Table of Contents

Dubbed the “Global Cryptocurrency exchange” CoinEx is a Hong Kong based centralized crypto exchange looking to compete favorably with the best of them.

We took a few weeks to check out CoinEx to see how the crypto exchange stacks up against competitors like Coinbase.

Straight out of the gate, we would recommend this exchange to our readers because everything checks out as of now but of course that may change over time.

If you’re looking for an exchange that gives you trading pair diversity, competitive fees and regulatory security, you may have just found the one.

CoinEx gives you all that with a complimentary, pleasant light green interface that’s cool to navigate through.

Aside from the usual features, we will take a deep dive into why this exchange may be the right fit for you depending on the kind of trader or investor you are.

CoinEx Overview

We rate the exchange as follows on a scale of 1-10 per all its main features.

| Rating | |

| Security And Safety | 6.5 |

| Necessary Requirements | 8 |

| Pricing And Fees | 7 |

| Deposit and Withdrawal Methods | 8 |

| Customer Support | 9 |

Who CoinEx Is Best For?

The Institutional Investor

With the Bitcoin ETF approval creating a buzz that might see institutional investors trooping into crypto, an exchange like CoinEx could be a great place to park institutional money.

The exchange doesn’t offer a Bitcoin ETF, but institutions who want to acquire the native coin itself should give the exchange some attention.

The institution has taken some impressive steps to ensure user money is safe such as a proprietary cold storage system, and multi-signature protocols.

The exchange may not be regulated by a top tier regulator in the mold of the SEC as yet, but it had its US MSB license approved by the Financial Crimes Enforcement Network (FINCEN) back in 2021.

This should appeal to institutions looking to hold some deposits in crypto.

Retail Investors

The exchange is not just suitable for big money institutions, it’s also great for individual investors with smaller deposits to put away.

There is no crypto minimum deposit, which makes it accessible and you can earn extra income thanks to their innovative CoinEx Financial Account product.

Retail investors are often pulled in by provisions like that. The platform also has a provision for teaching retail investors how to manage their money and beat peers in investing.

We will get more in depth about that provision later in the article.

Spot Traders

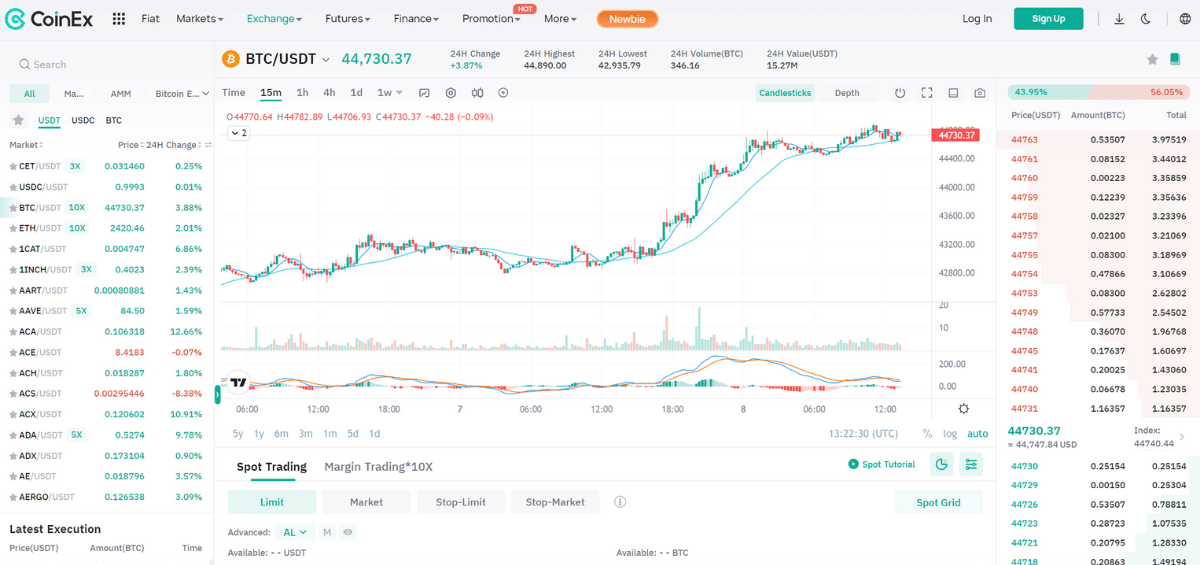

CoinEx supports spot trading and also provides a comprehensive guide on how beginners can get started.

