Table of Contents

BingX is a P2P exchange launched in 2018 to cater for users looking to delve into the crypto market. We’ve spent the last few weeks combing through the platform, so you don’t have to.

The exchange is not regulated by any top tier regulators, we therefore recommend you pass up on this exchange and consider opening an account with a regulated exchange like Interactive brokers, instead.

What if you don’t care much for regulation?

Is BingX for you if you’re trying to stash some cash into crypto without the high fees and regulatory hassle?

Stick around as we review the exchange top to bottom to help you decide.

BingX Overview

We will bring out 1-10 scales to rate this exchange based on several key factors that all exchanges are ranked by. Here we go.

| Rating | |

| Security And Safety | 7 |

| Necessary Requirements | 7 |

| Pricing And Fees | 8 |

| Deposit and Withdrawal Methods | 6 |

| Customer Support | 8 |

Who BingX Is Best For?

Though the exchange has only been around for five years, it has gained popularity and has been widely compared to its peers. Here’s who the exchange would be best for.

No-Kyc users

If you despise having to give up personal information to crypto brokers despite the decentralized promise of anonymity, this exchange is for you.

Bingx does not require you to go through a mandatory KYC process. Traders can simply log in and start trading without needing to fill out lengthy forms.

There’s a bit of a catch though if you’re one to move large amounts of USDT. There is a $50,000 USDT cap within a 24-hour period for non-verified users and a $100,000 USDT cumulative cap.

If you don’t move such amounts often (that’s most people), then you will be right in the sweet spot. Large movers will need to go through the KYC process and get their accounts verified to see these cap ceilings raised significantly.

Crypto traders

BingX was created specifically for crypto traders. This makes it a great environment if you want to dabble into crypto and have a feel of the digital asset world.

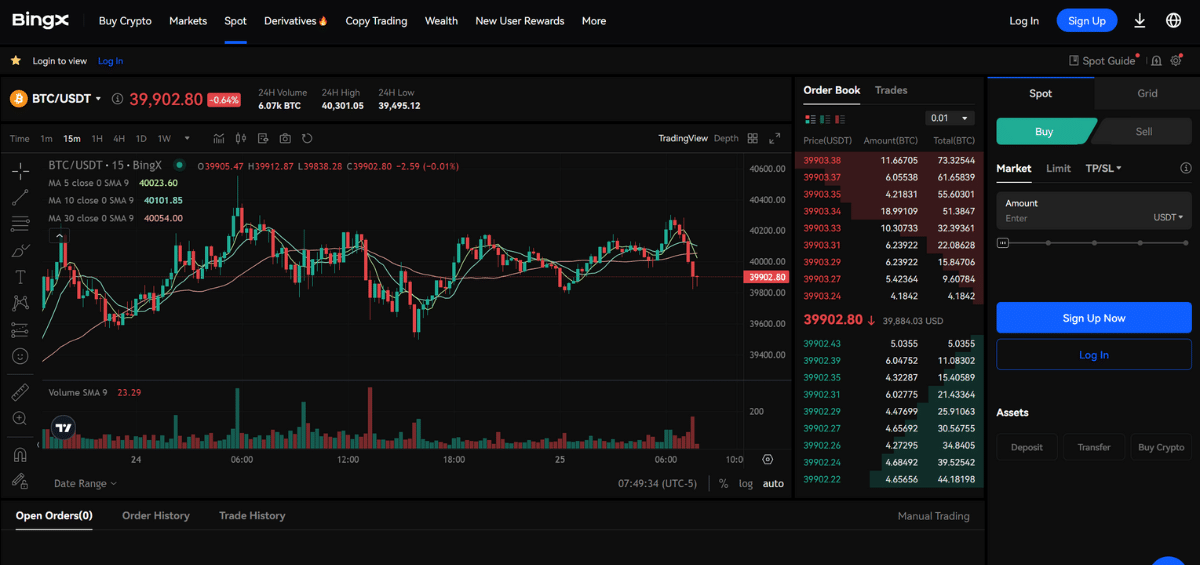

The platform caters for both new and advanced traders with learning tools and advanced charting tools.

New users get to learn as they play the field on low transaction fees while advanced traders get to check out features such as the Live order book, advanced drawing tools for enhanced market analysis and the annotation feature to help develop trading strategies.

