Table of Contents

We continue to dive into the good and bad of crypto trading and investing to determine what will best suit our community here at Libertas Bella.

We have seen many companies collapse, as well as rebrand, after the typical fallout from the close of each crypto cycle.

Case in point: we began preparing our Okcoin review and were presented with a website notification that they would be rebranding to OKX for their global operations due to changes in local regulations.

A statement from the company at their Twitter-X account noted that they would begin focusing more on the U.S., as well as committing to building out more services for DeFi and Web3.

As of January 31st 2024, all account holders have been notified about how to migrate their assets to the new brand.

Our experts previously had signed up for Okcoin and were familiar with that interface, but have since been thoroughly testing OKX to assess its functionality and any signs that OKX is in fact expanding their offerings.

OKX is a Web, Android and iOS hybrid crypto exchange that offers a full range of traditional cryptocurrencies along with DeFi, NFTs, DApps, and Web3 wallet integration. After a complete review, our verdict is an enthusiastic Yes.

The OKX exchange is presented in an exceptionally clean package that is perfect for novice traders. Yet, not far beneath the surface are all of the tools that intermediate, advanced, and institutional traders will need.

Let’s dive into benefits that can be found at OKX and highlight the deficiencies that we uncovered in our extensive testing.

OKX Overview

| Rating | |

| Security And Safety | 9 |

| Necessary Requirements | 8 |

| Pricing And Fees | 8 |

| Deposit and Withdrawal Methods | 6 |

| Customer Support | 8 |

Who OKX Is Best For?

OKX is ideal for users who would like the choice between centralized or decentralized trading options.

A user-friendly, clean interface makes OKX a breeze for beginners to get started, while low fees and a trove of more advanced features will appeal to every level.

Beginning users will be comforted by an initial prompt that asks for your level of trading experience. Subsequent prompts will be tailored to your preferences.

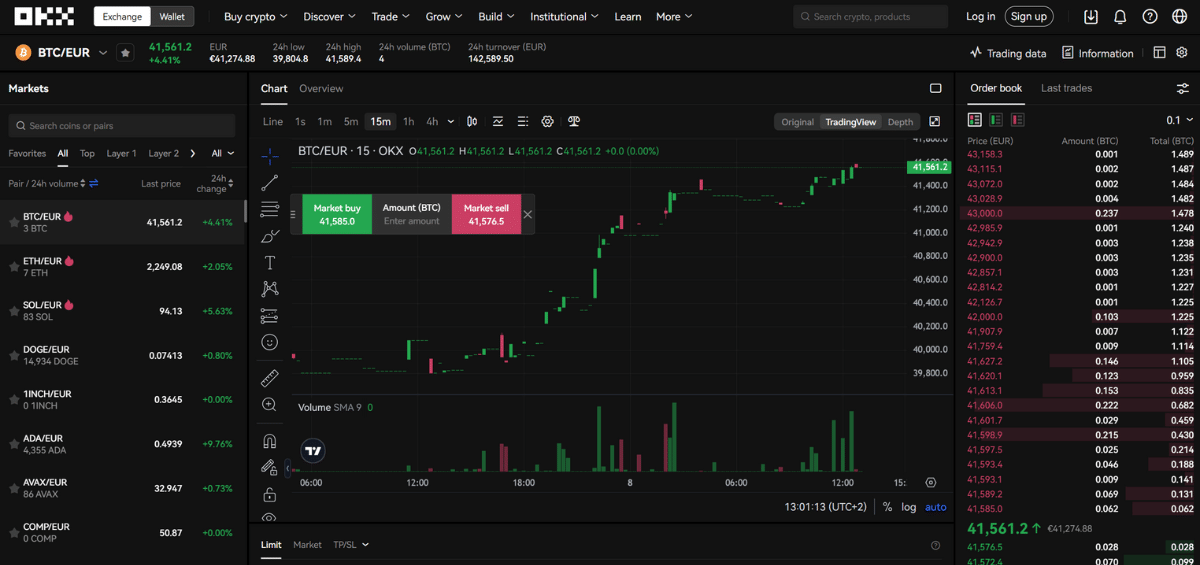

We also liked the inclusion of an option to immediately choose between the original trading chart layout and a new layout that offers more customization options.

We prefer the new layout which is less cluttered, putting the real-time chart front and center in a wider format.

