Table of Contents

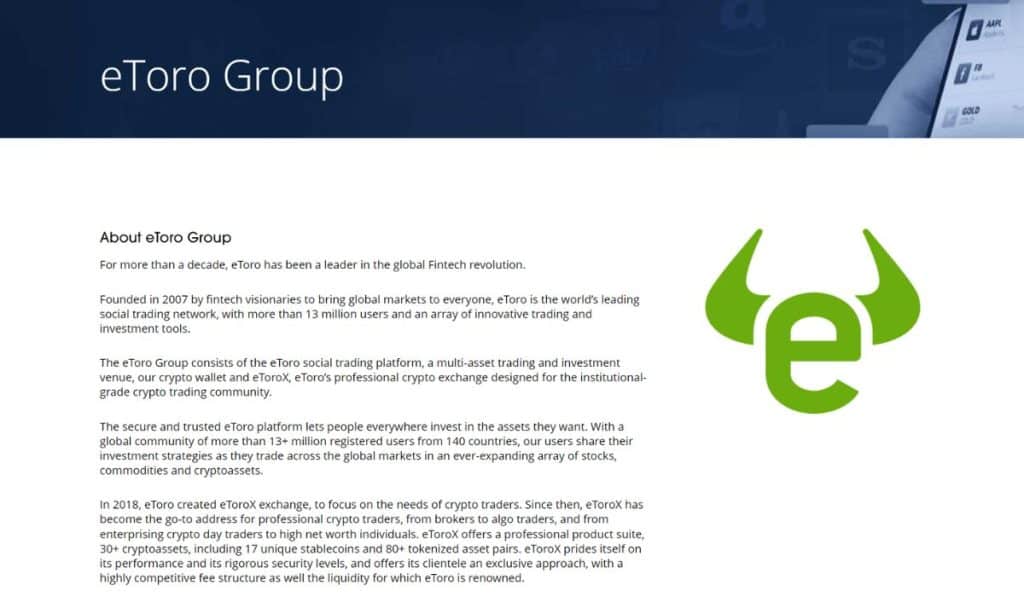

Is EtoroX different from EToro? Yes and no, they are similar except EtoroX gives you way more asset variety.

EtoroX is a prime example of a regulated decentralized exchange (RDEX) that we’ve signed up for and checked out for weeks, so that you don’t have to do all the legwork.

Our verdict is that this is an exchange you want to pass up on unless you’re okay with a $10,000 minimum deposit.

If the $10,000 deposit is too much, Robinhood would be a better alternative. There’s no minimum balance and you can take your pick between traditional and crypto assets.

In the era of the FTX aftermath, custody is a hot button issue, so keep reading to find out what resources this exchange offers to build trust.

Key: EtoroX is considered the crypto arm of eToro, so you want to read this especially if you’re looking to buy and stash away some digital assets.

EtoroX Overview

We’ve gone through the trouble of testing and triple testing all of this exchange’s basic and hottest features so you don’t have to. On a scale of 1-10 EtoroX ranks as follows on each count.

| Rating | |

| Security And Safety | 9 |

| Necessary Requirements | 7 |

| Pricing And Fees | 7 |

| Deposit and Withdrawal Methods | 6 |

| Customer Support | 4 |

Who EtoroX Is Best For?

EtoroX is for you if you value security, stability and access to a variety of asset classes. Since that’s all of us, let’s go into the nitty gritty of who should love this exchange.

Institutions

EtoroX is primed for institutional investors and professional traders. As a fully regulated exchange under the Gibraltar Financial Services Commission, it offers services to enterprise-level clients with ease and confidence.

Day Traders

Traders who track charts all day keep a keen eye on transaction fees. EtoroX offers taker transaction fees of between 0.24% and 0.12% depending on the size of the transaction.

This is reasonable considering other exchanges such as Coinbase exact between 0.20% and 0.60% in taker fees.

With some day traders executing hundreds of trades in a day, it’s important to ensure that transaction fees don’t eat too much into your ROI.

Liquid Investors

EtoroX offers great liquidity to its customers. With billions in institutional money flowing in, it’s not hard to see why. The platform also pumps in some extra liquidity through its credit line feature.

Spot traders find this feature to be particularly useful because it helps them use leverage to purchase more crypto and potentially maximize returns. This credit line feature is also great for institutional money because institutions get a great credit line of up to 5X their initial investment.

The leverage investors get depends on their asset class of choice and the amount of money invested. An investor who stakes $100,000 can get as much as $500,000 to trade crypto.