Futures traders

This platform will be appreciated by futures traders who choose to interact with it.

BingX offers both standard and perpetual future’s trading with a remarkable potential of up to 150x margin. With such capabilities, traders can rest easy as they map out their trading strategies 150x in leverage in mind.

Spot traders

Buyers and sellers requiring immediate delivery of their cryptos can rest easy because BingX offers spot trading.

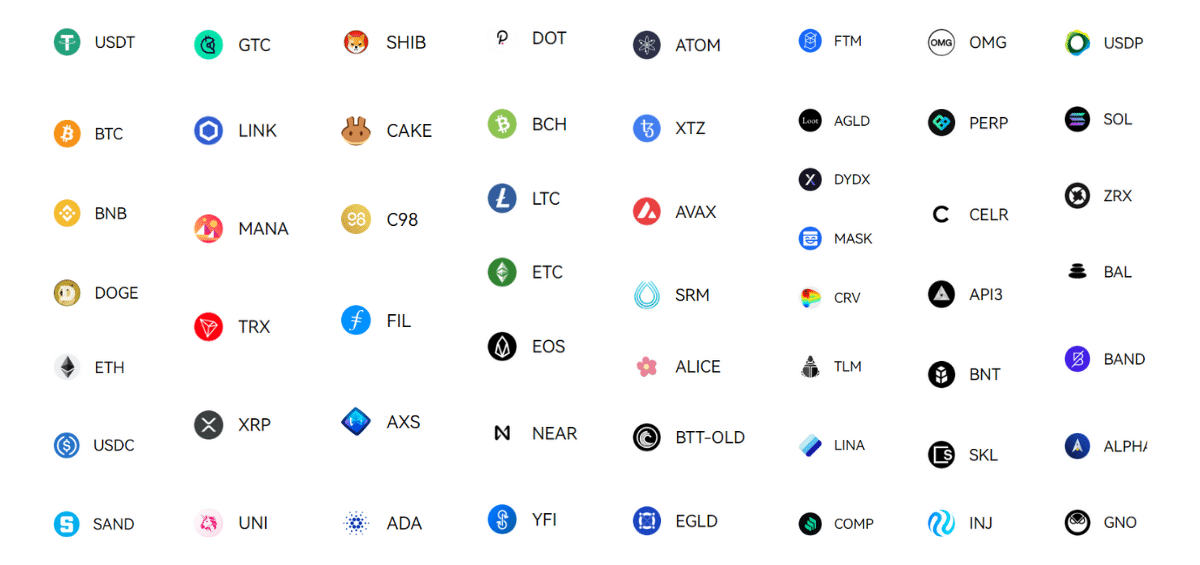

Spot trading has become a must have for crypto exchanges that want to be considered elite. Users seeking to spot trade will be spoilt for choice as the platform offers 550 different cryptocurrencies and 1,000 trading pairs to dabble with.

Liquidity watchers

All traders should be liquidity watchers anyway, but some are more hawkish than others. Traders keen on an exchange’s liquidity levels will be happy with BingX.

Aside from the platforms $300 million in trading volume money for spot traders, the platform has boosted its liquidity levels thanks to a partnership with the Woo network.

The Woo network partnership offers an institutional liquidity solution known as Wootrade.

Wootrade has an impressive growing list of assets that have now surpassed the $600 million mark.

BingX traders can swoop from Wootrade’s depth of liquidity while trading major pairs. This boosts investor confidence while also attracting more inflows into the platform.

