Table of Contents

There are more ways than ever to trade, exchange and invest in cryptocurrency. We continue to explore the full range of features across the crypto landscape to help the Libertas Bella community maximize profits as we surge into the next crypto cycle.

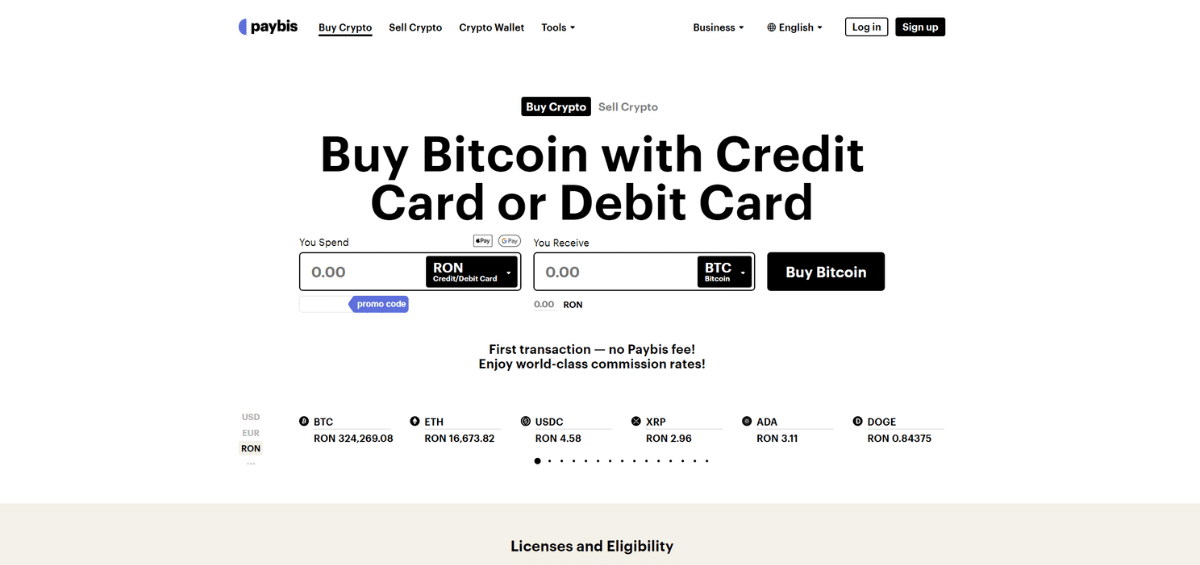

Paybis is an iOS, Android and Web centralized gateway to buy and sell Bitcoin with a credit or debit card in nine languages. After several weeks of our experts testing the Paybis platform, our verdict is Yes this is a worthwhile platform that serves a very specific important function.

The simple and straightforward Paybis interface makes it easy to buy, sell and exchange your Bitcoin for fiat. A crypto wallet, basic charts and a convenient crypto converter make it a breeze to get started.

Let’s examine what Paybis offers to crypto investors and what drawbacks we uncovered.

Paybis Overview

| Rating | |

| Security And Safety | 10 |

| Necessary Requirements | 8 |

| Pricing And Fees | 7 |

| Deposit and Withdrawal Methods | 8 |

| Customer Support | 8 |

Who Paybis Is Best For?

The user-friendly interface at Paybis is most suitable for anyone who would like to exchange Bitcoin and altcoins quickly and easily by utilizing familiar payment systems.

Beginners will find a no-frills simple interface that presents all functions within a single click or two right from the Paybis.com home page.

The Prices page shows a Buy/Sell button to easily determine what is available alongside basic price, market cap and chart information.

A crypto calculator is also a handy tool for beginners to easily convert from the various cryptocurrencies to USD, EUR and many dozens of other currencies. Crypto to crypto conversions are also made much easier with this calculator.

All prices on the crypto calculator are updated to reflect current market conditions. To buy Bitcoin, for example, it is possible to simply buy the amount that was converted right from the Buy button beneath the calculator.

HODLers who are looking for a quick way to accumulate digital assets for the long term will find a deep number of common payment systems matched to a long list of available cryptocurrencies. It is then fast and simple to make a sale and take profits back into the fiat currency of your choice.