Other than the how-to guide, the platform offers decent market maker fees for spot traders that meet their CET holding and trade volume thresholds.

Spot traders with crypto assets lying idle can benefit from compounding if they transfer those assets to the platform’s financial account.

Non-Anonymous Traders

Traders that do not mind sharing their identity with crypto exchanges will find CoinEx a pleasant broker to work with. The platform has a comprehensive KYC/AML provision that ensures traders on the exchange get their credentials verified before making transactions.

Though some traders can bypass the KYC process if they insist on remaining anonymous, the platform offers incentives to verified traders. The verification process is easy with a clear guide on how to get it done in minutes.

Who CoinEx is Not For?

Anonymous Traders

Traders who wish to remain anonymous will be hampered by the platform’s tight limits on unverified accounts. Unverified accounts having a restricted number of promotional event invites will be the least of investor worries.

Unverified users looking to withdraw large sums in a day will have to deal with a $10,000 maximum withdrawal cap. Verified users on the other hand can withdraw as much as $1,000,000 within a 24-hour period.

US Users

The platform closed its doors to the American market in April 2023 after settling a $1.8 million suit with the state of New York.

State attorney Letitia James had accused the broker of failing to properly register which led to the high profile case that led to CoinEx closing its curtains to US investors soon after retreating from the state of New York. This may change with time and users should remain alert for new updates.

Forex and Stock Traders

CoinEx is not an all inclusive broker. The broker only restricts itself to crypto trading which means that traders who like to dabble into forex pairs and stock indices will need to look elsewhere. Deriv may be a great alternative for such investors.

The only diversity CoinEx users are exposed to, is the segregated crypto categories the platform offers. The platform segregates its crypto offerings into categories like RWA, GameFi, layer-2, top gainers and others.

CoinEx Features Explained

Security and Safety

User funds protection is the most important feature for any exchange or broker and CoinEx has taken steps to put users at ease. Some of the steps the exchange has taken to secure user funds include;

Proprietary Cold Storage System

The exchange has embraced a cold storage system that keeps user funds offline while keeping private keys away from the internet. This is akin to taking the funds offgrid, away from hackers and exploiters.

The cold storage infrastructure has also been fortified with multidimensional mechanisms such as strict white listing, multi-signature protocols, real-time monitoring of abnormal transactions and dedicated hardware authentication capabilities.

CoinEx Shield Fund

The exchange created this provision to insulate user funds from unforeseen circumstances. This provision is part of the exchange’s guiding principle dubbed the “Users first” principle.

The platform moves to protect user funds by allocating 10% of trading fees to a user protection insurance fund. This will go a long way to ensure reimbursement of user funds incase of a negative event.

Proof of Reserves

With the FTX saga of 2022 setting off a contagious financial contagion, exchanges were under pressure to prove that they can provide liquidity to their customers.

Some exchanges took initiative and declared proof of reserves to allay any fears of possible bankruptcy. CoinEx took that step by declaring proof of reserves back in December 2022.

Cybersecurity Partnerships

The exchange has secured cybersecurity partnerships with some top firms to ensure user funds safety and user peace of mind. Anti-money laundering is a point of focus after CoinEx sealed a deal with cybersecurity firm SlowMist.

The two are forging an information sharing network that will enhance the exchange’s traceability capabilities.

Security Committee Team

CoinEx has also done the extra work to recruit top line security experts to work within its ranks. Yes, we are sure this happens in other exchanges as well, but it’s not common to hear about an exchange setting up a full fledged security committee.

The committee is mandated to run in depth security analysis, identify and mitigate potential threats,as well as pioneering new security strategies.

