choosing trading partners, managing payment methods and the time spent manually configuring options will likely be too daunting for the completely uninitiated.

Absolute beginners also might not be able to detect some of the scams and red flags that a more seasoned crypto investor might recognize.

The lack of a demo trading account is one final missing piece that could add comfort to first-time users.

Certain advanced users and institutional traders

While Bisq does have many of the components that are best utilized by users with advanced knowledge, limitations will exclude portions of advanced traders.

Bisq does not have the tools available, nor the low-cost fast confirmation times with high liquidity needed for effective day trading.

Although high-limit trades can be completed, there are no tools or incentives for institutional traders.

Coupled with a lack of regulation, Bisq is not suitable for traders who wish to conduct business in a traditional centralized investment environment.

Bisq Features Explained

Security and Safety

This is the single most important area for all decentralized systems; without security and safety in a trustless environment, all of the other features and services are worthless.

If done correctly, it will create the greatest value of all for those who seek it: a safe, private way to trade funds without permission from central authorities.

It is essential to first understand that security and safety in a decentralized environment is a shared responsibility between the creators of the software and the users, with most of the weight being placed upon the individual.

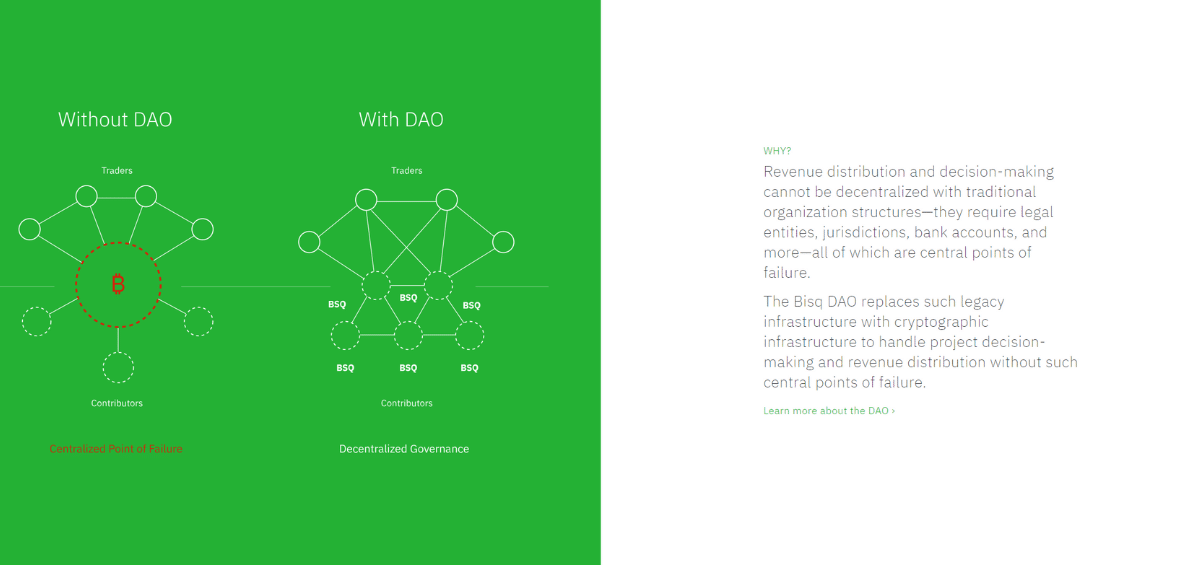

Bisq is merely a protocol wrapped in the trappings of a decentralized exchange. Bisq is governed as an open-source DAO.

There is no physical place of business, no centralized databases or servers, and Bisq does not hold funds. Bisq is designed only to facilitate transactions between parties in a trustless manner.

For those who consider safety and security to be their own responsibility and do not trust government and bank intervention into their finances, and do not trust a centralized exchange to always release your funds as instructed, Bisq offers a best-in-class service.

Using Bisq is primarily dependent upon how knowledgeable and comfortable each user is with being their own bank and their own exchange. Just as one would expect a centralized exchange to take every possible precaution against hacks, phishing and other security breaches, each user must protect their own computer with the same rigor.