A demo Web3 wallet is offered as a great place to get acquainted with portfolio management, as well as separate NFT and DeFi tabs to explore those options.

More advanced possibilities can be explored in the tab under Toolkit where users can learn about minting, handling multiple wallet addresses for import and sending, private key management and more.

Demo trading is also available from the Exchange drop-down menu. This is one of the more comprehensive demo accounts we’ve seen, offering substantial virtual money to test and improve your skills in a real-time trading environment.

Spot, margin, perpetual swaps and futures can all be applied with step-by-step guides for each area.

Finally, a comprehensive Learn area offers beginner guides, market updates and trading tips to help novices increase their knowledge and progress to higher levels of complexity.

Intermediate users can also utilize the demo account as they begin to employ various trading strategies. Guides are available for learning to read charts, analyze moving averages and trend lines, and identify key indicators for upcoming price movements.

Ten trading bots are made available for all levels, but intermediates can really benefit from learning how to create trading parameters and add AI to their repertoire to increase efficiency and experiment with automating various strategies.

A dedicated guide for intermediate traders covers derivatives trading and liquidations, how to open trades for long bull or short bear positions.

Perpetual and expiry positions are clearly explained. Reverse and forward margin trading can also be explored here, as well as the risky world of leverage trading.

OKX really leaves no stone unturned in their knowledge database, and will greatly alleviate the anxiety and mistakes that so often plague intermediate users who are experimenting with more complex systems and higher crypto amounts.

Advanced users will find an array of features that will help put them at the top of the mountain for crypto investing.

Copy trading

Spot and futures copy trading is available with hundreds of trading pairs.

While beginners and intermediates can certainly benefit from the simplicity and efficiency of copying expert trades, OKX actively recruits lead traders with up to a 13% profit share after KYC verification and acceptance into the program.

These leading spot and futures traders are represented on a leaderboard for others to easily modify their own trading behavior based on top suggestions.

All statistics are available to evaluate past performance, and communications channels are open to lead traders. We also liked the inclusion of a clearly defined risk level for each lead trader.

Lead traders are also eligible for invitations to exclusive events and early access to new OKX features.

Crypto staking and lending

More than 100 tokens across the crypto landscape are available under several OKX Earn features.

- Simple Earn: lower thresholds, lower risk, with 24/7 instant subscription and redemption. Flexible and fixed terms.

- Structured Products: proprietary trading packages in four categories allow investors to tailor their approach to enhance stability or enhance APR up to 322%.

- On-chain Earn: this approach focuses on Proof-of-Stake and DeFi protocols. This is a great way to increase exposure to potentially lucrative minted token rewards, transaction fees, providing liquidity, yield farming and borrowing and lending.

It is possible to move further into the field of DeFi trading with various single altcoins and pools that can earn extra bonuses and rewards within the OKX Web3 yield aggregator.

BRC-20 staking is in Beta where pools can be deployed or created from the browser or from your Web3 wallet.

Day trading

Low trading fees and high liquidity make OKX a perfect environment for day trading. A full range of order types are available that ensure maximum flexibility for experienced traders:

- Stop

- Trigger

- Advance limit – post only, FOK, immediate, cancel.

The OKX trading engine can handle up to 400,000 transactions per second.

Build

For those who would like to contribute to the highest levels of the crypto space, OKX offers a range of tools for developers. The X1 layer-2 network is powered by the OKB native token and built using Polygon CDK.

Lower fees, high compatibility and powerful scalability is presented as an all-in-one Web3 Gateway to build bridges, add testnets, and deploy smart contracts using Hardhat, Truffle and Foundry. Step-by-step guides are available, as well as support through the OKX dedicated Discord channel.

Institutional investors will find a suite of options, bonuses and VIP offers ideal for brokers, asset managers, market makers or family offices.

- Exchange order book for tokens, pairs, derivatives and options

- Instant trading of OTC, future spreads and options with customizable pricing

- DeFi protocol access

- Advanced execution algos – time-weighted average price (TWAP) and Iceberg execution algorithms

- VIP loan pool

- ETH 2.0 staking

- Rebates on order books and Liquid Marketplace

- Tailored broker solutions

- 24/7 dedicated customer service

- Up to 0% maker fees for VIPs

The Options Taker Rebate Program is by invitation only for a limited time, but offers high-volume institutional traders up to 12,500 USD every week for top takers.