Crypto Traders

The platform has been christened the crypto arm of eToro for a reason. Traders get access to a variety of cryptos and stable coins with favorable crypto-crypto trading fees.

A variety of stablecoin pairs are available on the platform. Some of the popular ones include; CADX, AUDX, USDEX, JPYX, CHFX and EURX.

Who EtoroX Is Not For?

EtoroX is not for you if you fall under one of these categories.

No-KYC Traders

EtoroX has stringent KYC requirements. Before logging into the platform, you will be required to verify your identity and satisfy their KYC/AML procedures.

If this doesn’t sound like something you want to do, check out no-KYC platforms like Changelly, SimpleSwap, TradeOgre, MexC, Phemex, Hodl Hodl, Probit and Pionex. These platforms are better suited for your anonymity and decentralized needs.

Retail Investors

As pointed out at the top of this article, the minimum deposit for this platform is $10,000. That amount is out of reach for most retail investors. It is also not ideal for beginner investors looking to dip their toes into the digital asset world.

The trade volumes on the exchange can however be useful to smart retail investors interested in tracking the direction of institutional money.

The average retail investor should check out Coinbase, Robinhood and other exchanges with reasonable minimums or no minimums at all.

Decentralization Advocate

If your attraction to digital assets stems from your desire to beat the centralized financial system, this exchange may put you off. EtoroX betrays some of the tenets of decentralization and privacy.

The platform is a regulated exchange with some decentralized traits in that they trade in cryptos, that’s it.

Everything else has the makings of your local central bank. The platform also has a KYC/AML process which undermines the tenets of privacy and anonymity.

EtoroX Features Explained

EtoroX has unique features that differentiate it from its parent company eToro while also setting it apart from its close competitors. Some of its top features include:

Security and Safety

Crypto exchange hacks have been a common fixture in crypto-related headlines since Bitcoin went mainstream.

This coupled with the financial contagion precipitated by the FTX collapse has made the security of funds the main talking point for the past year.

EtoroX has put in place measures to address these concerns.

- KYC Requirements: EtoroX being a KYC exchange may repel some users, but it also secures others on the platform. It has stringent KYC/AML procedures. A user’s identity has to be established before they can log in and that gets rid of most of the anonymous malicious user risk.

- Two-factor authentication: The platform requires that all users enable Google two-factor authentication before they are able to transact. Users will need to verify their information every time they log in. This is an extra layer of security built in to protect user information and funds.

- Military-grade cold storage: With institutional money on the line, the platform has pulled all the stops to ensure safety and security of funds. To counter any exploits and hacks, EtoroX employs a state-of-the-art, military-grade, cold storage CaaS (Cold storage as a service) feature.

This feature puts institutional money at ease even in times of industry-wide hacks and distress.

- Encryption protocols: The platform’s crypto wallet is backed by analytic behavior machine learning and secured by advanced signature mechanisms. This way, the platform can easily detect malicious actors and remove them.

EtoroX has also partnered with blockchain firm Chainanalysis to launch a ‘know your transaction’ feature that helps secure the network while fulfilling anti-money laundering requirements at the same time.

- EtoroX hack history: As of the time of writing, EtoroX has yet to experience a hack that is similar to the $40 Million Binance hack. This is most likely due to their well advanced security protocols setup to secure institutional money.

Aside from the protective technology, the exchange is heavily regulated by the Gibraltar Financial Services Commission (GFSC).

The exchange is also backed by its parent platform eToro which operates under FCA, CySEC and ASIC regulations which require specialist measures to protect investors. This means investor funds are stashed away in top-tier banks and their information is secured under SSL encryption.

With all these measures in place and no major hack reported on the exchange, it’s hard to tell what measures they would take to refund investors if a hack were to happen.

- Proof of reserves: With the FTX saga of 2022 causing an industry wide financial contagion, crypto exchanges have been under pressure to reveal their holdings. Exchanges such as Binance, HuoBi, Bitfinex and Kraken have all provided their proof of reserves.

EtoroX is yet to provide proof of reserves at this moment. This could be because the platform is backed by its parent company and operates like a centralized central bank, which puts customers at ease. The exchange is also heavily regulated and also has most of its holdings in cold storage.

- CER ranking: Though the exchange has impressive security protocols, it only has a CER security ranking of 52% on the user side and 82% on the server side which isn’t as impressive as Kraken’s 100% on both user and server side.

Opening An Account With EtoroX

Opening an account with EtoroX is fairly easy. Before accessing the platform, you need to be a verified user. You achieve this by going through a KYC/AML process.