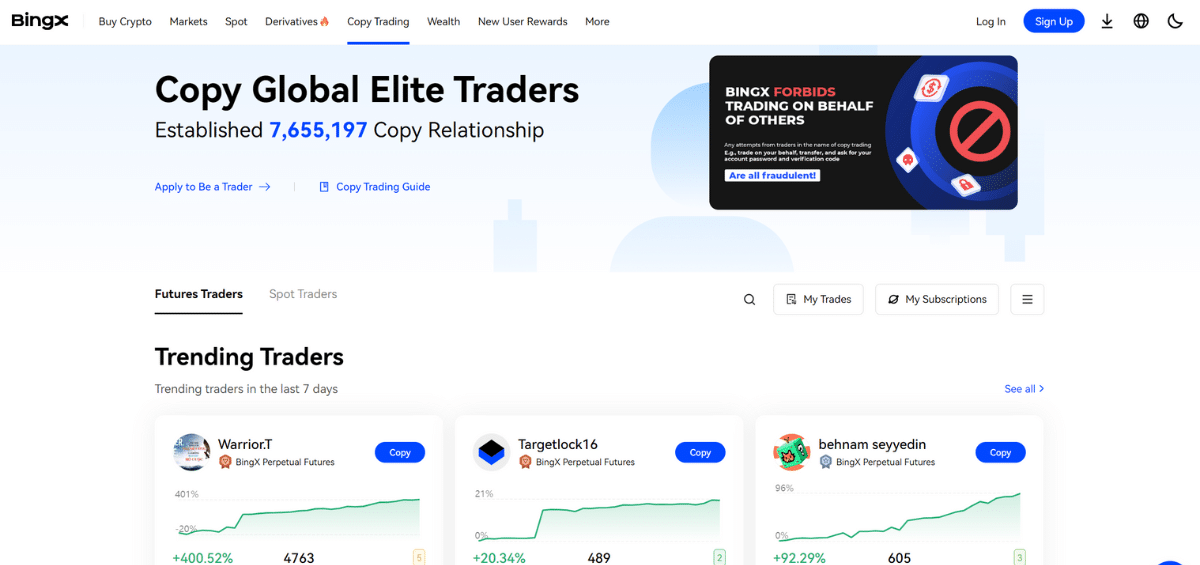

Copy traders

Copy traders will enjoy the BingX experience because the platform offers them a chance to copy trades from experienced traders.

Users can pick from any of the 20,000 traders showcased and mimic their trades if their strategies align.

Before mimicking traders, copy traders can look into the history of their trader of choice to see their past moves and win rate.

Copy traders are assured of exposure to top quality traders because the platform incentivizes top traders to share their trades.

Top traders who make their trades accessible to copy traders earn a profit share of between 8% to 10% per order.

Who BingX Is Not For

Anonymous large movers

As stated in the previous section, there is a tight cap for non-verified large movers which is placed at $50,000 USDT for a duration of 24 hours.

The cumulative ceiling is at $100,000 USDT. These are tight caps for large movers who don’t want to fill out KYC requirements. They would be better off looking elsewhere.

Institutional investors

Though BingX swears by its efforts to secure its customers, many institutions may find the exchange wanting in terms of regulation.

The exchange touts its compliance levels on its website, citing its registration as a Money Services Business (MSB) under the Financial Crimes Enforcement Network (FinCEN) of the US Department of Treasury with approval to engage in FX activities.

Most institutional investors may not see this as proof of sufficient regulation since the exchange is not under the purview of any tier 1 regulator.

Tier 1 regulators include bodies such as; SEC (Securities and Exchange Commission), FCA (Financial Conduct Authority), BaFin (Federal Financial Supervisory Authority), ASIC (Australian Securities and Investments Commission) and the FINMA (Swiss Financial Market Supervisory Authority).

This doesn’t necessarily mean that the exchange is not safe. The exchange boosts of bank-grade custody solutions as well as a transparent proof-of-reserves policy.

However, in the era of FTX, those interventions still may not wash with institutional investors.