CoinEx Refund and Hack

Despite all these security measures that the platform has put in place, you will notice that we only gave them a score 6.5, lower than all its other features.

This is because the platform suffered a major hack that saw $70 million worth of investor crypto stolen from private wallets.

Coinex CEO Haipo Yang released a statement after the attack which led to the platform halting withdrawals and promising to resume the service once a new wallet system was set up. In its latest update, the exchange has promised that user assets will not and have not been affected by the hack. CoinEx will bear the financial losses from the incident.

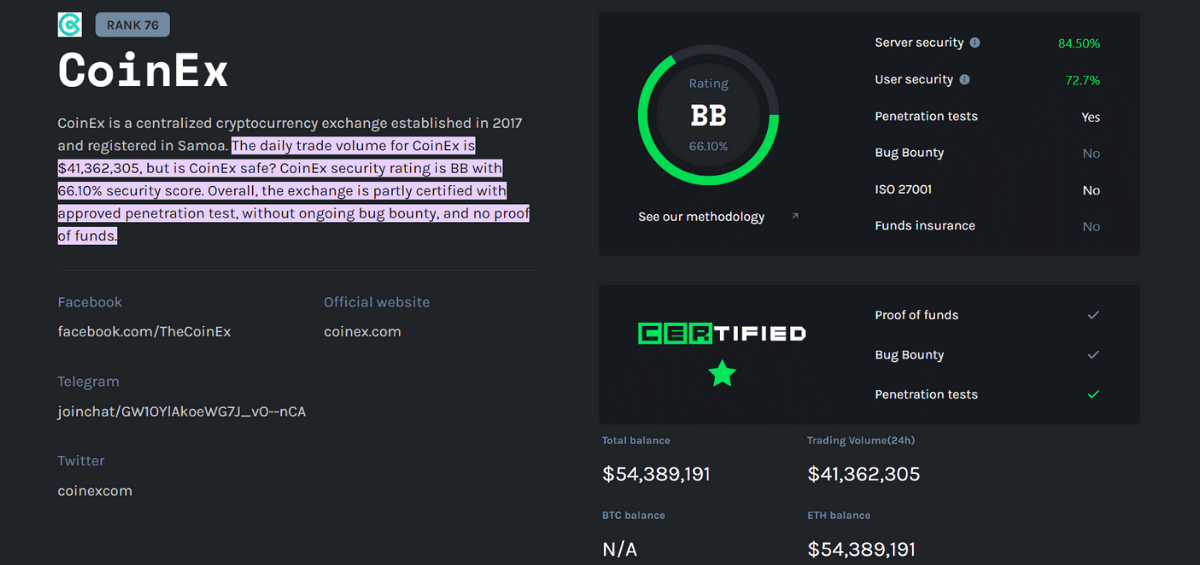

CER Rating

The exchange believes in utmost transparency and is open about the number of assets it has on chain and onsite. It has 100% reserve as its bottomline. CoinEx scores 84.50% in server security and 72.7% in user security.

The exchange could have probably scored higher if the much publicized incident didn’t happen.