Traditional investors who have been trading in stock markets, ETFs, index funds and foreign currency exchanges (FTX) will find a wide assortment of cryptocurrencies and altcoins here to help diversify their portfolios, while retaining the flexibility to easily exit positions at a moment’s notice.

Paybis, in fact, operates more like a brokerage than a typical crypto exchange, which makes it much less intimidating for this demographic of investor.

A high level of regulation and security will also appeal to investors accustomed to the strict standards of legacy financial systems.

Influencers, blog and website owners

Those who already have an established audience can best take advantage of the Paybis multi-tier referral program. Among the many benefits, users will receive:

- 20% from commissions on all purchases made by referrals

- Up to 30% multi-tier program for high-volume referral producers

- Get paid for all future purchases made from referrals

- No upper-bound limits

- Monthly payouts in Bitcoin or bank transfers

- Dedicated account manager

- Global access in 9 languages – 190 countries, 48 U.S. states

Businesses

Any business can add the Paybis API to their branded product listing and help their customers exchange a variety of cryptocurrencies just as if using Paybis itself.

After contacting the Paybis sales department and being approved, businesses can begin promoting.

Flexible integration for Web and apps available with customizable native software development kits (SDK) tailored to individual business needs.

Recurring payment options are standard.

No-KYC also becomes a possibility as terms and conditions are shifted to the third-party business.

For those businesses using KYC, there will be no double KYC, as Paybis will re-use businesses’ customer verification.

High conversion rates are touted at 98%.

All chargebacks are issued by Paybis, alleviating a common business risk and administrative headache.

Partner portal is issued which can be accessed at any time to view analytics, statistics and customization options.

Paybis promotes the following businesses as being ideal partners:

- dApps

- crypto wallets

- NFT platforms

- e-commerce

- exchanges

- DeFi platforms

- gaming

Limits from $4.99 to $500,000.

Processing fees as low as 0.49%

Who Paybis Is Not For?

A list of prohibited countries and U.S. states is available here.

Decentralization and privacy advocates

Paybis employs the highest levels of KYC. An email and phone verification process is just the beginning of the personal information that will be requested to use the trading platform. It’s not possible to even access the Paybis wallet or test the interface without full KYC verification.

Frequent Traders

Paybis only serves as a gateway to exchange funds between crypto assets and fiat, it does not function like a full market exchange.

As such, frequent traders – especially day traders will not benefit from the Paybis environment where fees are higher than the most active exchanges.

Additional third-party fees and outside network fees can add up quickly and create a prohibitively expensive trading environment in some cases.

Paybis Features Explained

Security and Safety

Paybis is fully registered and regulated by the Financial Crimes Enforcement Network (FinCEN) in the United States with permission to operate in all states with the exception of New York and Louisiana.

Paybis is recognized by the Financial Conduct Authority in the United Kingdom.

Paybis is registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

Paybis proudly touts its “industry-leading security.” This begins with the three-step account verification noted earlier, which includes strict adherence to the KYC and AML rules across the U.S. and Europe.

Security continues by promoting wallet safety which is often an easy gateway for scammers and hackers if individual security is not properly set up.

The most important initial security methods are to have a strong email password for the address linked to the Paybis wallet, and set up two-factor authentication (2FA).

Paybis makes it impossible to change the email address that has been established, which is a very important security measure when the email is tied directly to the user’s wallet.

The same is true for account deletion; this is not possible unless users contact Paybis directly to [email protected].

Paybis offers additional security protection by generating a 6-digit phone verification code that must be entered to confirm each transaction.

Other specific methods of securing user funds are understandably more hidden, but Paybis will pre-authorize credit and debit card transactions in order to provide another layer of potential rejection due to security concerns.

Paybis also will suspend an account if the company identifies a potential hack. While this might seem inconvenient, it is a legitimate method to help secure user funds.

Users can also utilize their own security best practices by keeping as much of their funds in several self-custody wallets to help distribute risk and minimize the likelihood of all funds being frozen or stolen from scams or hacks.

