Table of Contents

We continue to evaluate the highs and lows of the current crypto exchange landscape.

Our experts signed up for MEXC several weeks ago and have been thoroughly researching and testing the user interface and functionality.

MEXC is a Web, Android and iOS centralized crypto exchange that offers a full range of cryptocurrencies with DeFi trading and investing.

After a complete review, our verdict on whether or not this is a versatile exchange is an enthusiastic Yes.

The MEXC exchange has become one of the largest and most popular of the global centralized crypto exchanges that don’t require KYC to get started.

It offers one of the widest range of assets available at more than 2000 tokens and nearly 2500 trading pairs. MEXC is packaged in a user-friendly interface suitable for all levels of crypto investing experience.

Let’s dive into the multitude of benefits that MEXC presents and note just a few deficiencies along the way.

MEXC Overview

| Rating | |

| Security And Safety | 9 |

| Necessary Requirements | 8 |

| Pricing And Fees | 10 |

| Deposit and Withdrawal Methods | 5 |

| Customer Support | 10 |

Who MEXC Is Best For?

MEXC is one of the most complete exchanges we have tested and is suitable for all users. It offers services in 18 languages and has a nearly global reach.

The app and browser both offer the same features, clarity, and customization, including a day/night choice.

Beginning users will benefit greatly from MEXC’s “Learn” library. Novices will find an outstanding selection of video tutorials and clearly enumerated how-to articles with accompanying graphics.

Dozens of guides cover everything from your first spot trade to reading charts, advanced futures trading, margin swaps, leverage trading, staking, and more.

One of the most important beginner guides is how to best utilize MEXC’s native token MX for a range of long-term benefits.

A demo futures account is also available so that new traders can begin gaining skill and confidence in a simulated real-time environment without any risk to personal funds.

A MEXC hot wallet is available, but off-site backup by MEXC helps serve as a cold wallet for added security.

Although MEXC does not provide easy tax calculation for beginning users, it does have an area to download transaction history, which can then be integrated into your personal tax software or handed off to your accountant.

Intermediate users and more experienced investors will find a deep user pool and high liquidity to ensure that they have fast access to their trades.

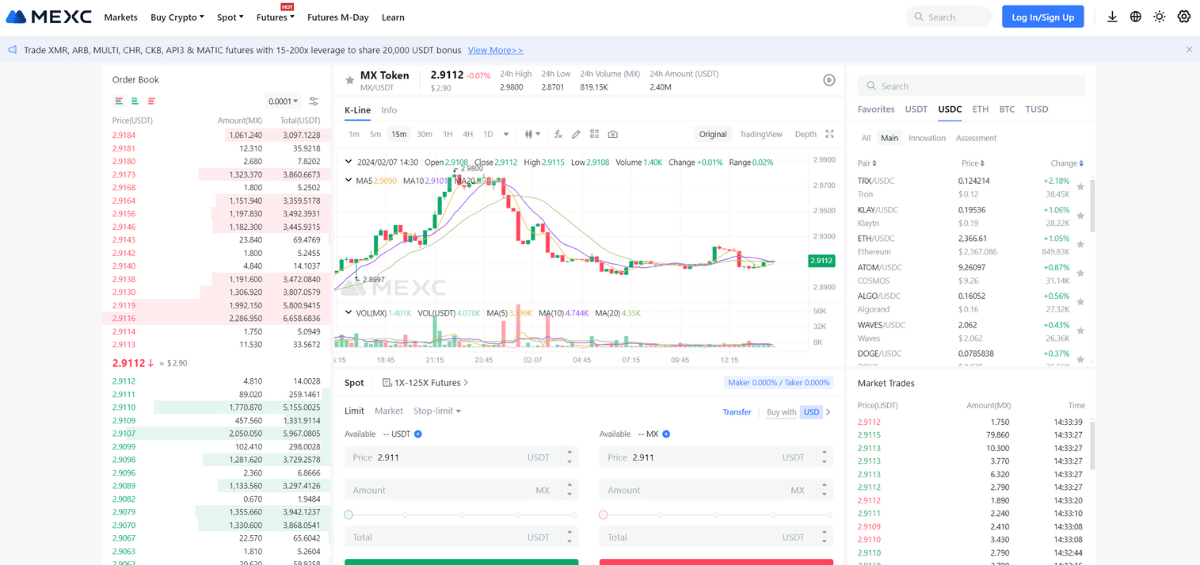

The user interface is laid out in a familiar style that is reminiscent of CoinMarketCap. Clearly defined tabs help you zero in on exactly what type of trading interests you.