Your computer is essentially the gateway to the Bisq code and how you will be using it.

Bisq has fulfilled its side of the security agreement by first building its service upon the Tor network.

Tor relays traffic in an encrypted and distributed set of commands that anonymizes data and protects users from the various tracking and data-collection methods typical of internet use.

Tor forms the basis for the censorship-resistance that Bisq users are seeking. Each Bisq trade is then encrypted as well, with none of the trading data stored or recorded.

Bisq keeps funds secure by never taking custody of any tokens used in trades with the exception of escrow, discussed below.

All wallets are uniquely generated, private and non-custodial by default.

Another layer of privacy and security is presented by Bisq’s total lack of integration with banks or third-party payment systems.

All funds are exchanged between parties who agree on the method of payment outside of the Bisq interface.

These parameters for privacy and security completely remove any concerns about loss of funds due to systemic hacks, but it does call into question how trade disputes are handled.

In a fully anonymous trustless peer-to-peer system, there must be a method of arbitration to account for fraudulent activity, mistakes or other misuses of the network.

First, all trades include a security deposit made by each party. Deposits and trade agreements are then locked in a 2-of-2 multi-signature escrow until both parties prove the completion of their respective obligation.

Any disputes are then handled by a decentralized third party who serves as mediator and arbitrator via end-to-end encrypted chat.

Bisq stresses that the security deposit is an effective way to ensure good behavior. If arbitration determines that trading rules have been violated, some or all of the security deposit will be awarded to the counterparty.

A recent update has added yet another layer of security by giving users the option to “clear sensitive data” from old trades that could contain bank account information and other identifiers exchanged between parties.

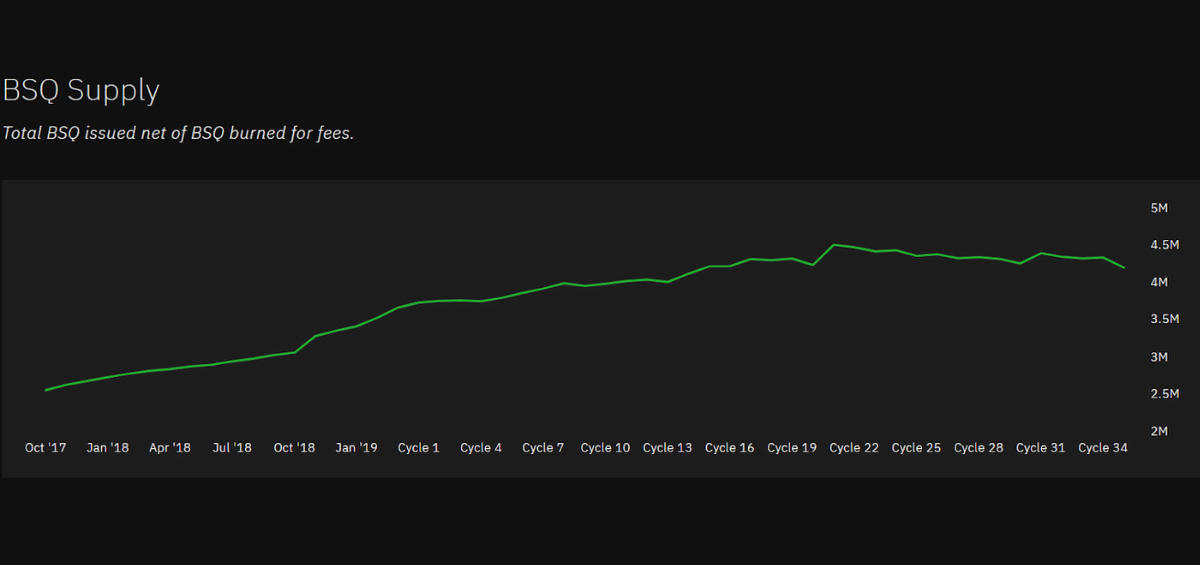

Lastly, because Bisq operates as a DAO, the health of the Bisq token, BSQ, is important for maintenance, development and continued operation of the platform.

