Table of Contents

When it comes to crypto lending and borrowing, it doesn’t get bigger than Nexo. This is why we endorse the platform if you are looking to borrow or lend cryptocurrencies.

In a world where crypto exchanges can vanish faster than a meme coin’s value, we did our homework on this centralized exchange – so you don’t have to. After thorough checks, it’s a strong yes from us on this centralized exchange.

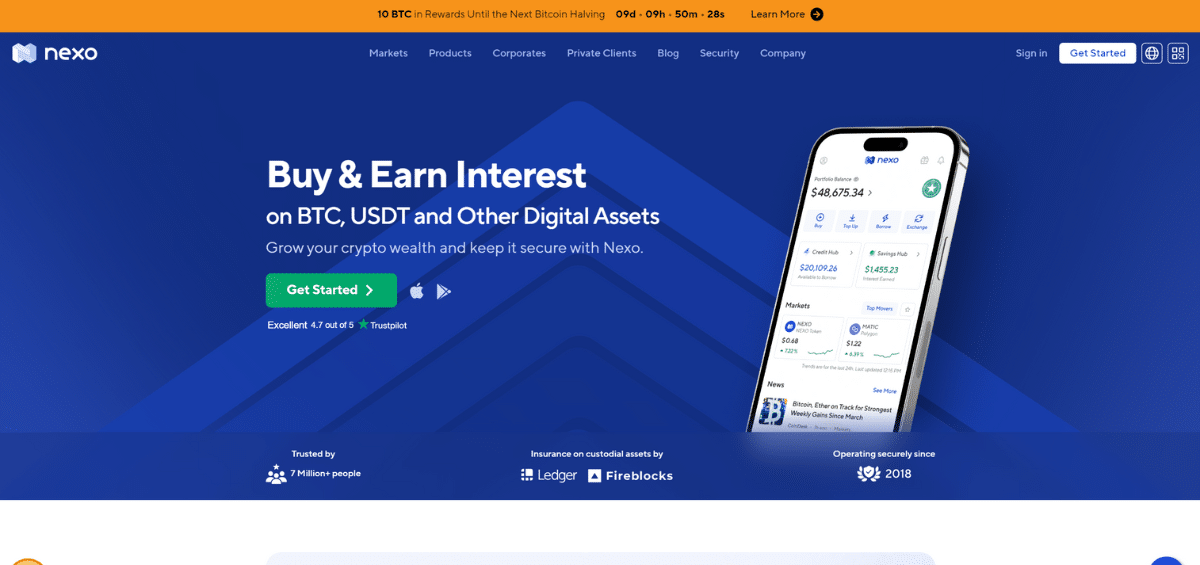

A quick glance shows a good-looking website with an attractive interface – that’s easy to navigate as you scroll down. A further scroll down will show you that the site has some reputable backers and some solid trust credentials.

Stick around as we break down who this platform is good for and what features it offers – we will also include a security caution statement to help you make an informed decision.

Nexo Overview

| Rating | |

| Security And Safety | 5 |

| Necessary Requirements | 7 |

| Pricing And Fees | 8 |

| Deposit and Withdrawal Methods | 8 |

| Customer Support | 7 |

We’ve carefully evaluated Nexo over several weeks to provide you with a comprehensive overview of its functionalities. Here’s a breakdown of our ratings on a scale of 1-10 (with 10 being the highest).

Who Nexo Is Best For?

Crypto lenders

If you are a crypto lender seeking a robust and efficient platform, Nexo offers a compelling solution. Nexo acts as a bridge, connecting lenders with a vast pool of crypto borrowers. Lenders have two options when it comes to how they want to earn passive interest on their crypto.

The platform caters to different earning preferences with its flexible interest program. You can choose to earn “in-kind,” receiving interest payments in the same cryptocurrency you deposit. This is ideal if you want to hold onto your existing crypto assets and benefit from potential price increases.

Alternatively, you can opt for Nexo’s native token, NEXO. This unlocks a sweet 2% interest rate bonus, but you’ll be accumulating NEXO instead of your original crypto.

With Nexo, the choice is yours: stick with what you know or explore the potential of the platform’s token. This flexibility allows you to tailor your earnings strategy based on your preferences for stability or potentially higher returns.

Crypto borrowers

Nexo’s lending feature lets you tap into the value of your cryptocurrency without selling it. You simply deposit your crypto as collateral, similar to a pawn shop. Based on the value of your crypto, you can borrow cash (fiat currency) or stablecoins (cryptocurrencies pegged to a fiat value) like US dollars.