Once you’re verified, you can log in and start navigating through the platform. You can then fund the account and pick the first asset you want to buy.

1% may not be too high but it’s not as competitive as other exchanges like Swissborg which charges 0.1%.

The platform offers advanced trading tools, 30+ crypto assets which include 17 unique stablecoins and 80+ tokenized asset pairs.

Traders will also have access to Smart Portfolios, which leverage machine learning algorithms to pile together the best performing asset bundles.

Pricing & Fees

EtoroX is known for its competitive fees at 0.24% per trade for takers with makers being charged at 0.10%.

Larger volume traders provide much needed liquidity to the exchange, and they are rewarded rebates if their volumes exceed $100,000 in a month.

| 30-Day Trading Volume | Maker Fee | Taker Fee |

| $0 – $100,000 | 0.10% | 0.24% |

| $100,000 – $1M | 0.10% | 0.22% |

| $1M – $10M | 0.05% | 0.08% |

| $10M+ | 0.01% | 0.03% |

The platform charges a 1% fee on buying and selling crypto assets on top of the spread. It also charges $5 on withdrawal fees.

Deposit Methods

Just like with most exchanges, there are no charges for crypto deposits at EtoroX. SInce EtoroX is mainly a crypto trading exchange, users make deposits through cryptocurrencies, with the US dollar being the only fiat currency supported.

Traders can make fiat-to-crypto conversions round the clock, seven days a week thanks to two regulated and secure on-ramps.

Traders can either deposit funds into the EtoroX account via a bank transfer through Signature Bank or via SIgnature Bank’s blockchain-based payments platform, SIGNET.

With the bank being a federal reserve member, traders can be assured of a regulated environment and security for their funds.

EtoroX also allows professionals to instantly purchase the dollar stablecoin USDEX thanks to a partnership with Signature Bank.

The minimum deposit is $10,000 but there is no minimum for crypto deposits.

EtoroX is a centralized exchange since the platform plays an intermediary role between buyers and sellers.

This automatically crosses it off the list of peer-to-peer exchanges. Traders looking to work with P2P marketplaces can always check out Binance, KuCoin, Paybis, OKX and a host of others.

Withdrawal Methods

There are set withdrawal limits for each asset that you will want to pay attention to. Here is a table of the withdrawal limits of some of the more popular assets on the platform.

The platform exacts a $5 fee for both bank transfer and credit/debit card withdrawal fees.

For users worried about their funds being potentially accessible to malicious hackers, EtoroX does not provide a defined process for users to move their funds offline. They however do swear by their military-grade cybersecurity measures to keep funds safe.

Aside from the advanced cryptography and heavy regulation, the platform stores most of the user funds away in a home vault. This is their cold storage mechanism where most of the deposits are kept offline and away from potential hackers.

Institutional investors and professionals can rest easy because most of the exchange’s reserves are not in hot wallet custody.

Switching Between Currencies and Blockchains

To switch between currencies and blockchains, you will need a third party platform. This is because you cannot convert cryptos in your crypto money wallet to fiat currencies.

To make the switch, users will need to transfer their holdings to an external wallet. This will cost you some gas fees depending on the platform.

First, you have to transfer your money from the trading platform to your crypto money wallet. This is a straightforward 4 step process.

- Open the EtoroX trading platform to get started.

- Click on the portfolio tab on your trading platform.

- Select the crypto asset you would like to transfer by clicking on the specific trade.

- On the ‘Edit trade screen’ click ‘Transfer to wallet’.

- Review the transfer details and execute.

Note that this is a one way process. You cannot transfer the crypto back to the trading platform. There are significant fees depending on the asset you want to transfer to your eToro money wallet. Here is a list of fees for the key crypto coins.

| Crypto/Ticker | Minimum position amount (in units) | Fee | Minimum Fee | Maximum Fee |

| Bitcoin (BTC) | 0.007195 | 0.5% | $1 | $50 |

| Ethereum (ETH) | 0.107588 | 0.5% | $1 | $50 |

| XRP (XRP) | 17.7574 | 0.5% | $1 | $50 |

| Litecoin (LTC) | 0.084546 | 0.5% | $1 | $50 |

| Bitcoin Cash (BCH) | 0.02296 | 0.5% | $1 | $50 |

Once the crypto is in your crypto wallet you can then transfer it to an external wallet. Transferring crypto to a third party wallet is a seamless process that involves 7 steps.

