Table of Contents

In our ongoing research to find the best crypto exchanges, our experts have signed up for Mercatox. This is a centralized crypto exchange with many of the key features that every trader needs.

However, after weeks of testing, our final verdict is No. We recommend Bitstamp or Poloniex as far more complete and secure centralized exchanges.

For those of us who have been through many crypto cycles, we have come to value security most of all. Unfortunately for Mercatox, despite having resolved major issues in the past, it remains too low on our overall evaluation of trust to suggest trading on the exchange at this time.

Let’s explore a few areas that Mercatox gets right and what it gets wrong as a centralized crypto exchange.

Mercatox Overview

| Rating | |

| Security And Safety | 1 |

| Necessary Requirements | 5 |

| Pricing And Fees | 7 |

| Deposit and Withdrawal Methods | 2 |

| Customer Support | 1 |

Who Mercatox Is Best For?

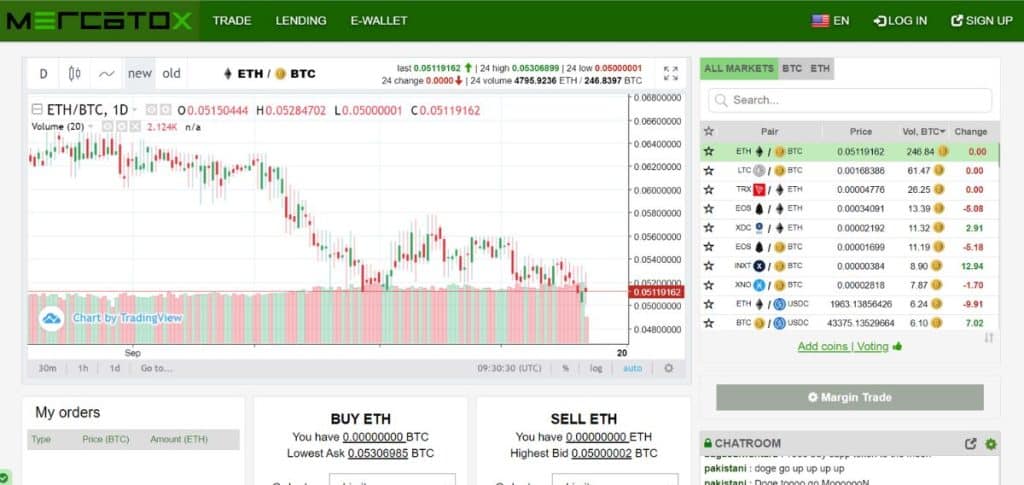

The Mercatox crypto exchange is a decent place for beginning traders to quickly sign up and get a feel for the layout and options of a typical exchange. The interface is a clean and well-designed Web-based trading platform that also offers lending and multi-currency options to explore.

Built-in e-wallet, simple trading fee structure, margin trading, and availability in nearly every country (where legal) makes it a fair entry point. Unverified no-KYC is available with restrictions.

Who Mercatox Is Not For?

Mercatox is a non-regulated exchange with a history of ongoing issues that should make traders extremely wary of putting their hard-earned money to work here. There is also a lack of some basic options available on many other centralized exchanges.

No one should use a product with limited functionality and ongoing concerns about exchange integrity when so many other outstanding products are available.

Mercatox Features Explained

Security and Safety

Account security at Mercatox is very basic with password creation and 2-factor authentication for email and account login.

We could not find evidence of cold storage or encryption protocols. There is also very little transparency or information about what the exchange is doing to prevent hacks, scams and other potential attacks upon its users.

The exchange only displays a general “safety” button on its homepage, and three sentences at its FAQ page that are reassurances, nothing specific.

Worryingly, their own news page acknowledges that “our service is still have difficulties due to hacker attacks.”

Further investigation reveals that it was part of a multi-exchange hack in 2018. Instead of clarifying what measures would be taken to prevent future attacks, there were again only vague and general statements from the company.

Even big-name exchanges have fallen prey to hacks, but if we look at the current state of the Mercatox shown below in their CER ranking, they have earned a D score.

Most importantly, they are not up to current standards in the three key areas that should concern all traders: penetration tests, bug bounties, and proof of funds.

View CER methodology and additional information

These systemic security concerns are coupled with a history of user reports that indicate frozen funds, withdrawal failures, and weak resolution when problems do arise.

The highest average user-review scores we could find were still well below average. Trustpilot shows a dismal 1.9 score.

User complaints do seem to have diminished over time, but this might simply be an indication that most users have already left the exchange.

If we look at the statistics page on the Mercatox site, we can see that they show 765,000 signups with only 5,000 active users in a 24-hour period.