Trades can be initiated directly from the home page with the click of an icon that calls up the order book for a detailed snapshot of current conditions.

A “details” icon leads to real-time data, additional information about tokens, performance charts and a trade calculator.

New features continue to be added; among the most recent is the addition of an area on the futures page to check the average entry/close prices of historical positions.

Search history and top searches round out some of the newest features that can assist users graduating from novice to intermediate and beyond.

DeFi staking and yield farming options, as well as automated trading, will also help intermediate users progress to the highest levels of crypto investing.

Advanced users, particularly day traders, can make use of industry-leading low-cost trades – especially when maximizing the use of the native MX token.

A full range of order types are available that ensure maximum flexibility for experienced traders:

- Stop-loss

- Take-profit

- Trailing stops

“Copy trade” is an additional function that enhances efficiency for professional traders.

This function first can be used in “observer” and “follower” mode to view the trades and patterns of experts, but the full benefits are revealed after filling out an application to become a full-fledged MEXC trader.

Upon acceptance (typically 1-2 days), professional traders will begin to receive profit shares. A new range of trading options will then be open to maximize the full scope of the MEXC exchange.

Lead trades are generated, which includes the choice of leveraged futures trades up to 125x.

A management dashboard becomes available for tracking followers, time followed, copy trade equity, as well as follower preferences.

A separate profit-share management area offers a detailed and transparent way to document the total performance of the trader’s portfolio.

Last, but certainly not least, MEXC’s trading engine can handle 1.4 million transactions per second, ensuring that trades are executed with speeds that rival traditional banking systems.

Institutional investors also can enjoy a range of dedicated benefits within the following categories:

- Brokers – API and independent brokers can customize parameters to best serve their clients. Brokers also can create sub-accounts under their master MEXC account.

- Market Makers – High-frequency trading with a quicker API interface, personalized customer support, higher withdrawal limits and interest-free loans.

- Funding – A dedicated account manager can tailor needs to increase leverage, offer more flexible funding and repayment options, as well as higher limits.

- Institutions – Fully incorporated businesses with requisite documents can enjoy lower rates, higher withdrawal limits, and 24/7 access to dedicated account managers.

Who MEXC Is Not For?

Prohibited jurisdictions include the United States and territories, Canada, Cuba, North Korea, Syria, Sudan, Iran, Crimea, Indonesia, Mainland China, Singapore, and Venezuela.

MEXC is not the best choice for those who prefer to trade on an exchange that employs full KYC in the sign-up process.

MEXC is also not optimal for those who value decentralization above all else.

MEXC Features Explained

Security and Safety

MEXC is registered in the Seychelles. The exchange is regulated in the UK by the Financial Conduct Authority.

It also holds an MTR license in Estonia that is recognized by all territories where MEXC operates.

Customers have Two-Factor Authentication (2FA) set as their default account sign-in for their first line of defense. From there, customers can choose to enhance security with more options:

- MEXC/Google Authenticator

- Mobile/SMS verification

- Anti-phishing code via email

- Withdrawal whitelists

- Third-party account authorization

- Device management

- Activity tracker

- Freeze account

- MEXC Verify

MEXC offers a convenient indicator from low to strong as users choose the above options.

A dynamic encryption algorithm assigns unique encryption keys for each user, which adds to MEXC’s base AES-256 encryption.

The layered architecture of MEXC is further strengthened by individual server hosting across multiple countries to help prevent a single point of failure.

Multi-signature and offline signatures are also employed to secure cold storage of digital assets.