50% off in combo options fees is another offer for trades executed on the RFQ platform.

Who OKX Is Not For?

Prohibited jurisdictions include the United States, Belgium, Cuba, France, Iran, Japan, North Korea, Crimea, Malaysia, Syria, the Bahamas, Canada, the Netherlands, Ireland, Bangladesh, Bolivia, Donetsk, Luhansk and Malta.

The OKX exchange is not the place for advocates of no-KYC or decentralization. This exchange comes with the highest level of identity requirements, including additional levels for wire transfers.

OKX was also among a number of exchanges that delisted a group of privacy token pairings. As reported by Blockworks, customers have until March 5, 2024, to withdraw these assets.

| Spot Trading Pairs | Delisting Time |

| KSM-USDC, FLOW-USDC, JST-USDC, KNC-USDC, ANT-USDC, FSN-USDC, ZKS-USDT, CAPO-USDT, CVP-USDT | January 4, 2024, 8:00-8:30 am UTC |

| XMR-BTC, XMR-ETH, XMR-USDT, XMR-USDC, DASH-BTC, DASH-USDT, ZEC-BTC, ZEC-USDT, ZEC-USDC, ZEN-BTC, ZEN-USDT | January 5, 2024, 8:00-8:30 am UTC |

Full list of trading pairs to be delisted; Source: OKX

OKX Features Explained

Security and Safety

Very basic email verification is the first step offered by OKX when signing up. Users are then given a wide array of additional security features they can choose:

- Biometric passkeys via face or fingerprint

- Authenticator app integration

- Anti-phishing code for emails

- Two-factor authentication

- Device management

- Trading clearance settings for market, crypto and max leverage

- Freeze account

- Close account

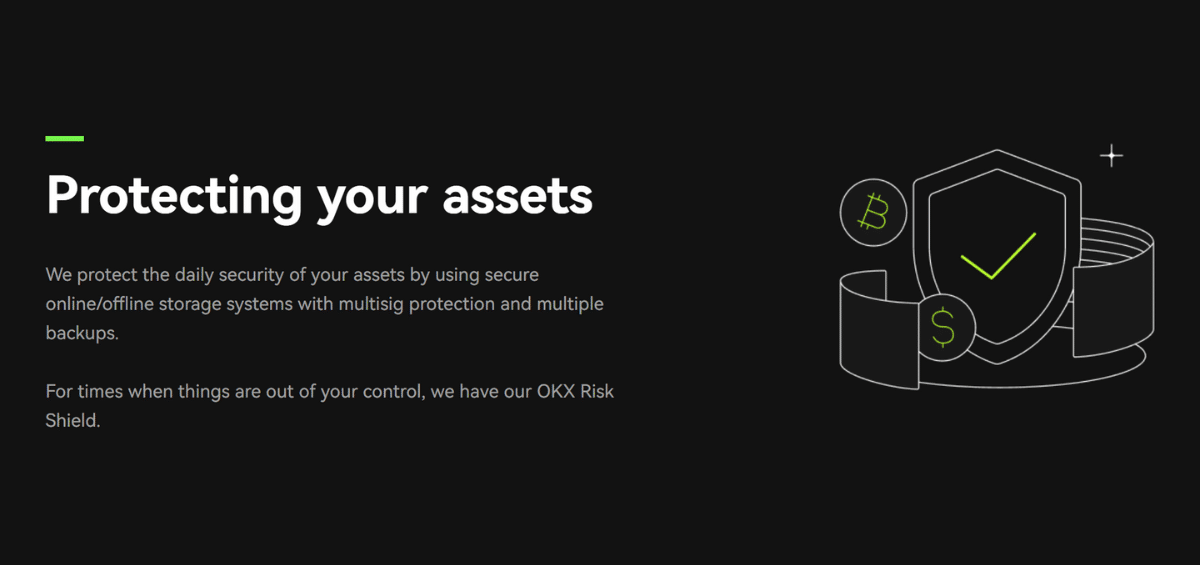

OKX states that overall security of funds is provided by using online and offline storage systems with multi-sig protection and multiple backups.

Their comprehensive approach to account and platform security includes keeping 95% of funds in offline cold storage, and does not interact with USBs or external memory devices.