Opening an Account with CoinEx

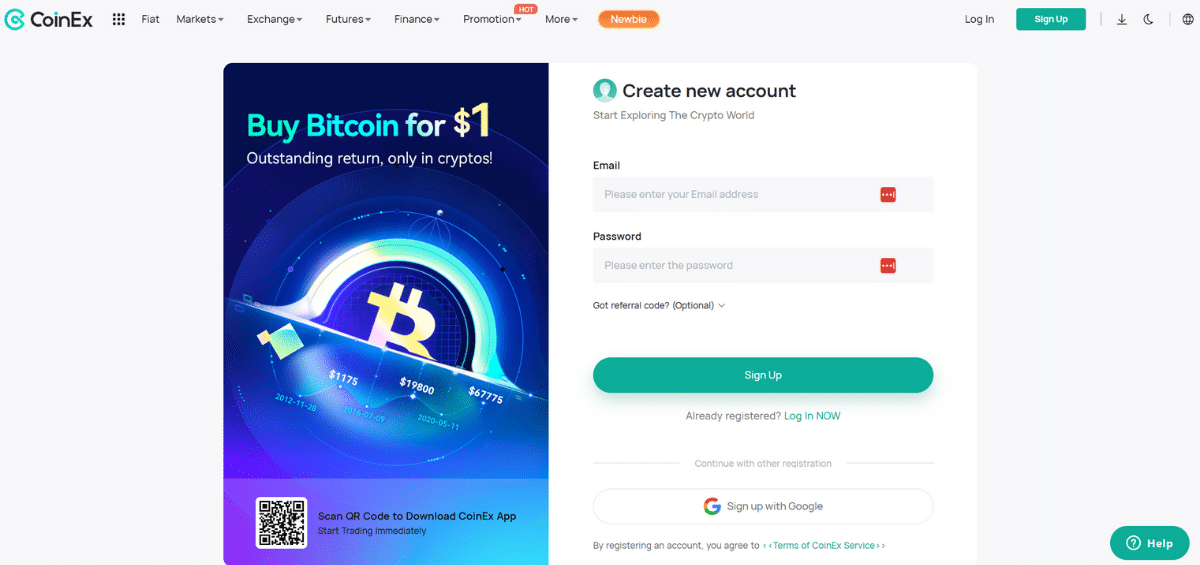

If CoinEx is available in your country, setting up an account is straightforward.

Hitting the “Signup” button will prompt you to input your email and password or sign up using your gmail account. After taking some details about your level of knowledge, you will end up on the dashboard where you can start trading.

The platform does not immediately require you to fill KYC details, but a newbie guide flashes when you hit deposit.

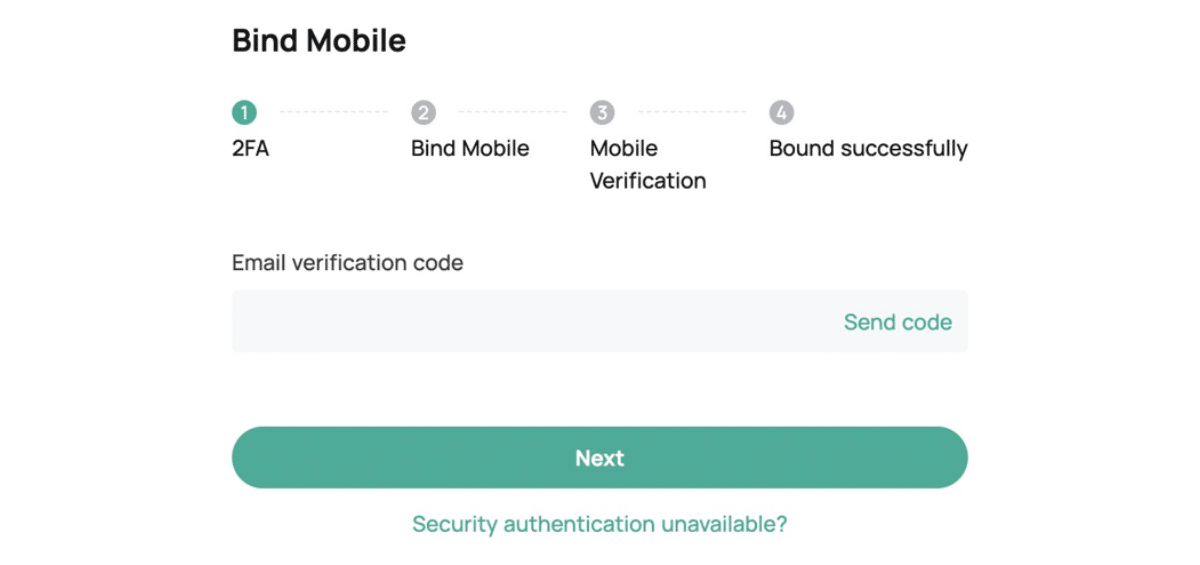

It is important to secure your account as a new user by completing the new user flow. You do this by initiating spot trading and then futures trading.

To complete the verification process you must choose between setting up a personal or enterprise account. You must then bind your mobile number to boost your profile’s security.