This borrowed cash can be sent straight to your bank account, giving you immediate spending power. Nexo even offers a crypto debit card that you can link to your loan for easy purchases.

The key thing to remember with crypto’s inherent volatility is that the spending limit on your debit card will automatically adjust based on the current market value of your collateral. This ensures your loan stays secure even if there’s a price swing.

Institutional Investors

Nexo positions itself as the trusted partner for discerning institutional investors navigating the complexities of the digital asset landscape. Having earned the confidence of leading trading firms, hedge funds, family offices, and OTC desks –

It offers a comprehensive suite of services designed to empower success.

The platform’s deep liquidity pools ensure efficient trade execution, minimizing latency and maximizing returns. This potent combination allows for not only scaling operations but also exploring a multitude of investment strategies with unparalleled flexibility.

It gets even better for liquidity investors, thanks to the recent partnership sealed with Fidelity. Investors already using Fidelity to keep their crypto safe, can now tap into Nexo’s powerful crypto prime brokerage services. That means even more options for borrowing and lending with digital assets

Spot traders

This platform caters to spot traders thanks to its smooth and cost-effective crypto spot trading. With Nexo, spot traders can forget having to deal with clunky platforms and outrageous fees thanks to Nexo Prime’s best-in-class infrastructure.

The platform lets you execute even massive orders with ease, all while keeping your costs down with their competitive trading rates.

For those who prefer programmatic trading, API access is available. Alternatively, a user-friendly interface caters to those seeking a more traditional trading experience.

Their Smart Routing System acts like your own personal deal finder, automatically scouting the market for the best execution price. Plus, you get access to a giant pool of liquidity from top exchanges, liquidity providers, and even selected market makers.

Margin and futures traders

This platform supercharges your crypto strategy, offering leverage options for both spot and futures trading. Traders looking to buy more crypto than they can afford at the moment can have their buying power boosted at competitive interest rates.

Nexo’s leverage provision multiplies your holdings up to 5x, basically giving your buying power a nice boost.

Alternatively, traders can utilize perpetual futures contracts to gain exposure to a variety of cryptocurrencies without directly owning them. This approach allows them to capitalize on market movements without tying up capital in individual assets.

Here’s the best part: Nexo uses your entire portfolio as collateral, so if one of your cryptos is doing great, it can help offset any losses in another.

This holistic approach, combined with Nexo’s deep liquidity pool, means your leveraged trades go smoothly.

And for the futures traders out there who crave even bigger gains and maybe a little more excitement, Nexo offers leverage of up to 20x. Talk about amplifying your buying or selling power!

Crypto affiliates

Through their affiliate program, you can generate revenue by introducing friends and followers to the exciting world of crypto with Nexo. Every time an invited user leverages Nexo’s features, you earn a commission.

This includes 10% of the interest they earn on their holdings for the first year, 1% of any funds they borrow within 12 months, 0.2% of the total crypto they swap using Nexo, and even $20 for every invited user who makes three purchases with their Nexo Card.

Nexo also provides a user-friendly dashboard to track your earnings and monitor the performance of your unique affiliate links. This way your network is growing and the revenue it generates.

It also offers a generous 30-day referral window, so you’ll still earn commission if they register within a month of clicking your link. This effortless reach, combined with the extended window, maximizes your earning potential without any additional work on your end.

Who Nexo Is Not For

US traders

Nexo decided to withdraw from the US market in 2022 and issued a notice to US clients to withdraw all funds from its platforms by April 1, 2023.

The move was precipitated by problems with federal and state regulators, which culminated in a $50 million settlement for offering unregistered crypto lending products.

Nexo had previously reached an agreement with the SEC, after facing state-level cease-and-desist orders for the same issue.

No-KYC clients

Nexo operates as a fully regulated digital asset institution across all 200+ jurisdictions we serve. They adhere to KYC (Know Your Customer) regulations, a crucial step in verifying client identities and combating money laundering, fraud, and corruption – which means you can only access their products once your identity is verified.

Know Your Customer (KYC) checks ensure seamless operations with its banking and financial partners, and go beyond just protecting Nexo. KYC checks also safeguard user assets by adding a crucial layer of security – preventing unauthorized individuals from accessing user tokens.

For users who prioritize complete anonymity, the platform’s KYC requirements might not be ideal. Platforms like Changelly, Probit, and KuCoin offer non-KYC options for those seeking a different approach.

Nexo Features Explained

Security and Safety

Security is paramount in the crypto space, as headlines of exchange hacks and lost funds all too frequently remind us.