This can be considered an insurance fund, and Bisq offers a transparent updated view of the health and performance of its token, as shown below:

All cycle results are further broken down into each unit for users who would like to trace the full history.

Opening An Account With Bisq

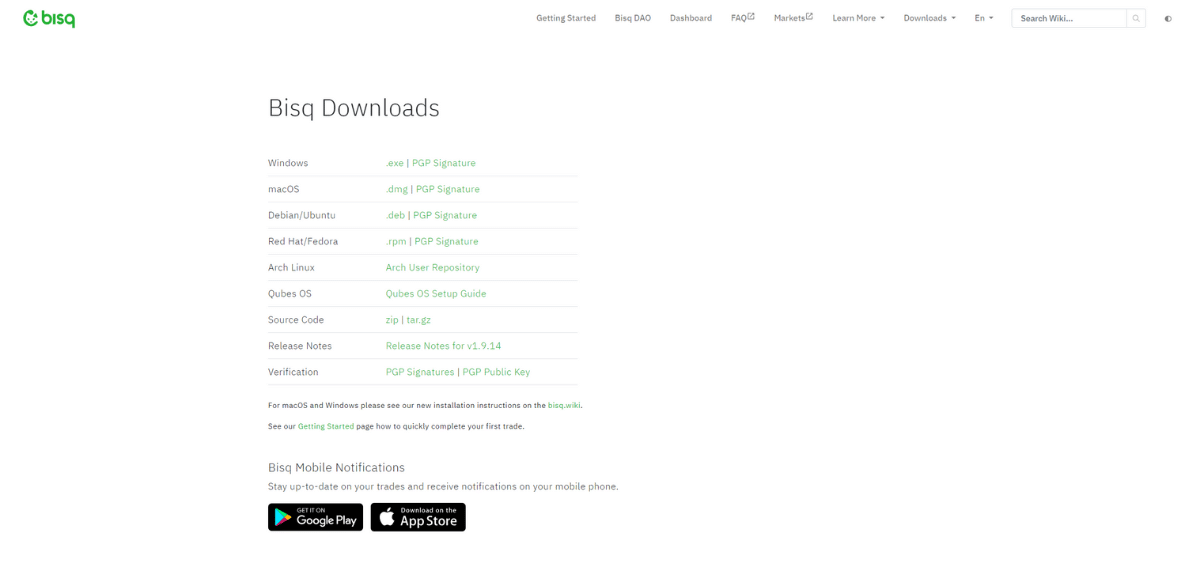

Bisq is not accessed through a standard sign-up process, it is made available as a desktop software download for Windows, macOS, Debian/Ubuntu, Red Hat/Fedora, and Arch Linux.

Because Bisq is open source, there is also the option to build Bisq yourself from its source code.

Bisq is a peer-to-peer decentralized network that will never ask for personal information, making it the ultimate in no-KYC. However, this requires users to back up their private keys and write down their seed words as a means of manual security.

After Bisq is installed, it is necessary to configure Bisq with your payment method.

It should be noted that there are account buying limits that operate through a tiered system.

Altcoins can be traded up to 2 BTC immediately.

Fiat follows a different structure:

- Accounts are first signed with a new-account buy limit of .01 BTC, after which you can complete your first major buy as defined by your payment method.

- After 30 days, the limit is raised to 50% of the maximum buy.

- After 60 days, the maximum buy limit is approved.

The full description with tables can be consulted here.

Pricing & Fees

Maker Vs Taker Fees / Trading Fees

Trading fees are integrated into a fund for Bisq DAO for both making and taking an offer. These fees are paid in either BTC or the native wrapped Bitcoin token BSQ.

Traders begin by first choosing how they would like to pay their fees. A convenient fiat currency option is also available for easier calculations if needed.

Maker 0.0015 BTC or 18.57 BSQ

Taker 0.115 BTC or 142.38 BSQ

The combined BTC trading fee rate is 1.3% (0.15% maker and 1.15% taker). Minimum fee to avoid dust is 0.00005 BTC.