You will then need to fill out your basic information, upload your id card and then complete the facial recognition process. Once verified, a user will benefit from a higher ceiling in withdrawal limits.

A verified user can withdraw up to $1 million within a 24 hour period up from a $10,000 cap on unverified accounts.

Pricing and Fees

CoinEx offers favorable maker and taker fees compared to some of its peers. Fees are segregated for futures traders and spot traders.

SPOT MARKET MAKER

| Level | Ranking | Maker | Taker | Maker CET Deduction | Taker CET Deduction |

| Lv 5 | ≤ 10% | -0.02% | 0.05% | -0.02% | 0.040% |

| Lv 4 | ≤ 25% | -0.01% | 0.05% | -0.01% | 0.040% |

| Lv 3 | ≤ 45% | 0% | 0.06% | 0% | 0.048% |

| Lv 2 | ≤ 70% | 0% | 0.07% | 0% | 0.056% |

| Lv 1 | last 30% | 0% | 0.08% | 0% | 0.064% |

| Lv 0 | – | 0.20% | 0.20% | 0.16% | 0.16% |

FUTURES MARKET MAKER

| Level | Ranking | Maker | Taker |

| Lv 5 | ≤ 10% | -0.015% | 0.25% |

| Lv 4 | ≤ 25% | -0.010% | 0.25% |

| Lv 3 | ≤ 45% | 0.005% | 0.25% |

| Lv 2 | ≤ 70% | 0% | 0.25% |

| Lv 1 | last 30% | 0% | 0.30% |

| Lv 0 | – | 0.030% | 0.50% |

The broker charges trading fees of 0.2% with a minimum withdrawal of $0.6396461.

Deposit Methods

Crypto deposits are free on CoinEx as with most exchanges. CoinEx supports several fiat currencies to buy mainstream coins such as BTC, ETH, and USDT. Some of the supported currencies are USD, EUR, AUD, and GBP.

The exchange works with 11 third party providers that provide crypto onramp services.

These third parties accept payments via Visa, Mastercard and other payment methods such as Apple Pay. Here is a table showing the payment methods accepted by several crypto on-ramp services.

| Service Provider | Payment Method |

| Mercuryo | VISA, Mastercard, PIX, Apple Pay |

| BTCDirect | VISA, Mastercard, Bank Transfer, iDEAL |

| Guardarian | VISA, Mastercard, SEPA, Revolut |

| Banxa | VISA, Mastercard, SEPA, Bank Transfer |

| MoonPay | VISA, Bank Transfer, Apple Pay, Google Pay |

| LoopiPay | PIX |

| AdvCash | VISA |

| Simplex | VISA, Mastercard, PIX, Apple Pay |

| Remitano | Remitano Pay, Bank Transfer |

| OnRamp | UPI, IMPS |

| Onmeta | UPI, IMPS, NEFT |

Transaction processing takes place within 30 minutes of completing the payment process.

Withdrawal Methods

CoinEx employs the B2C model which allows users to buy and sell cryptos at any moment through the exchange’s third party partners such as Banxa, Moonpay and Remitano.

The withdrawal process is straightforward and easy. You can follow their withdrawal guide to ensure you don’t miss a beat.

The exchange does not detail how easy it is for users to move their stash offline incase of an attack. They do however talk about cold wallets and offline keys they have put in place.

Switching Between Currencies and Blockchains

With the third-party onramp partnerships available for users on CoinEx, users can easily switch their funds from fiat to crypto.