- Sign in to your crypto wallet app.

- Tap the crypto icon you will see on your screen to reveal your wallets.

- Tap on the crypto you wish to send.

- Tap ‘send’

- Select the amount you want to send and input the recipient’s wallet public address. You can also tap on the camera icon to scan the recipient’s QR code which will input the recipient address automatically.

- Review the address to ensure accuracy and then tap ‘send’.

- Verify the notification that will be sent to your phone.

Once the cryptos are in your third party wallet of choice, you can now convert them to fiat currency. If your third party wallet of choice is a Coinbase account, you can easily convert crypto to fiat currency in 4 steps.

- Sign in to your Coinbase account.

- Click Buy/sell at the top of the screen.

- Enter the amount you wish to transfer into your local fiat currency.

- Preview the transaction and then execute.

History Of Downtime

EtoroX touts its collaboration with DoiT International to run a Google cloud solution as a great enhancement of the platform’s security, scalability and stability.

This means that the risk of protracted downtimes are greatly reduced. The platform’s terms and conditions mentions the possibility of transmission delays.

These possible delays are grouped under Security-related, Information retrieval-related, and Verification-related delays.

Under these provisions there is a dark ‘no-liability for delays’ clause that absolves the platform of any responsibility incase of a delay due to high traffic or any reason out of the platform’s control.

Customer Support

Customer support reviews for this exchange are quite damning on most platforms. Customers decry difficulty accessing their livechat which only works 24/5 and not 24/7.

There is a customer support form on their website with no details as to how soon their response to you will be. The platform’s parent company does a better job by offering a customer support Chatbot and 24/7 Live Chat.

Alternatives

EtoroX may have its proponents and loyal customer base, but it has also marginalized traders who are not institutional.

There are also some big money investors that may look elsewhere for better terms. Here is a chart of popular EtoroX alternatives and their fees.

You can visit Cointracker.io for a more comprehensive list.

Conclusion

EtoroX is one of the best wallets out there if you are an institutional investor looking to park some money in cryptos. The platform was created to serve corporate level clientele with large amounts to put away.

With storage being the hot topic in the industry at the moment, the platform has invested in military-grade cyber security resources to keep funds secure.

This is backed by the fact that most of these funds are kept in cold storage which allays institutional fears when the exchange next door gets broken into.

This exchange is not for you if you’re a retail investor or a beginner. The minimum requirements are prohibitive and the customer service isn’t that great. You can also get lesser transaction fees by choosing exchanges like Binance, Bitpanda and Bitbox.

Swapping crypto coins to fiat is also a hassle, since you have to involve a third party by sending the coins to an external wallet.

Our overall recommendation is to avoid this exchange unless you tick the boxes for who this exchange was created for. Institutional investors and professionals with large volumes to move and manage. This exchange could also be for you if you move large amounts and don’t want to cold store your own coins.

Frequently Asked Questions

What Cryptocurrencies Can I Trade on EtoroX?

The eToro Money Crypto Wallet supports the trading of Bitcoin, Bitcoin Cash, Litecoin, Stellar, Cardano, Ethereum, Tron and XRP. Users trading on the eToro platform can transfer, send and receive any of these coins.

How Secure is EtoroX for Trading Cryptocurrencies?

EtoroX is quite secure for trading cryptocurrencies. The EtoroX wallet is backed by its parent company eToroX Limited (‘eToroX’), a limited liability company incorporated in Gibraltar with company number 116348 and with its registered office at 57/63 Line Wall Road.

The platform is a regulated DLT provider licensed by the Gibraltar Financial Services Commission under the Investments and Financial Fiduciary Services Act with licence number FSC1333B.

In Germany, the wallet is provided by eToro Germany GmbH., supervised by Bundesanstalt für Finanzdienstleistungsaufsicht, Bafin. The heavy regulation goes a long way in ensuring safety and stability.

Are There Fees Associated with Trading on EtoroX?

Yes. Crypto-to-crypto conversion fees are charged at 0.1%. This is a relatively reasonable rate compared to peer platforms like Coinbase which charges fees of up to 0.60%.

The rates are charged according to prevailing market rates. The minimum transaction limit is $20 while the maximum is $10,000. Send transaction limits are at $50,000 per transaction and the overall daily maximum limit is $200,000.

There are also some charges for creating different asset wallets. Creating XRP and Ethereum wallets is enabled as part of the coin transfer process and is therefore not charged.

Creating an XLM wallet however, requires a minimum non-spendable deposit of 2.5 XLM.