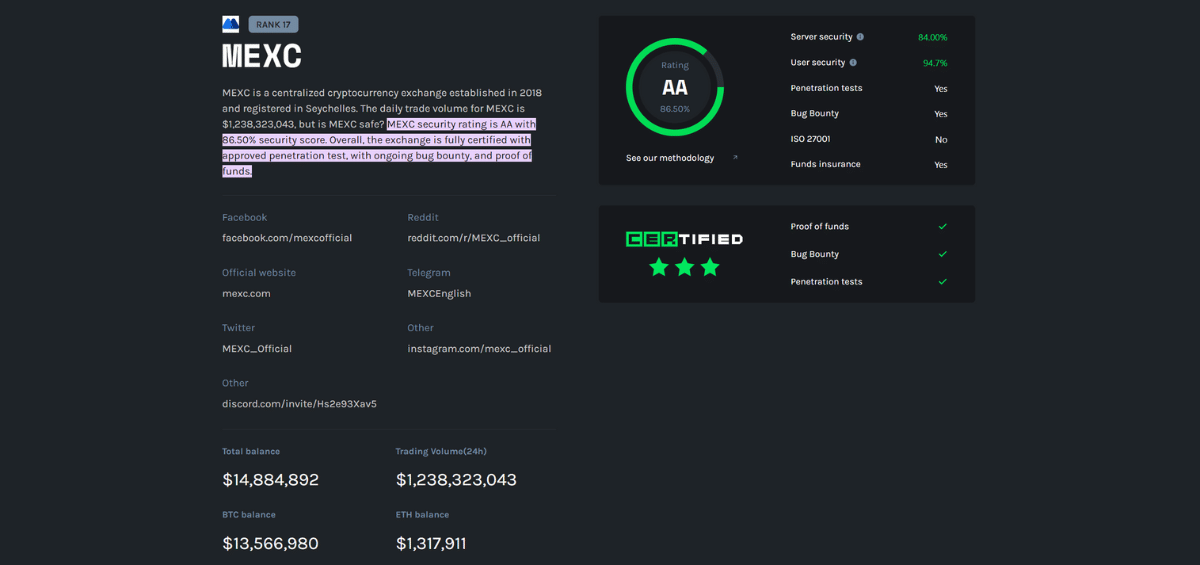

As we can see below, MEXC is fully certified and has received a highly commendable AA rating from CER, addressing the most critical points of server security and user security.

Security is further bolstered by ongoing penetration tests and bug bounties.

View CER methodology and additional information

Perhaps most importantly, proof of funds as well as funds insurance, is available for additional transparency and confidence that the overall health of the exchange is in top order.

The proof of at least 1:1 reserves for all assets is made available from MEXC here where users can check all relevant audits as well as individual token wallet addresses.

Here are the results of the most recent audit of reserves:

Additionally, MEXC has a dedicated liquidation and bankruptcy insurance fund to protect its users from the potential volatility in the futures market. As MEXC states:

When the losses from a position exceed the margin, the insurance fund is used to cover the bankruptcy losses. The increase in the insurance fund comes from the surplus generated by liquidation orders being executed at prices better than the bankruptcy price in the market.

Users can check the balance of each cryptocurrency at any time by viewing the insurance list.

Opening An Account With MEXC

Signing up at MEXC is free, no-KYC, and available in 18 languages with email and verification follow-up.

New users are immediately entitled to a welcome “Goodie Bag” that includes up to 1,000 USDT in bonuses for completing a series of gamified trading tasks.

There is also a convenient e-mail reminder that these benefits are waiting to be collected.

All users are immediately given a referral link to invite friends and earn up to 70% commission on applicable trades.

After referring at least 5 first-time traders, users can upgrade their status to become an affiliate with the ability to earn passive income of 50% for direct referrals and 10% on sub-referrals.

VIP levels are available to unlock for high-value customers after completing tiered KYC requirements.

Gold – 300,000 USDT total assets

Diamond – 1,000,000 USDT total assets

Premium – 2,000,000 USDT total assets

Additional benefits are extensive and range from 24/7 one-on-one customer support, exclusive industry analysis reports, exclusive events online and offline with gifts, affiliate programs, express deposits and withdrawals with higher limits, private seminars, beta testing invites, and more.