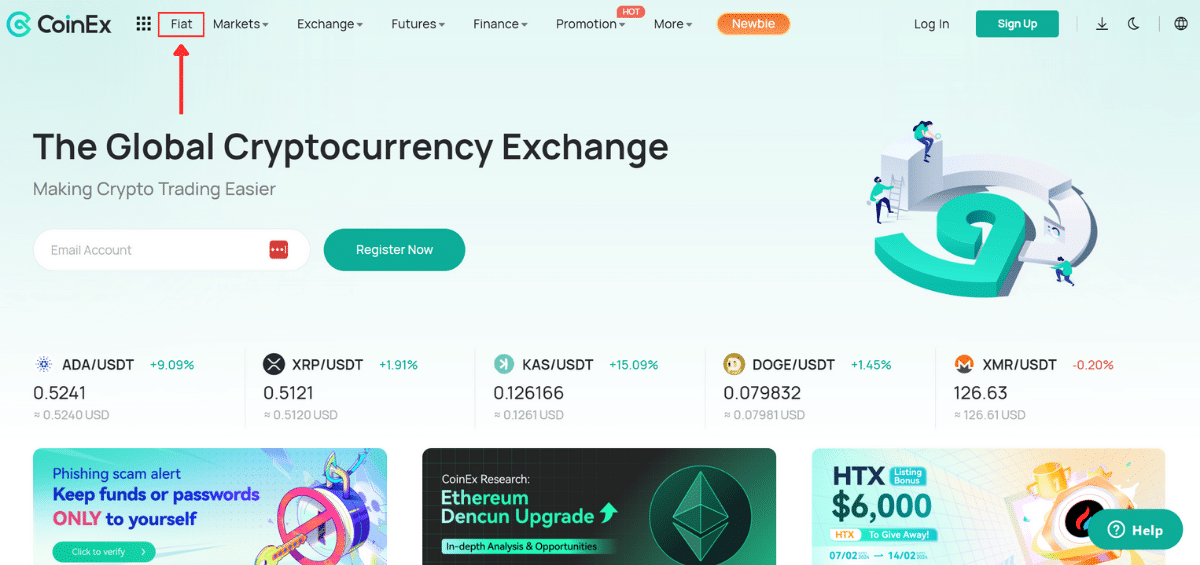

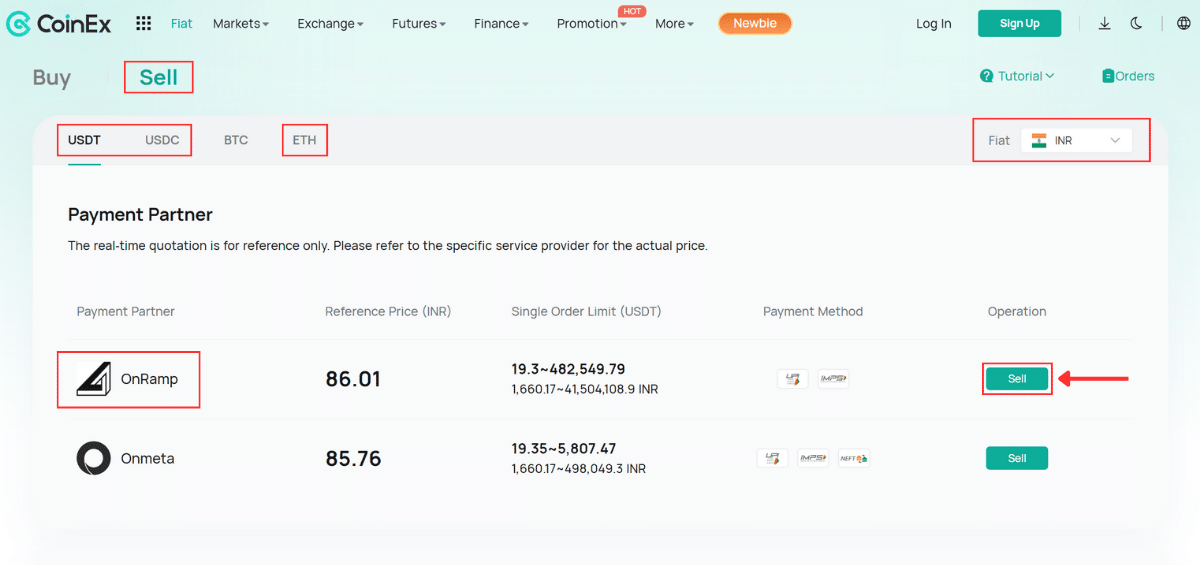

You do this by choosing your third party of choice and then sell or buy your cryptos through that gateway. Here is a brief guide in case you choose to go with Onramp for instance.