BingX Features Explained

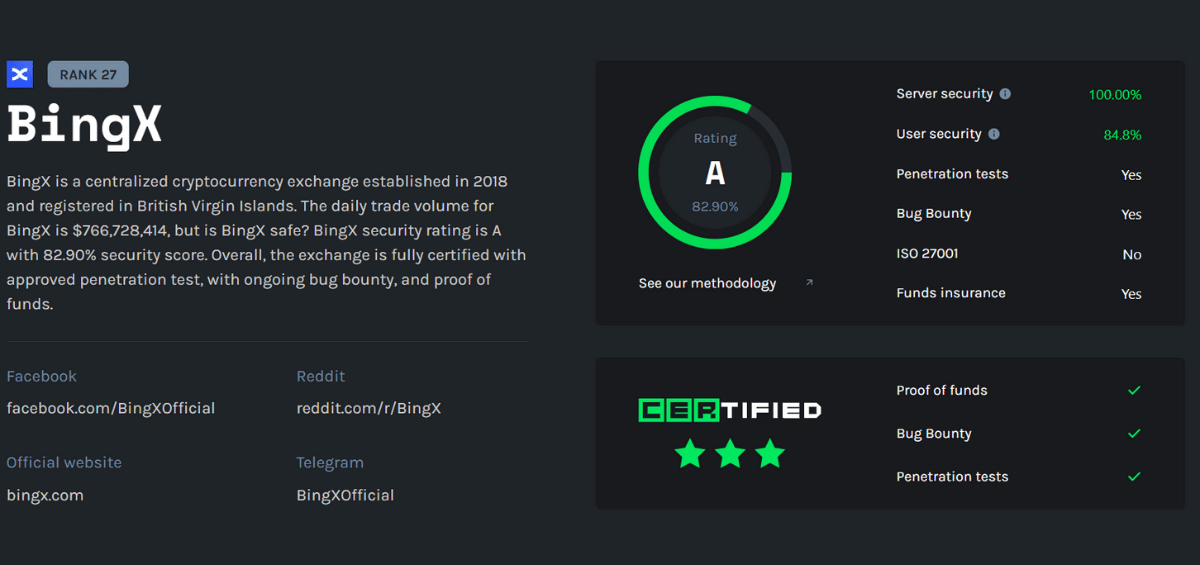

Security and Safety

As stated at the near top of this article, the exchange is not regulated by top tier regulators, such as the SEC and the FCA.

This does not take away the measures the exchange has taken to secure their customers, though. Some of the impressive measures the exchange has taken include:

Proof of reserves

With the crypto world still recovering from the FTX fallout, the Silver gate bank collapse underscored the need for investors to exercise caution before committing their funds with any institution.

BingX has done a great job at ensuring proof-of-reserves transparency. The exchange has made it clear that it offers 100% proof of reserves with all the funds backed by reserve funds.

Asset insurance

The platform has put in place asset protection and risk management measures that ensure customer funds are insured against potential loss.

BingX does this by maintaining a portion of its principal balance sheet which should cover costs in case of customer asset loss.

It also helps that the exchange maintains a round the clock suspicious activity monitoring system to keep off hackers and exploiters. This adds that extra layer of protection to Bingx’s asset protection mechanism.

Bank grade custody solution

Oversight by a tier 1 regulator would have moved this score up to a 9.

Though this kind of solution doesn’t exactly fill investors with confidence after the Silvergate collapse, it is a solid way to keep investor funds stashed away.

BingX tightens permissions across servers to ensure deposits are kept away safely. To put investors at ease, the bank has added an extra layer of security by cold storing most of its assets.

By only keeping a limited amount of assets in hot wallets, the exchange has moved to reduce risks of online threats. We therefore give the bank a solid 7 for its security and safety measures.

The exchange has also not suffered any major hacks leading to massive loss of investor funds. The exchange enjoys a CER ranking of 84.8% on user security, having gone through extensive penetration testing.