Pricing & Fees

Maker Vs Taker Fees / Trading Fees

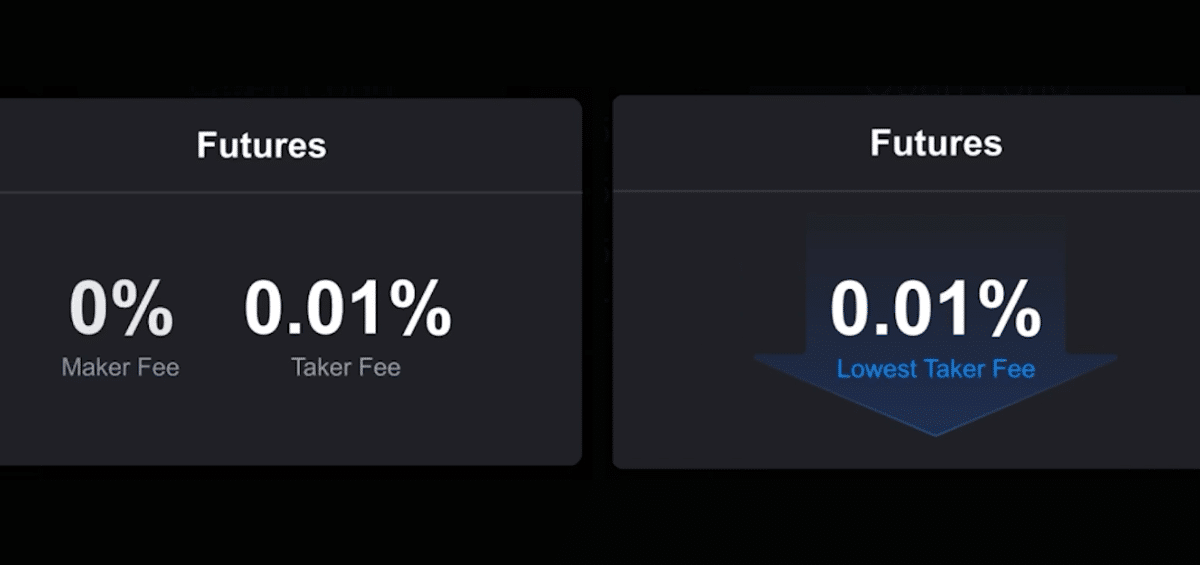

MEXC offers a low-cost, flat trading fee for both spot and futures trading.

Spot: 0.1% maker, 0.1% taker

Futures: 0.01% maker, 0.05% taker

MEXC also offers “Special Trading Pairs” that carry no maker or taker fees. The current list is as follows:

- DOGE – USDT

- TON – USDT

- XRP – ETH

- DOGE – USDC

- ETH – USDT

- XRP – USDC

- BTC – USDC

- XRP – USDT

- ETH – BTC

- BTC – USDT

- XRP – BTC

- ETH – USDC

While deposits are free, there are a range of withdrawal fees that can be a bit costly. Due to the high number of tokens available, it is best to consult this fees page prior to trading.

Deposit Methods

Funding your account can be done easily with any of the supported cryptocurrencies and tokens.

Fiat options are clearly presented on a single page with tabs for Express, P2P, and Third-Party.

Fiat transfers can be made with debit and credit card where regulations permit.

Global bank transfers in fiat can be done through SEPA where available.

Third-party funding options can be made through various service providers such as Banxa, MoonPay, Mercuryo and Simplex.

A P2P area is available for direct transfers between MEXC users.

Lastly, a MEXC MasterCard is available to be topped up and used for global purchases in supported regions.

Withdrawal Methods

All cryptos can be withdrawn to supported addresses on-chain or to other exchanges.

No-KYC accounts still have a substantial withdrawal limit of up to 30 BTC per 24 hours. Higher tiers progress from 80 BTC with KYC, up to 400 BTC per 24 hours for institutional accounts.

Withdrawals can also be made via transfer to other MEXC users with no fee using UID, email or mobile number.

There is currently no option for direct fiat withdrawals to bank accounts for retail users. This can lead to costly workaround solutions noted below.

First, it is important to mention that fiat withdrawals are a notorious problem across the entire crypto landscape.

While people tend to blame exchanges for this – and yes, centralized exchanges can be more susceptible to issues – this is mainly due to regional regulations and the ever-changing rules imposed by the traditional banking system and local governance.

The lack of fiat withdrawals can be remedied in many cases by withdrawing to a third-party wallet connected to a bank account where permitted.

There also might be P2P options that can be conducted between MEXC users, or through other P2P crypto sites, but these will generally be restricted by limits and be subject to additional commissions.