Paybis enhances its platform cybersecurity by offering bug bounties, which is a key way to help identify systemic vulnerabilities. This bug bounty program has its own dedicated email contact through [email protected].

Opening An Account With Paybis

Signup is a three-step process:

- Email verification

- Mobile phone number verification

- Access granted after full KYC verification and approval

KYC can be instantaneous, but normally takes a few minutes, and in rare cases can take up to 24 hours or longer to be verified.

Once approved all users can qualify for the affiliate program and begin inviting new users.

Note: Paybis advertises global coverage, with the exception of sanctioned countries and jurisdictions where cryptocurrency is banned, but it is always important to consult the Terms & Conditions page to discover what services might be excluded in your area. Stablecoins, for example, have an extra layer of regional regulation.

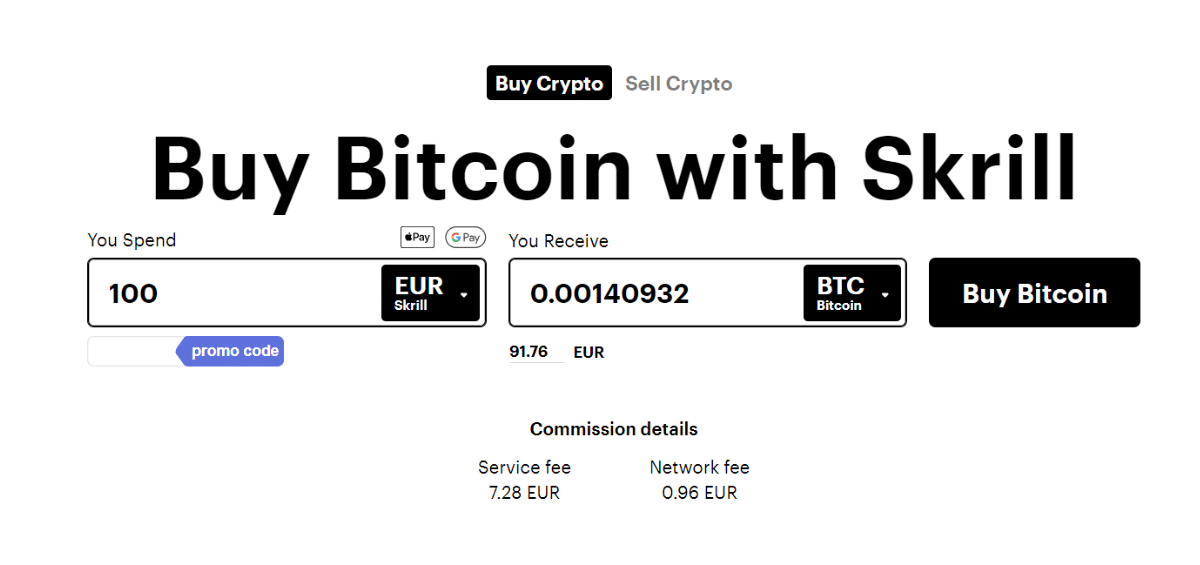

Pricing & Fees

Paybis does not operate with the maker and taker spot fees that are standard across traditional crypto exchanges. Instead, Paybis fees are more akin to broker fees found in standard finance.

The fee structure is split between Service fees and Network fees.

Service Fees

These fees will depend most upon the method of payment. Paybis stresses that bank transfer payments are less costly than some of the third-party payment systems.

Users must also account for which currency they are using, which can fluctuate – sometimes greatly – due to foreign exchange fluctuations.

A minimum transaction amount of 2 USD is also applied.

Network Fees

Fees generated by each cryptocurrency network also can vary greatly. These mining and network fees are added to all other transaction fees.

Fortunately, these factors are always completely transparent when Paybis begins the confirmation process. An example from Paybis is shown here:

It is always our recommendation to consult the fees page to find any updates prior to trading.

Disclaimer: Users should pay attention to possible fees incurred outside of the Paybis platform that might be applied during various transactions.

Your bank card issuer might apply a range of fees from cash advance fees and even additional fees when purchasing cryptocurrencies.