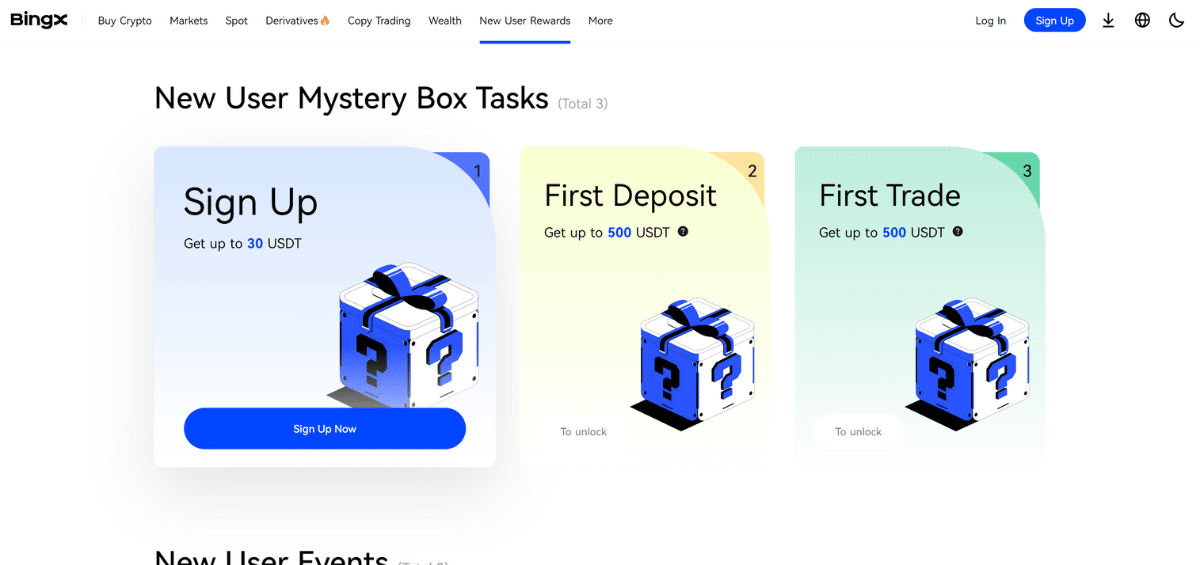

Opening An Account With BingX

Opening an account with BingX is easy. Navigate to the top of the page and click on the avatar icon to register. You will then need to provide basic details like email and then set up a great password for your account.

Next up will be the KYC registration process, where proof of identity will be required to verify your account. This is the uncomfortable part for many users who wish to remain anonymous on the platform.

The good thing is that the KYC process is not mandatory and can be bypassed as you register.

The catch is that your account will be unverified and capped to a $50,000 transaction limit per day. Once the registration process is done, you will be ready to start buying and selling assets on the platform.

Pricing & Fees

The exchange offers a uniform spot fee for all its major trading pairs at 0.1% which is nominal compared to its peers like Coinbase who charge at 0.6%.

| Trading pair | Maker fee | Taker fee |

| BTC/USDT | 0.1% | 0.1% |

| ETH/USDT | 0.1% | 0.1% |

| BNB/USDT | 0.1% | 0.1% |

| XRP/USDT | 0.1% | 0.1% |

| ADA/USDT | 0.1% | 0.1% |

Perpetual futures are charged differently according to the amounts users are moving.

| Level | 30-day Volume | Taker | Maker |

| Common user | <20 Million USDT | 0.040% | 0.020% |

| VIP 1 | 20 Million or Plus | 0.040% | 0.018% |

| VIP 2 | 150 Million or Plus | 0.035% | 0.016% |

| VIP 3 | 400 Million or Plus | 0.032% | 0.014% |

Deposit Methods

The platform restricts deposit methods to only cryptos. Users seeking to make deposits using fiat currencies like the Euro and the dollar would be better off checking out an exchange like Kraken or Coinbase.

BingX users may however, use third party options like MoonPay and Banxa to buy cryptocurrencies through their credit cards.

The minimum deposit is set at only 1 USDT, making it friendly to all users.

The hassle of needing a third party platform to make deposits leads us to score the platform at a 6 on this metric.

Withdrawal Methods

Withdrawals on BingX can only be done using cryptos because fiat withdrawals are impossible to do. Withdrawals attract different fees depending on the asset, the user is intent on withdrawing.

Withdrawing Bitcoin for instance, will exact a fee of 0.0002 BTC. Here’s a BingX withdrawal fee table for some of the top cryptocurrencies.

| Asset | Fees |

| Bitcoin | 0.0002 |

| Ethereum | 0.00076 |

| Solana | 0.0008 |

| USDT (ERC-20) | 6 USDT |

Switching Between Currencies and Blockchains

BingX only supports crypto deposits and withdrawals, this makes switching from cryptos to currencies complicated. Users wishing to switch from currencies to blockchains and vice versa must utilize a third party platform.

The third party platforms available for these kinds of transactions include MoonPay, Banxa, Apple pay, Crypto and Mastercard, or Visa. You can buy crypto with fiat currencies through P2P trading.

Here’s how to do that:

Step 1: Log in to BingX App. Click “Buy Crypto” on the homepage and select “P2P Trading”. New traders should consider fulfilling the KYC requirements first.

Step 2: Select a seller to buy from and click “Buy”. Click the buttons as shown below to switch b “By value” and “By amount”. Enter an amount and then click “Buy”.

Step 3: Select your preferred payment method and click “Buy” to place your order. Click “Pay” and you will be able to contact the seller for payment information.

Step 4: Once the payment is done, click “Transferred, notify seller” on the order page. The seller will release the cryptos to you after confirming the receipt of your payment. Click “Assets” on the homepage to check your assets.