While few platforms can claim complete immunity, Nexo proudly boasts a flawless security record, but there was one security concern that caused ripples back in 2022 – we’ll get into that soon. For now, let’s discuss some of the features that make Nexo so solid.

Nexo insurance

Nexo prioritizes the security of your assets. They employ industry-leading practices and leverage partnerships with security powerhouses like BitGo, Ledger Vault, and Bakkt to safeguard your funds. This comprehensive approach is further bolstered by $375 million in insurance coverage for added peace of mind.

Nexo goes a step further by utilizing fully audited smart contracts, ensuring the underlying code governing transactions is rigorously reviewed and secure. Additionally, they conduct regular third-party penetration testing, proactively identifying and addressing any potential security vulnerabilities.

These combined measures demonstrate Nexo’s unwavering commitment to protecting your crypto assets.

Solid security partnerships

Nexo leverages industry-leading practices and partnerships with security specialists like BitGo, Ledger Vault, and Bakkt. BitGo offers Nexo access to SOC 2 Type 2-certified cold storage solutions, utilizing bank-grade class III vaults for the ultimate physical protection of your assets.

Ledger Vault further strengthens this security by providing digital asset custody infrastructure and insurance coverage up to $150 million for additional peace of mind. Bakkt in its part safeguards Nexo’s Bitcoin and Ethereum holdings using secure custody solutions with air-gapped cold storage.

This isolation from online environments minimizes the risk of digital asset theft.

An extra layer of protection is the platform’s ability to quickly view all its holdings both in ledger accounts and its main bank account – thanks to Fireblocks. This is extremely valuable as Nexo’s customer base continues to grow.

Beyond these partnerships, Nexo implements fully audited smart contracts to ensure the underlying code governing transactions is rigorously reviewed and secure. They also conduct regular third-party penetration testing to proactively identify and address any potential security vulnerabilities.

This unwavering commitment to security, coupled with Nexo’s $375 million insurance policy, provides a robust security framework designed to keep your crypto safe.

Nexo’s security scare

Nexo faced legal challenges in 2023. In January, Bulgarian authorities raided their offices amidst allegations of misconduct. While Nexo was ultimately cleared after investigation, questions lingered.

In May, they shut down their two UK subsidiaries and found themselves under renewed scrutiny in Bulgaria, this time accused of involvement in an organized crime scheme.

Though it wasn’t a direct attempt to breach its security systems, it represented a significant scare for investors. As at the time of writing, Nexo is seeking $3 billion in damages from Bulgaria following a halted criminal investigation that the company claims derailed its planned U.S. stock market listing and a major soccer sponsorship deal.

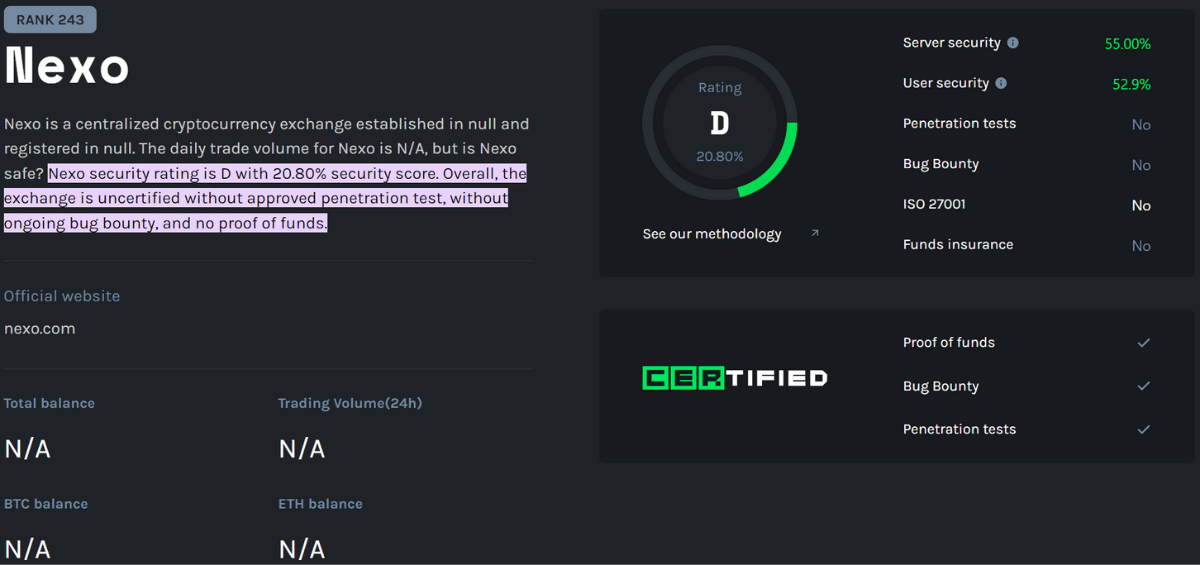

CER ranking

We ranked the platform at 5 because of its low CER ranking, attributed to lack of penetration testing, no proof of funds or an ongoing bug bounty.