Exchange rate fees can be applied by banks above and beyond any foreign exchange price variations.

Bank transfer fees can vary widely, so it is best to consult your bank prior to making trades.

Deposit and Payment Methods

All supported cryptocurrencies, altcoins and stablecoins can be transferred into the Paybis wallet.

The most common cryptocurrency coins and altcoins are all readily available with some of the more obscure altcoins and Web3 tokens also represented:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Ethereum (ETH)

- Tether (USDT)

- Litecoin (LTC)

- Cardano (ADA)

- Chainlink (LINK)

- Dogecoin (DOGE)

- Ripple (XRP)

- Polygon (MATIC)

- Solana (SOL)

- Polkadot (DOT)

- Tron (TRON)

- Flux (FLUX)

- Ontology (ONT)

- Zilliqa (ZIL)

- Shiba Inu (SHIB)

- Aave (AAVE)

- Ankr (ANKR)

- Compound (COMP)

- Fetch.ai (FET)

Paybis incorporates a wide variety of 40 different fiat currencies and the following methods for deposits and to buy cryptocurrency and fund accounts.

- Visa credit/debit card

- Mastercard credit/debit card

- Bank transfer

- Wire transfer

- Apple Pay

- Google Pay

- Bizum

- Blik

- iDEAL

- Advcash

- Giropay

- Pix

- Interac

- POLi

- Skrill

- Neteller

Withdrawal Methods

Paybis offers withdrawal methods in all of the same areas of cryptocurrency and fiat used for depositing and transferring funds listed above.

Switching Between Currencies and Blockchains

Speed is a core consideration for all exchanges, and the same applies when buying or selling cryptocurrency and switching to fiat when needed.

Most fiat-to-crypto or crypto-to-fiat take place in less than 20 seconds, according to Paybis. After testing the system ourselves, we can confirm that the system is perfectly suitable for quick transactions among major cryptocurrencies, although more obscure altcoins with low volume will take longer.

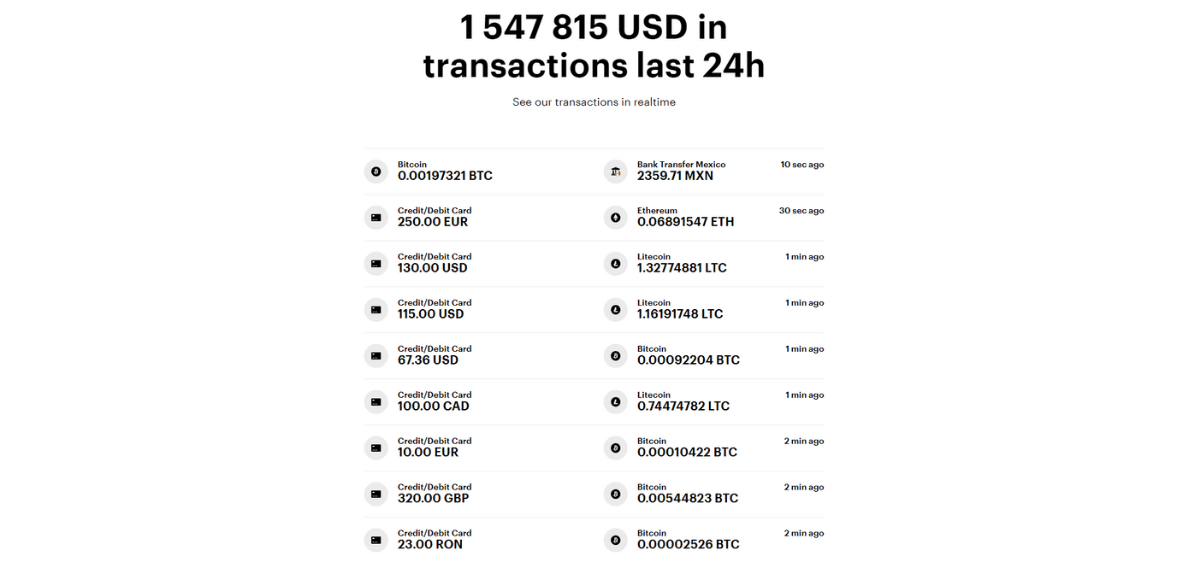

To ensure the fastest transfer speed, it is recommended to consult the convenient 24-hour transaction history page provided by Paybis. Here are the most common transactions of the nearly 2 million USD transacted:

History Of Downtime

We are happy to see Paybis offer a status page for full transparency of downtime or any ongoing service issues, including a full incident history and a way to subscribe to updates.