Combined BSQ trading fee rate is targeted at 0.65% (0.075% maker and 0.575% taker). Minimum fee to avoid dust is 0.03 BSQ.

Bisq also offers a 50% discount for using BSQ to pay fees in order to help strengthen the native token.

Bisq states that BTC fees remain fairly constant, but the BSQ rate can fluctuate as they are updated each cycle after being voted upon through the DAO.

It’s always smart to consult the fees page for any changes prior to trading. You also need to remember that mining fees apply to on-chain transactions and a refundable deposit is needed for escrow requirements.

Deposit and Payment Methods

It is first necessary to have at least .01 BTC to safely begin trading, due to the security deposit requirements. This can be transferred from any wallet or exchange.

Bisq only handles BTC and its native token on Bisq itself; all other currencies are listed as payment methods within the marketplace that are transferred outside of Bisq between the two parties.

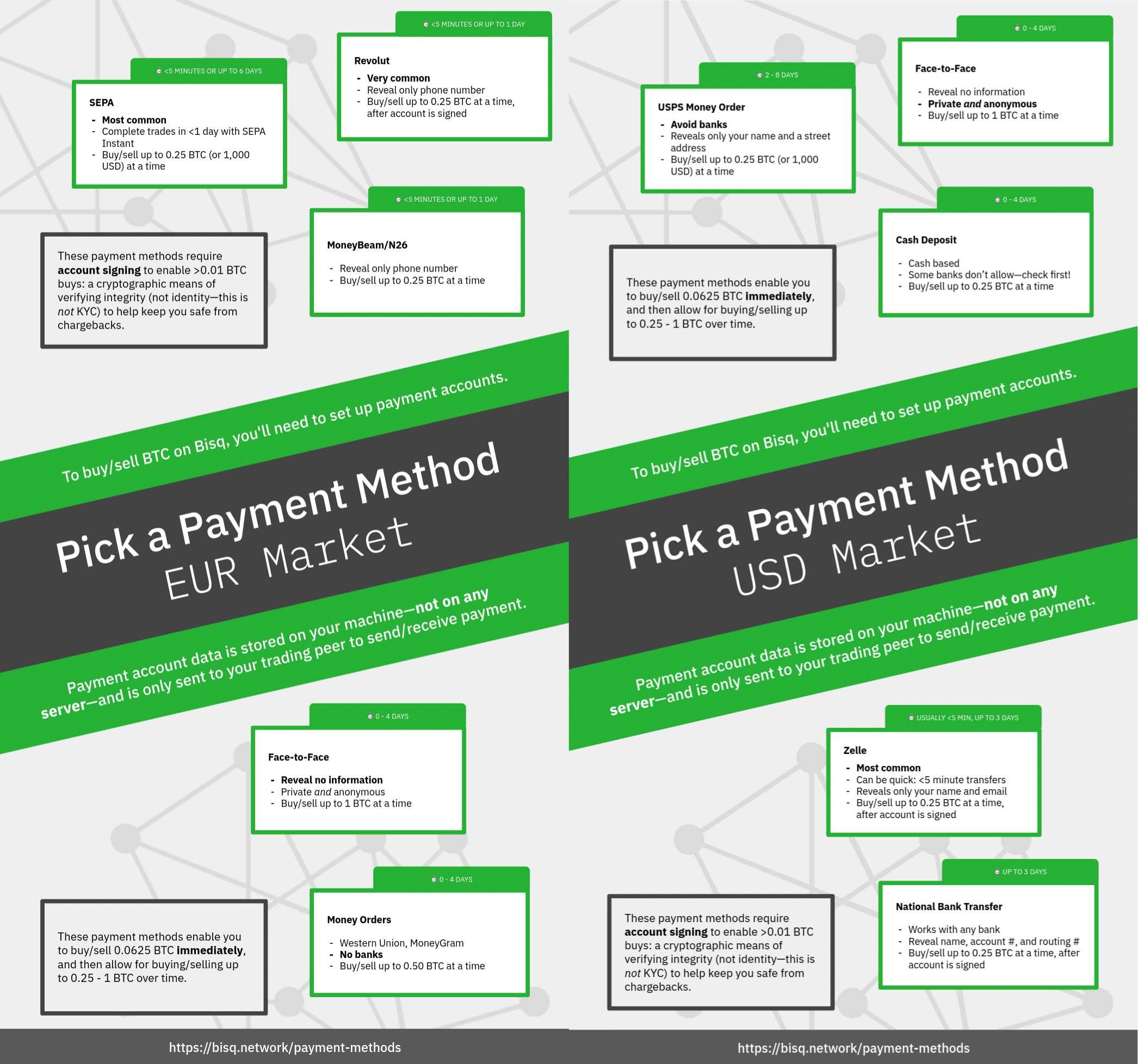

Fiat payment methods are extensive at more than 50 options, but Bisq is quick to point out that these methods are highly dependent upon risk, regional availability, transaction limits and many more parameters.

Chargeback risk is perhaps the most important to consider which is why Bisq does not support systems with easy chargebacks such as PayPal, Venmo, and Cash App.

Bisq offers a detailed and constantly updated list of fiat payment methods here for easy consultation broken down into 5 categories:

- Payment Method

- Region

- Trading Period

- Per-trade Limit

- Notes

This makes a complex system quickly understandable once you determine which method works best for your situation.

The most common payment methods include:

- ACH bank transfer

- Amazon Gift Cards

- Cash by Mail

- CelPay

- Domestic Wire Transfer

- Moneygram

- SEPA

- Skrill

- Strike

- US Post Money Order

- Uphold

- Western Union

- Zelle

Highest current volumes are SEPA for Europe and Zelle for USD, giving traders the highest probability of easy fulfillment.

Two helpful illustrations provided by Bisq are shown below for the US and Europe and offer additional notes.

Popular altcoin payment options include Monero (XMR), Ethereum (ETH) and Zcash (ZEC).

Withdrawal Methods

Each of the above payment methods applies on the withdrawal side of a trade. Additionally, funds can be sent to your Bisq wallet or an external wallet.

Switching Between Currencies and Blockchains

Trading speed is a major sticking point for peer-to-peer systems and Bisq is no different. Trades can be done quickly if buyer and seller are both immediately available, especially if they’ve established a prior relationship. However, there is a standard 24-hour window for trade confirmation.

Bisq is further hampered by a shallow user pool with low trading volume where trades are occurring with regularity among only a handful of cryptos.