- You first need to register your account and enable 2FA, and then login to your Onramp account and complete ID verification;

- Login to CoinEx and click the fiat button.

- Select the fiat currency and the crypto you want to convert before selecting Onramp. Then click sell.

- It’s important to note that the exchange only supports USDT, USDC and ETH transactions via Onramp. You will need to check out other third party services like Moonpay if you want to transact in BTC and other tokens;

- Enter the amount you want to sell and click sell.

- It’s advisable to read through the attention notes carefully, then click to access the Onramp site.

- Double check the order confirmation and click.

- Enter the OTP code and click verify.

- Fill in your bank account details and click.

Depositing from fiat to crypto is very similar to this process.

History of Downtime

CoinEx has a recent history of being hacked like we highlighted earlier in this review. The hack caused a significant downtime where withdrawal services were disabled.

This became part of a crypto newscycle that led to the exchange resuming services and giving assurances that user funds were safe.

The exchange has made it clear that suspensions may happen under certain circumstances. According to their website, users can still withdraw and deposit using other blockchains.

Some of the circumstances that may lead to downtime include; hardforks, network upgrades, smart contract/token migration, airdrop snapshot or token delisting.

Customer Support

The exchange has a decent customer support system as per our checks. If you need help contact support to arrive at a help center page. The page will require you to fill out a “submit a request” form.

Other than the ticket form, the exchange has a live chat section with a response system of 5 minutes.

Alternatives

This is how the exchange compares to some of its peers.

| COINEX | KUCOIN | BYBIT | |

| Founded | 2017 | 2017 | 2018 |

| Users | 2 million | 30 million | 20 million |

| Cryptos | 600+ | 700+ | 450+ |

| Spot Fees | 0.2% | 0.1% – 0.3% | 0.1% |

| KYC | no | yes | yes |

| Countries | US, CA, CN | US, CA, CN | US, CA, UK, CH, SG |

| Registered | Hong Kong | Seychelles | Singapore |

| Signup | Coinex | KuCoin | Bybit |

Conclusion

CoinEx is a decent exchange if you are a retail investor, spot trader or even institutional investor because of some of its beefed up security features.

It’s ideal for retail investors who want to remain anonymous provided they can live with the $10,000 withdrawal cap within a period of 24 hours.

Is it the safest option for you in 2024? Calling an exchange that was hacked for millions in crypto in 2023 the safest option in 2024 would be a bit of a stretch.

A hack does not necessarily mean that an exchange is unsafe though. Kucoin is a top 5 crypto exchange yet it was hacked for $280 million back in 2020.

The exchange went on to recover 84% of the stolen funds and restored the rest from their own reserves.

Kucoin then bounced back with a strategic ‘safeguard program’ where a network with other exchanges was set up to help track and recover stolen funds.

CoinEx in its part bounced back from their incident with a new wallet system and a 100% reserve policy. This shows that there is a sense in which a hacked exchange comes back stronger with more beefed up systems that keep user funds safer.

Despite CoinEx’s recent hack history, it’s a decent bet for your crypto transactions.

Frequently Asked Questions

What services does Coinex offer for crypto users?

CoinEx offers asset management services as well as transactions through a diversity of assets where fiat currency can be converted into cryptos like BTC, ETH and other tokens. The exchange also offers swap trading, futures trading and a financial account where users’ funds can appreciate in value thanks to compound interest. The exchange also offers crypto loan services where a user can use one or more crypto assets to borrow other crypto assets. The borrowed assets can be withdrawn, used for trading or investing in financial management.

How does CoinEx protect its users and their assets?

After the 2023 hack, the exchange took further steps to protect its users. CoinEx stores most of their assets, there is an SSL encryption for data transmission and the use of multi signature wallets. The exchange has also declared proof of reserves to allay any fears of a liquidity crisis.

What are the costs associated with using Coinex?

Transaction fees depend on the volume of the orders. The flat fee offered is 0.20% which is within the global average range of between 0.20% and 0.25%. The withdrawal fee is 0.0005 BTC.