At least two personnel must be available to access any offline cold storage. Secure bank vaults are one more layer that require in-person access.

OKX also employs a proprietary system called Risk Shield that allocates a portion of earnings as a reserve fund to further protect from down-side and unforeseen risks.

It’s also comforting to see that all private keys are encrypted with Advanced Encryption Standard and the original keys are deleted.

All assets are also spread across multiple addresses, further reducing single-point failure.

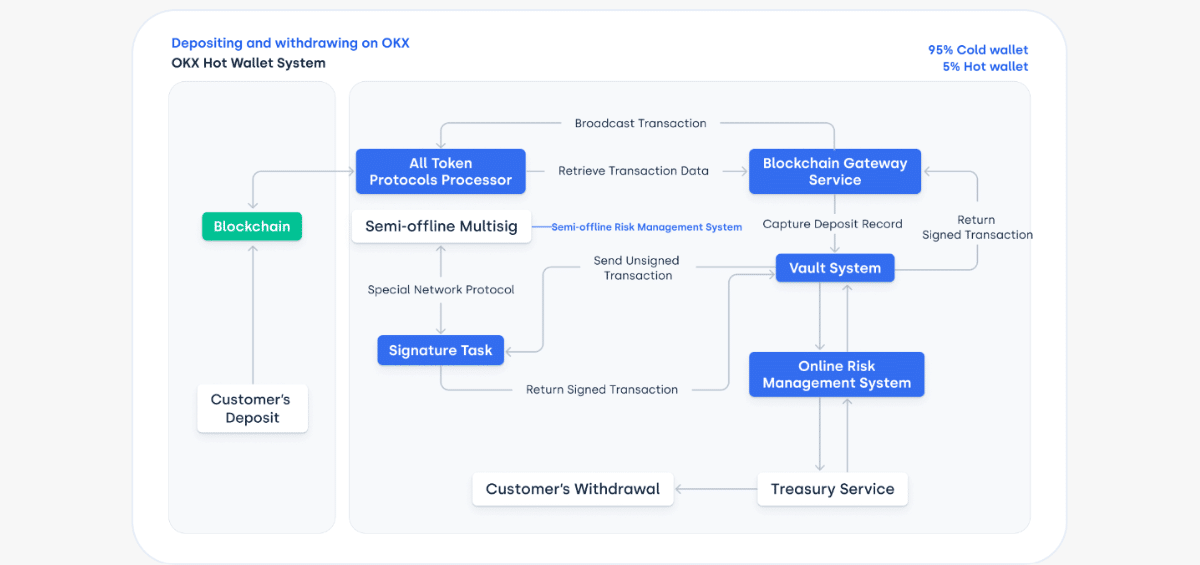

Online hot wallet functionality is handled with additional complexity as indicated in the diagram below:

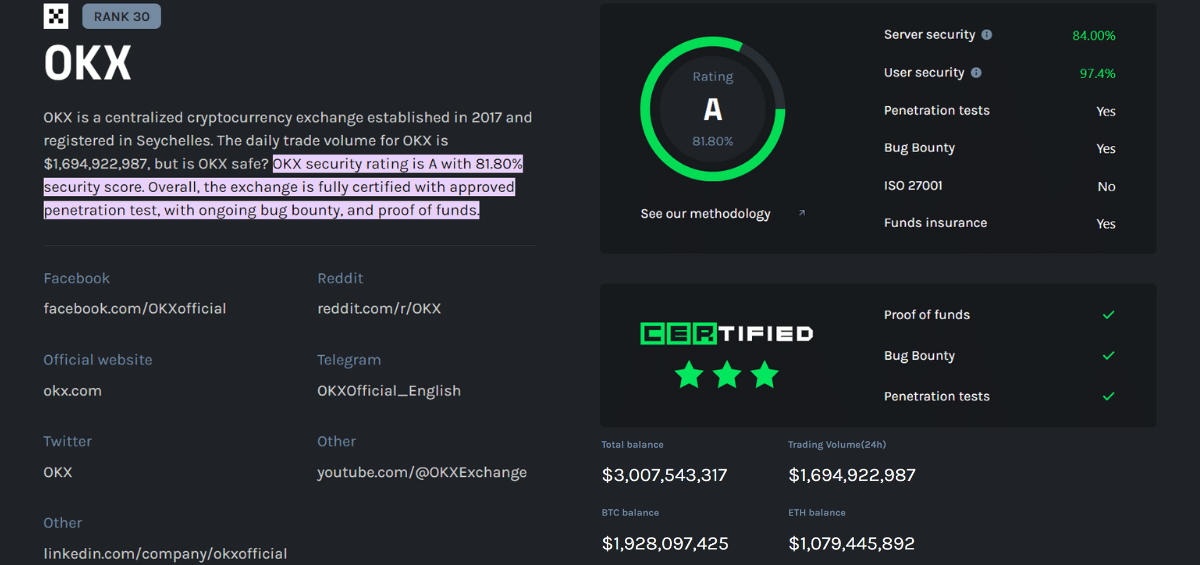

As we can see below, OKX is fully certified and has received a commendable A rating from CER, addressing the most critical points of server security and user security, including penetration tests and bug bounties.

View CER methodology and additional information

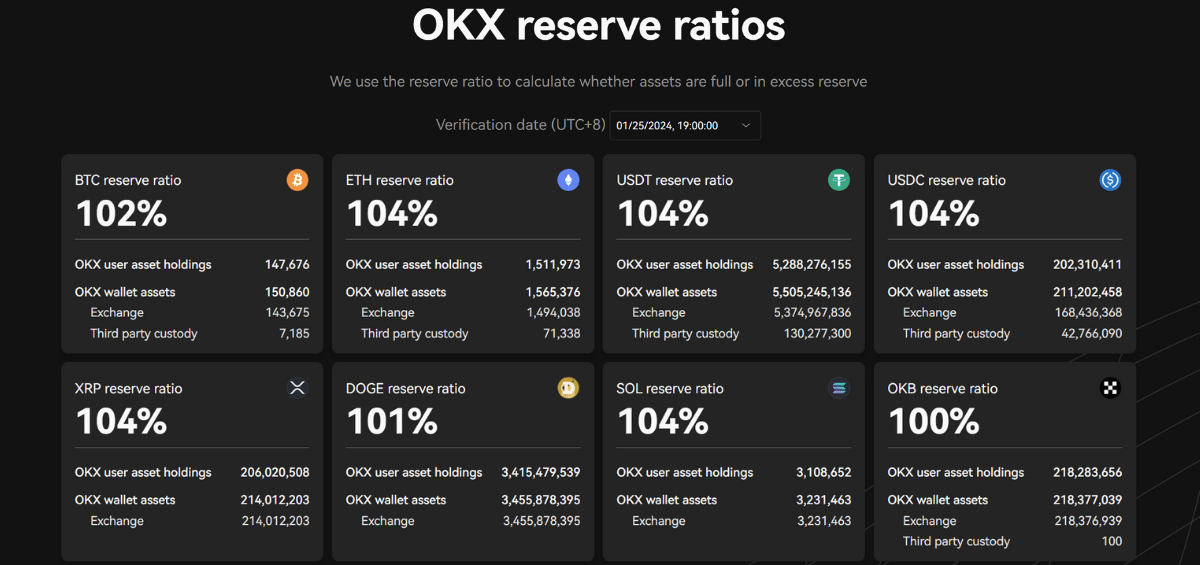

Perhaps most importantly, proof of at least 1:1 reserves for all assets is made available from OKX here where users can check all relevant monthly audits.

Here are the results of the most recent audit of reserves for their top holdings. A convenient drop-down menu lets users also search by verification date.

Moreover, OKX further touts the cleanliness of their holdings through third-party confirmation:

OKX is the only crypto exchange to have 100% clean assets, as reported by DefiLlama and as confirmed by CryptoQuant.

Users can verify all OKX address holdings here and use the self-audit feature here to verify a 1:1 match for their personal holdings.