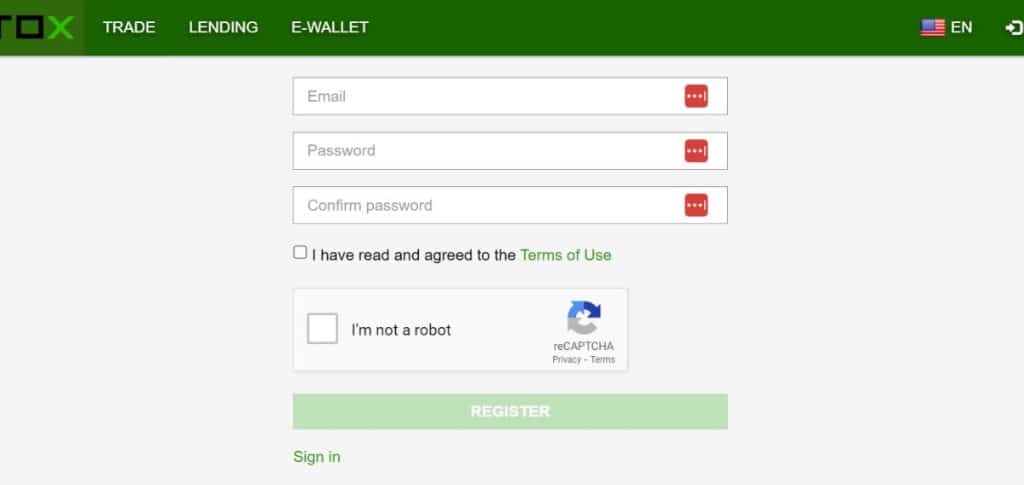

Opening An Account With Mercatox

Signing up at Mercatox is easy and free, but it is important to note that it is Web-based only, there is no mobile app available – smartphone use would have to be done by browser.

An email confirmation is all that is required for those who just want to look around and engage in basic trades. Users can choose to remain “unverified.”

However, stringent KYC is required to unlock all features as a “verified” user.

Verified users also immediately qualify for the Mercatox affiliate program that offers commissions for referrals, as well as subsequent trade commissions.

A loyalty program is available by application that issues point rewards, discounted fees and other benefits for various levels of platform promotion.

Language options are limited to English, Russian and Chinese.

Pricing & Fees

For those who prefer simplicity, Mercatox forgoes the typical taker and maker fees of most exchanges by offering a flat 0.25% trade fee, which is on the lower end of the scale.

Deposit Methods

Deposits are limited to crypto only, no fiat bank options are available, nor is PayPal. There is no fee for deposits, but there are minimum amounts required depending on each cryptocurrency, which you can search here.

A P2P send feature for deposits, transfers and lending is available between Mercatox users. Electronic payment gateways for dollars, rubles or Euros are listed as Yandex, Qiwi, Perfect, OKPAY and Payeer.

Withdrawal Methods

No fiat withdrawals are allowed, but electronic withdrawals are accepted with the same deposit methods. Withdrawal to personal wallets is free, but any other type of withdrawal contains fees based on each currency or electronic payment method, available here.

There are minimum withdrawal amounts as well. Unverified users have an upper-bound withdrawal limit of .5 BTC in a 24-hour period. Verified users can withdraw up to 5 BTC.

Among negative customer reviews, withdrawal difficulty leads the list. Long wait times, failed confirmations, frozen funds due to “maintenance” and even sending crypto to the wrong address are among those that we encountered across many comment sections.

While some of these can be ascribed to user error, these complaints are far too widespread and consistent to give confidence that funds can be withdrawn in a quick and accurate manner.

Switching Between Currencies and Blockchains

Mercatox boasts of having 700 currency pairs to enable easy access to a multitude of trades and blockchains. In reality, there are only a few hundred listed.

Moreover, due to very low volume, nearly all trades occur among just a few dozen pairs with the bulk of the order book dominated by ETH/BTC, followed by LTC/BTC, TRX/BTC, XDC/ETH and EOS between both BTC and ETH.

This creates a very limited and slow environment for trading at anything beyond the most beginner level.

History Of Downtime

Mercatox has not experienced long periods of exchange-wide downtime, but they do advise users of periodic maintenance that can make the exchange unusable for several hours at a time. Mercatox also experiences ongoing token-specific delays and maintenance that can frustrate users, but the exchange does indicate these on its statistics page.

Customer Support

Limited to FAQ section, ticket submission for help desk, and e-mail. A chatroom is available to use with sign-in only, but we didn’t see evidence of problem submission and resolution by admin there, nor at their social channels.

Alternatives

| MERCATOX | BITSTAMP | POLONIEX | |

| Founded | 2016 | 2011 | 2014 |

| Users | 765,000 | 5 million | 400,000+ |

| Cryptos | 200+ | 80 | 400+ |

| Spot Fees | Flat 0.25% | 0.0% – 0.40% | 0.0%-0.20% |

| KYC | KYC adds benefits | Yes | KYC adds benefits |

| Mobile App | No | Yes | Yes |

| Countries | 190+ | 190+ | 150+, US N/A |

| Security Rating (CER) | D | AAA | A |

| Best For | Beginner | All levels. Staking and lending. | All levels. High volume, non-US |

| Overall Rating | ⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Signup | Mercatox | Bitstamp | Poloniex |

Conclusion

The Mercatox exchange is generally well designed and user friendly, offering a customizable dashboard and most standard trading features.

This would make it suitable for beginners, but there is a lack of tutorials and other educational material to help elevate user comfort and knowledge.

For intermediate and advanced traders, Mercatox is also deficient in key functionality. The lack of a mobile app, limited trade volume, and no traditional fiat options leads to a largely inactive trading community.

Poor security and company transparency, lack of live customer support and slow response time on ticket submissions creates a frustrating experience at best, and a treacherous trading environment at worst.

At this time, we cannot recommend Mercatox for anything other than as a research tool for beginners to explore basic functions.

We will continue to monitor the exchange for any important updates that will improve upon the negatives detailed above.

Frequently Asked Questions

Which Cryptocurrencies are Available on Mercatox?

More than 200 cryptocurrencies and 700 trading pairs are advertised, less are listed. Highest volumes appear for ETH, LTC, TRX, EOS, BTC, XDC and XNO. Some notable tokens such as ENJ, XMR, SOL and AVAX are not available.

How Secure is Mercatox for Crypto Transactions?

Not secure based on previous hacks, limited transparency and updates, and ongoing withdrawal difficulties.

What Fees Does Mercatox Charge for Trading?

0.25% flat fee.