History Of Downtime

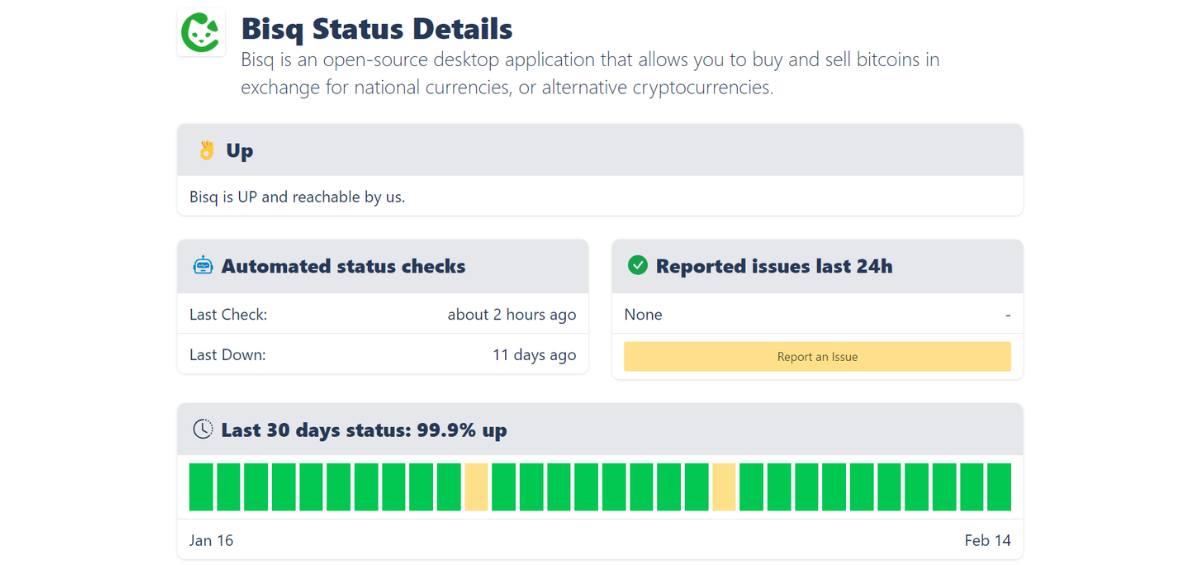

Bisq has a solid uptime history, as indicated below by third-party monitoring done by SassHub over the previous 30 days, showing only two short downtime notices.

The best place to identify ongoing issues and resolutions, including arbitration, is at the GitHub support page dedicated to Bisq.

It is notable that Bisq was hacked in 2020 when a trade protocol flaw was exploited that resulted in hackers stealing $250,000 from 7 different users.

Bisq quickly acknowledged the hack, halted trading, and fixed the flaw within 18 hours. Bisq also reportedly compensated the victims. There has not been another hack since.

Customer Support

Traditional direct customer support options are limited due to the intense focus on privacy. However, in-trade live chat is available for dispute resolution, most importantly. Users can also communicate with the Bisq community via the following methods:

- FAQ

- Bisq wiki

- Matrix bisq.chat

- Telegram

- GitHub

- Bisq forum

Alternatives

Bisq vs. Alternatives

| BISQ | PAXFUL | COINOMI | |

| Founded | 2014 | 2015 | 2014 |

| Users | ~ 5,000 | 12 million | 1+ million |

| Cryptos | 20+ | 7 | 1500+ |

| Spot Fees | 0.1% – 0.7% | 0.25-2.5% | Variable mining, transaction |

| KYC | no | no | no |

| Mobile App | notifications only | yes | yes |

| Card | no | no | no |

| Countries | Only where crypto is illegal | Only where crypto is illegal, sanctions | Only where crypto is illegal |

| Security Notes | E2EE, Tor | 2FA, Cloud storage | No cold storage |

| Best For | Decentralized P2P | Latin America P2P | Privacy advocates, advanced traders |

| Overall Rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Signup | Bisq | Paxful | Coinomi |

Conclusion

Bisq is the best option for novice to advanced traders who value the highest levels of privacy and censorship resistance when exchanging funds in a peer-to-peer marketplace.

Bisq’s multifaceted approach to autonomy, sovereignty and security comprises everything from its lack of identity verification, to its Tor architecture, end-to-end encryption, private wallet and more.

A modern, intuitive, and no-frills interface also welcomes all levels of traders by removing many of the more intimidating options.

The downsides of using Bisq are essentially the same as using a computer with all privacy features enabled and a VPN.

It should be understood that all decentralized systems which employ the full range of privacy features will be slower, more cumbersome and will have certain features disabled that are default on the average centralized trading platform.

Another limitation for some people is that Bisq only runs as a desktop application with a notable lack of Android or ioS mobile trading, though notifications can be received to your mobile device.

If one is willing to accept the tradeoffs from the decentralized nature of Bisq in functionality, speed, and cost, the architecture of privacy and security that Bisq provides to its users leads the pack.

Frequently Asked Questions

What Services Does Bisq Offer for Crypto Users?

No-KYC download for a wide range of platforms. Private wallet. Mobile app for trade notifications and alerts. Beginner tutorials and wiki serve as a comprehensive learning library.

How Does Bisq Protect Its Users and Their Assets?

Completely non-custodial. No registration or ID requirements. Built on Tor to further hide services. No central servers or databases.

Network-wide data encryption. Makers and takers both add a security deposit, refunded after trades are complete.

Multi-signature address escrow security. Trade disputes are handled through encrypted mediation and arbitration.

What Are the Costs Associated with Using Bisq?

Spot maker and taker fees 0.1% – 0.7%. Other fees include cryptocurrency-specific withdrawal fees, P2P market fees and third-party fees.