Updates and additional details about scheduled maintenance can also be found in their news section.

The Paybis exchange shows a highly commendable 100% reliable uptime over the previous 90 days in all service areas.

Paybis has never been hacked, but personal due diligence is always required to not fall prey to targeted scams, phishing or hack attempts outside the control of Paybis services.

Customer Support

FAQ. Web and in-app 24/7 live technical and customer support. Support ticket submission. Email. Site-wide search function. Social channels, app and site reviews also show a presence of customer support comments, explanations and resolutions.

Alternatives

Paybis vs. Alternatives

| PAYBIS | UPHOLD | COINMAMA | |

| Founded | 2014 | 2015 | 2013 |

| Users | 2 million | 1.7 million | 700,000+ |

| Cryptos/Fiat | 150+ | 250+ | 100+ |

| Fees | 2 USD service, network, 0.49% business | 2% avg. spread | variable service, network, payment processing |

| KYC | yes | yes, tiered | yes |

| Mobile App | yes | yes | yes |

| Card | no | debit | N/A |

| Countries | 190 | 180 | 180+ |

| Security Rating (CER) | AAA | AAA | A |

| Best For | beginners, traditional investors, HODL, business | intermediate, staking | intermediate, advanced, institutions |

| Overall Rating | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Signup | Paybis | Uphold | Coinmama |

Conclusion

Paybis is an outstanding service for those who are not interested in a full-feature exchange, but prefer an easy method to buy and sell their cryptocurrency in a fast and secure environment.

Top-notch security is backed up by top-level customer service options found in the clearly marked Support Portal. Dependable customer service is further reflected in a high Trustpilot score of 4.2 among the nearly 21,000 reviews.

The user-interface is simple and perfect for beginners, but also will be appreciated by those users who are familiar with traditional investment platforms that make buying and selling as simple as a click or two.

Paybis fees are reasonable and straightforward, instead of the often-complex fee structures of cryptocurrency exchange trading.

The only downside we could detect for beginners is that there is not a central learning library to help with key definitions and terminology. The search function is fine, but that is dependent on asking the right questions.

A solid referral program can reward all users, but a well-crafted tiered structure acknowledges the value of influencers, as well as blog and website owners, who can bring much higher volume to the platform and thus deserve higher payouts.

We were particularly impressed with the well-thought-out approach to wooing businesses with the integration of the Paybis API to allow full functionality and branding.

Customizable app integration and design elements will cater to a wide range of potential partners. Extra low fees, dedicated customer service, chargeback handling and a suite of analytics round out the impressive range of features for businesses.

However, Paybis should be understood as an ideal place only for those who would like to build a long-term diverse portfolio of Bitcoin, other popular cryptos and want to dabble in altcoins. It is not a place for day trading.

Lastly, because Paybis is most suitable for HODlers and novices, we would like to see options to purchase pre-selected bundles much like those that appeared in our Coinjar review.

Frequently Asked Questions

What Services Does Paybis Offer for Crypto Users?

Nine languages. Free custodial crypto hot wallet. Affiliate program. On/off ramp Paybis API for businesses to easily integrate the Paybis platform into their own site. Instant payouts with debit or credit card.

How Does Paybis Protect Its Users and Their Assets?

Highest level regulation and registration across U.S. and Europe, AML compliant. Three-step signup verification employs full KYC. Non-custodial wallet integration with private keys available.

Paybis custodial wallet. Impossible to change email address or delete account without contacting customer support. Bug bounties maintain cybersecurity best practices.

What Are the Costs Associated with Using Paybis?

First transaction is free. Service fees based on deposit and withdrawal method. Minimum transaction charge of 2 USD. Network mining and payment method transaction fees also apply.