You can also buy cryptos on BingX using bank transfer. Here’s the simple process.

Step 1: Log in and then Click “Buy Crypto” on the homepage and select “Bank Deposit”. Before buying cryptos via “Bank Deposit”, users will first need to complete KYC verification.

Step 2: Check out the instructions twice if you have to and then indicate that you have understood the statement of responsibility. Next, click “Verify Now”.

Step 3: Choose the crypto asset you would like to buy and your payment method of choice. Then, select a payment currency and enter an amount. Click “Continue”.

History Of Downtime

BingX has been pretty solid since its launch back in 2018. We have checked out what customers are saying in the reviews section and there has been no significant reported outage that has led to significant losses.

You however need to pay close attention to the platform’s disclosure statement, which addresses some of the risks traders may expose themselves to while using the platform.

Most of these are industry wide platform risks that cannot be avoided, such as price volatility and regulatory risk.

Special attention should go to item 3.2 on the page which addresses maintenance risk. It states that the platform may, from time to time, perform routine maintenance protocols, which may lead to downtime, meaning a lack of access to the trading platform.

The statement goes on to say that such protocols would lead to cancellation of a pending order or orders made during the time of maintenance.

Traders must therefore be on the lookout for maintenance alerts and announcements to avoid any activity on the platform during those times.

Customer Support

Bingx offers good customer services to customers with a standard dedicated email and a live chat feature that’s available 24/7.

The platform also has a help center that aids new users trying to figure out how to make deposits/withdrawals, how to access bonuses and find out the platform’s fee schedule.

The platform does not have a call center, and that’s why we scored it at 8.

Alternatives

| BINGX | BINANCE | BYBIT | |

| Founded | 2018 | 2018 | 2018 |

| Registered | Singapore | Cayman Islands | Singapore |

| Users | 5 million | 150 million | 20 million |

| Cryptos | 600+ | 350+ | 450+ |

| Spot Fees | 0.1% – 0.2% | 0.1% | 0.1% |

| KYC | no | yes | yes |

| Countries | OFAC | US, CA, UK, CN, ML, JP | US, CA, UK, CH, SG |

| Best For | spot & futures trading | great all around | best for traders |

| Overall Rating | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Signup | BingX | Binance | Bybit |

Though Bingx is a relatively new crypto exchange, it has done enough to be compared to the Binance’s and Bybit’s of this world.

If you’re wondering how the exchange compares to two of its worthy peers, here is a breakdown.

Conclusion

After testing the app for weeks, we can authoritatively say that BingX is a solid exchange if you are looking to dabble into cryptocurrencies.

It’s pretty accessible to newbies and retail investors since the minimum deposit is just 1 USDT and a transaction fee of 0.1%.

The platform is also secure especially for retail investors looking to stash some disposable income.

The platform has adopted a Bankgrade custody solution backed by cold storage wallets to secure investor funds. BingX has gone a step further by emulating its elite peers like Binance and Bybit in declaring proof-of-reserves.

Despite all these moves to reassure users of safety, the exchange is not under the purview of any tier 1 regulator. This makes it a hard sell to institutional and large cap investors.

This shouldn’t entirely deter mid-cap and high value retail investors with some funds to park.

Read on to see how the platform ensures safety of funds and what limits are in place for users who prefer to remain anonymous.

Frequently Asked Questions

What Trading Options are Available on BingX?

BingX offers an array of trading options which have brought in users with different tastes in the market.

The platform offers Perpetual Futures, Standard Futures, Copy Trading (Trader), Spot Trading, Grid Trading, Derivatives Trading, as well as major crypto pairs in Bitcoin, and Ether.

How Does BingX Ensure User Security and Fund Safety?

BingX ensures user security through its KYC requirements. Large movers will need to be verified because there is a $50,000 USDT cap for unverified users.

The platform has also installed a bank-grade custody solution along with a cold storage function for most user deposits.

User fund safety has also been addressed by the platform’s insurance move of keeping a large portion of its principal balance sheet to reimburse users in case of a hack.

What are the Trading Fees on BingX?

Users trading in major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), will pay spot trading fees at 0.1%, while those trading lower cap altcoins will pay slightly higher at 0.2%.

Spot traders will pay maker fees ranging from 0.1% to 0.2%, while futures traders will pay maker fees of 0.045% and taker fees of 0.075%.