The final option is to withdraw to an exchange like Coinbase or Binance connected to your bank account.

However, this not only includes additional costs but nullifies any of the original no-KYC benefits from MEXC.

Switching Between Currencies and Blockchains

Moving between supported assets is easy and quick with an array of fiat, cryptocurrencies, and multiple blockchains for tokens and stablecoins.

A deep user pool, plus high liquidity and fast transaction times help MEXC be among the top of the pack in this area.

History Of Downtime

MEXC has a dedicated area for downtime announcements that can be found in their support database here.

We could not find a historical uptime page, which can be a valuable metric for users to judge overall ongoing exchange stability.

Several other exchanges that we have reviewed do offer this. We would suggest that MEXC adds this to their maintenance section.

MEXC has never been hacked in its 6-year history.

It is important to remember that MEXC is a centralized store of funds.

Despite employing cold storage for keeping their holdings mostly offline, as well as their great track record of liquidity and limited downtime or withdrawal issues, we always recommend only keeping an amount sufficient for your trading needs, or an amount you are comfortable putting away long term.

All other funds should be removed into your own personal self-custody wallet.

Customer Support

FAQ section, site-wide search function, 24/7 in-app/browser live support, ticket submission for help desk, e-mail, and all social channels and forums offer community support and response to customer questions.

Alternatives

MEXC vs. Alternatives

| MEXC | BINGX | LBANK | |

| Founded | 2018 | 2018 | 2015 |

| Users | 10 million | 10 million | 10 million |

| Cryptos | 2000+ | 600+ | 700+ |

| Spot Fees | 0.1% | 0.1% | 0.1% |

| KYC | tiered | no | no |

| Mobile App | yes | yes | yes |

| Card | yes | yes | debit and credit |

| Countries | US, China, CAN, Singapore | US, CAN, China, Singapore | Only internationally embargoed |

| Security Rating (CER) | AA | AAA | A |

| Best For | all trders | day traders | futures, derivatives trading |

| Overall Rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Signup | MEXC | BingX | LBank |

Conclusion

MEXC is a truly comprehensive exchange that offers great flexibility for all levels of users from novice to institutional.

A low-cost, simple fee structure for both spot trading and futures enhances its desirability and makes it a great place for beginners to feel comfortable leveling-up their knowledge and progressing to more complex investing systems and programs.

We found the integration of the native MX token to be particularly seamless and value-added in a range of circumstances, including:

- Up to 50% savings on trading fees

- 87.9% current APY

- Up to 70% commission on referrals

- Subscription discounts

- Free airdrops

- MEXC Launchpad

- MEXC Kickstarter

One drawback we did find, however, is a constant stream of offers and notification pop-ups on the home page that masquerade as “reminders.”

This can give the user the impression that they are on a casino site rather than a leading crypto exchange. There is the option to turn these off for the day, but it was inconsistently applied over our weeks of testing.

On the flip side, some notifications do present valuable information such as daily bonuses that can sometimes include 0% trading options, matching trades, airdrops, competitions with prizes and more.

These pop-ups are too large and intrusive and could easily be made into a cleaner and more professional presentation by solely relying upon the clearly highlighted notification icon in the upper right.

Frequently Asked Questions

What Services Does MEXC Offer for Crypto Users?

Hot and cold wallet. Full-function crypto exchange, DeFi, staking rewards, yield farming, spot and futures trading, leverage and margin trading. Referral and affiliate program. Three VIP levels unlock additional features and benefits.

Dedicated institutional account management and benefits. Ongoing bonuses, tasks, challenges and events. Crypto MasterCard available in some locations.

How Does MEXC Protect Its Users and Their Assets?

2FA authentication and enhanced user security preferences. MEXC Verify to check phone numbers and social accounts for fraud. AES-256 and dynamic encryption algorithm. Independent servers in multiple countries.

Each cryptocurrency has fund insurance. Proof of funds held at least 1:1 is continually audited and transparent to users. Majority of assets held in cold storage. AA cybersecurity rating includes penetration tests and bug bounties.

What Are the Costs Associated with Using MEXC?

Spot and futures maker and taker fees apply, ranging from 0.01% – 0.1%. Other fees include cryptocurrency-specific withdrawal fees and MasterCard-related fees.