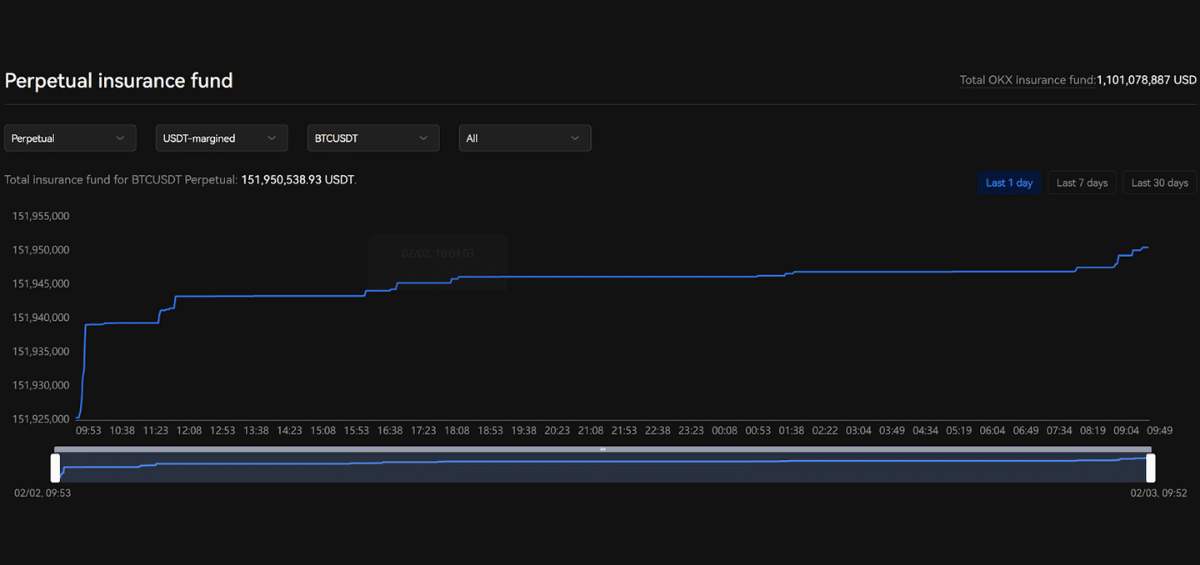

Lastly, OKX has established a Perpetual Insurance Fund designed to maintain liquidity for their riskier instruments.

This fund is broken down into components, but currently stands at more than $1 billion and is made transparent here:

Opening An Account With OKX

Signing up at OKX is free, no-KYC, and available in 20 languages with email and verification follow-up.

No-KYC is only for exploration, demo trading, and Web3 wallet use. Immediate verification is required to access real-time trading and all other main exchange features.

Once verified all users can access a referral link that also includes unlockable mystery boxes valued at up to 50 USDT.

Influencers and other content creators can sign up for a tiered affiliate program where rewards progress from 30 invitees up to 180, potentially generating thousands of USDT per month in commissions.

Pricing & Fees

Maker Vs Taker Fees / Trading Fees

USDT pairs are broken out between regular and VIP users as follows:

REGULAR USERS

| Tier | Total OKB holding | Assets (USD) | or 30-day trading volume (USD) | Maker Fee | Taker Fee | 24h crypto withdrawal limit (USD) |

| Lvl 1 | < 100 | < 100,000 | < 5,000,000 | 0.080% | 0.100% | 10,000,000 |

| Lvl 2 | ≥ 100 | < 100,000 | < 5,000,000 | 0.075% | 0.090% | 10,000,000 |

| Lvl 3 | ≥ 200 | < 100,000 | < 5,000,000 | 0.070% | 0.080% | 10,000,000 |

| Lvl 4 | ≥ 500 | < 100,000 | < 5,000,000 | 0.065% | 0.070% | 10,000,000 |

| Lvl 5 | ≥ 1,000 | < 100,000 | < 5,000,000 | 0.060% | 0.060% | 10,000,000 |

VIP USERS

| Tier | Assets (USD) | or 30-day trading volume (USD) | Maker Fee | Taker Fee | 24h crypto withdrawal limit (USD) |

| VIP 1 | ≥ 100,000 | ≥ 5,000,000 | 0.045% | 0.050% | 12,000,000 |

| VIP 2 | ≥ 500,000 | ≥ 10,000,000 | 0.040% | 0.045% | 16,000,000 |

| VIP 3 | ≥ 2,000,000 | ≥ 20,000,000 | 0.030% | 0.040% | 20,000,000 |

| VIP 4 | ≥ 5,000,000 | ≥ 100,000,000 | 0.020% | 0.035% | 24,000,000 |

| VIP 5 | ≥ 10,000,000 | ≥ 200,000,000 | 0.000% | 0.030% | 30,000,000 |

| VIP 6 | – | ≥ 500,000,000 | -0.002% | 0.025% | 36,000,000 |

| VIP 7 | – | ≥ 1,000,000,000 | -0.005% | 0.020% | 40,000,000 |

| VIP 8 | – | ≥ 5,000,000,000 | -0.005% | 0.015% | 40,000,000 |

Stablecoins and crypto pairs for regular users and VIPs are as follows (includes USDC, DAI, BTC, ETH, OKB, DOT, EURT):

REGULAR USERS

| Tier | Total OKB holding | Assets (USD) | or 30-day trading volume (USD) | Maker Fee | Taker Fee | 24h crypto withdrawal limit (USD) |

| Lvl 1 | < 100 | < 100,000 | < 5,000,000 | 0.050% | 0.070% | 10,000,000 |

| Lvl 2 | ≥ 100 | < 100,000 | < 5,000,000 | 0.045% | 0.065% | 10,000,000 |

| Lvl 3 | ≥ 200 | < 100,000 | < 5,000,000 | 0.040% | 0.060% | 10,000,000 |

| Lvl 4 | ≥ 500 | < 100,000 | < 5,000,000 | 0.035% | 0.055% | 10,000,000 |

| Lvl 5 | ≥ 1,000 | < 100,000 | < 5,000,000 | 0.030% | 0.050% | 10,000,000 |

VIP USERS

| Tier | Assets (USD) | or 30-day trading volume (USD) | Maker Fee | Taker Fee | 24h crypto withdrawal limit (USD) |

| VIP 1 | ≥ 100,000 | ≥ 5,000,000 | 0.025% | 0.045% | 12,000,000 |

| VIP 2 | ≥ 500,000 | ≥ 10,000,000 | 0.020% | 0.040% | 16,000,000 |

| VIP 3 | ≥ 2,000,000 | ≥ 20,000,000 | 0.015% | 0.035% | 20,000,000 |

| VIP 4 | ≥ 5,000,000 | ≥ 100,000,000 | 0.010% | 0.030% | 24,000,000 |

| VIP 5 | ≥ 10,000,000 | ≥ 200,000,000 | 0.000% | 0.025% | 30,000,000 |

| VIP 6 | – | ≥ 500,000,000 | -0.005% | 0.025% | 36,000,000 |

| VIP 7 | – | ≥ 1,000,000,000 | -0.010% | 0.020% | 40,000,000 |

| VIP 8 | – | ≥ 5,000,000,000 | -0.010% | 0.015% | 40,000,000 |

It’s always smart to consult the fees page for any changes prior to trading, as well as any variations based on your region.

Deposit Methods

Funding your account can be done easily with all supported cryptocurrencies and tokens.

Purchase in fiat can be handled through Visa and Mastercard as well as various third-party gateways like Banxa, Simplex, PayPal, Google Pay and Apple Pay, while P2P options are also available. Keep in mind that these will incur additional fees and commissions and might also require another layer of KYC.

Bank transfers might be available in your region and can be accessed through the P2P area under Manage Payment Methods.

Withdrawal Methods

All cryptos can be withdrawn to supported addresses on-chain or to other exchanges and wallets.

As of a January 29, 2024 update, OKX has begun to remedy a deficiency – they can now process cash withdrawals, accessible under the Assets tab.

Options are currently very limited. OKX states that options will be expanded, but currently are offered as follows:

FEES AND PROCESSING TIMES

| Payment Method | Currency | Channel | Deposit Fees | Withdrawal Fees | Processing Time |

| Local Bank Transfer | EUR | SEPA | N/A | N/A | Instant and up to 2 business days* |

| iDEAL | N/A | N/A | Instant | ||

| BRL | Pix | N/A | N/A | Instant |

Fiat withdrawals are a notorious problem across the entire crypto landscape mainly due to regional regulations and the ever-changing rules imposed by the traditional banking system and local governance.

The lack of fiat withdrawals can be remedied in many cases by withdrawing to a third-party wallet connected to a bank account where permitted.

P2P options are possible between OKX users, or through other P2P crypto sites, but will generally be restricted by limits and be subject to additional commissions.

Switching Between Currencies and Blockchains

Moving between assets is easy and quick with an array of fiat, cryptocurrencies, and nearly 80 blockchains for traditional crypto, stablecoins and altcoins.

A deep user pool, plus high liquidity and fast transaction times makes OKX one of the very best that we have tested in this category.

History Of Downtime

The OKX exchange has never been hacked, but there was one instance of a limited hack December 13, 2023 that was described as “unsophisticated” and was directed at 18 wallets on its decentralized exchange.

OKX handled the situation admirably, taking swift action and committing to compensate users for their losses. As reported on their Twitter channel at the time:

We regret to inform you that a deprecated smart contract on OKX Dex has been compromised. We have taken immediate action to secure all user funds and revoke the contract permissions.

We are working with relevant agencies to locate the stolen funds and will reimburse affected users with $370k. A thorough review is underway to prevent similar incidents. Our apologies for any inconvenience caused.

The amount listed above was reported to have swelled to nearly $3 million, and by all reports users were eventually made whole.

OKX has a dedicated status page to track expected downtime due to maintenance or other issues. Status of deposits and withdrawals also highlights problem areas.

A full historical downtime area is not available and would be a good addition in our opinion, as a few other large exchanges do offer this convenient metric for determining long-term stability.

OKX does make a general statement on their Institutions page that their uptime record stands at 99.99%.

It is important to remember that the exchange section of OKX is a centralized store of funds which opens up users to limitations imposed by OKX or changing regulations.

For example, in May 2023, OKX began limiting withdrawals based on new KYC terms.

We advise you to always keep your trading amount on the exchange, but move most of your funds into a self-custody wallet.

Customer Support

24/7 in-app/browser live support. Extensive support center page handles searches, FAQs and common self-service resolution. Social channels and forums offer community support and response.

Alternatives

OKX vs. Alternatives

| OKX | UPHOLD | PRIMEXBT | |

| Founded | 2017 | 2013 | 2018 |

| Users | 50 million | 10 million | 1+ million |

| Cryptos | 300+ | 260+ | 50+ |

| Spot Fees | 0.005% – 0.08% | 0.25-2.5% | 0.01% – 0.05% |

| KYC | yes | yes | no |

| Mobile App | yes | yes | yes |

| Card | no | yes | no |

| Countries | US, CAN, Belgium, France | US (NY), China, Middle East, Africa | US, Canada, Ecuador, Japan |

| Security Rating (CER) | A | N/A | N/A |

| Best For | day traders, altcoins, DeFi | beginners, HODL | privacy advocates, advanced traders |

| Overall Rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Signup | OKX | Uphold | PrimeXBT |

Conclusion

OKX is one of the most comprehensive crypto exchanges available. Exceptionally low fees and high liquidity for both spot and futures trading makes it a great choice for all investors.

While the learning library and interface are perfectly suitable for beginners, the addition of Web3, development tools and a range of more complex investment options should draw in the savviest of traders.

Security is multi-faceted and handled superbly well with redundant systems to make OKX one of the most reliable centralized exchanges in the world.

Limited fiat withdrawals and regional limitations do hamper the experience for some traders, but OKX appears to be committed to working with regulators to expand future offerings.

Finally, we would like to make special mention of a unique program offered in the P2P marketplace – all users can become Super Merchants. Three tiers begin with all users enabled as Lite; Super and Diamond tiers are unlocked through application.

- Post buy and sell ads up from 10,000 to 150,000 USD per ad

- 5-20 pending orders

- Increased exposure and ranking

- High-priority customer support

The all-encompassing features of OKX are presented in an extremely well-designed and easily navigated interface both for browser and app with constant prompts and how-to guides that never leave users feeling stranded.

Frequently Asked Questions

What Services Does OKX Offer for Crypto Users?

Spot, futures, derivative markets. Hot wallet. Web3 wallet for DeFi and NFTs. Staking and loans with single and structured products.

Referral and affiliate programs with bonuses. Copy trade. Trading bots. Development tools. Learning library with how-to guides for all levels.

VIP and broker programs with profit share for institutional traders.

How Does OKX Protect Its Users and Their Assets?

Enhanced user security preferences from simple to advanced. Anti-phishing codes.

Address encryption, 95% of funds held offline in redundant cold storage systems.

Proof of funds held at least 1:1. CER cybersecurity rating of A includes penetration tests and bug bounties.

What Are the Costs Associated with Using OKX?

Spot and futures maker and taker fees from 0.005% – 0.08%. Other fees include cryptocurrency-specific withdrawal fees, P2P market fees and third-party fees.