The exchange does enjoy a trust pilot score of 4.7 though, which is pretty impressive.

Opening An Account With Nexo

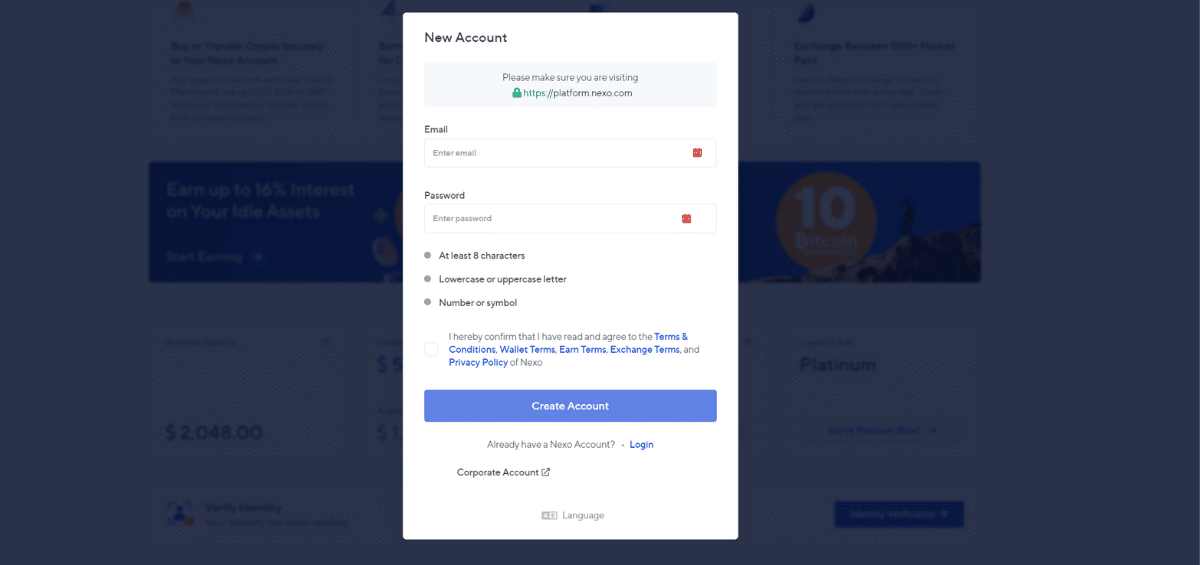

Creating a Nexo account is a quick and easy process. Follow these simple steps with screenshots to get your account up and running in just a few minutes.

- For on-the-go convenience, download the Nexo App, available on both the Apple App Store and Google Play. Start managing your digital assets with ease at https://nexo.com.

- Click “get started” and you will be redirected to an email page, where you fill out your credentials and create an account.

Pricing & Fees

There are zero deposit and withdrawal fees whether you’re making wire transfers or ACH payments. Nexo Pro offers standardized fees based on your trading volume.

Deposit Methods

You can use your Nexo account using various deposit methods. You can use Visa and Mastercard, and you can also use Apple Pay and Google Pay. To deposit funds, you must login and go to the dashboard, and scroll down to “assets” – to see the list of supported cryptocurrencies.

To deposit an asset, simply locate it, click the ‘Transfer’ button, and choose ‘Top Up’ from the menu.

Choose a network and then copy the “deposit address” using the “copy button”. Before sending funds, ensure the withdrawal network on your sending platform matches the top-up network you selected on Nexo. Then, locate and choose the desired crypto asset for transfer.

Your crypto will then appear in your Nexo account after the required blockchain confirmations.

Withdrawal Methods

Withdrawing funds from Nexo is quite easy. Go to the platform’s dashboard, click “transfer” and then hit “withdraw”.

Then select your network of choice from the drop down menu.

Double-check your withdrawal address and ensure the destination platform supports both the asset and network you choose. Platinum users enjoy one free withdrawal per month. Transfers between Nexo accounts are always instant, free, and unlimited

Switching Between Currencies and Blockchains

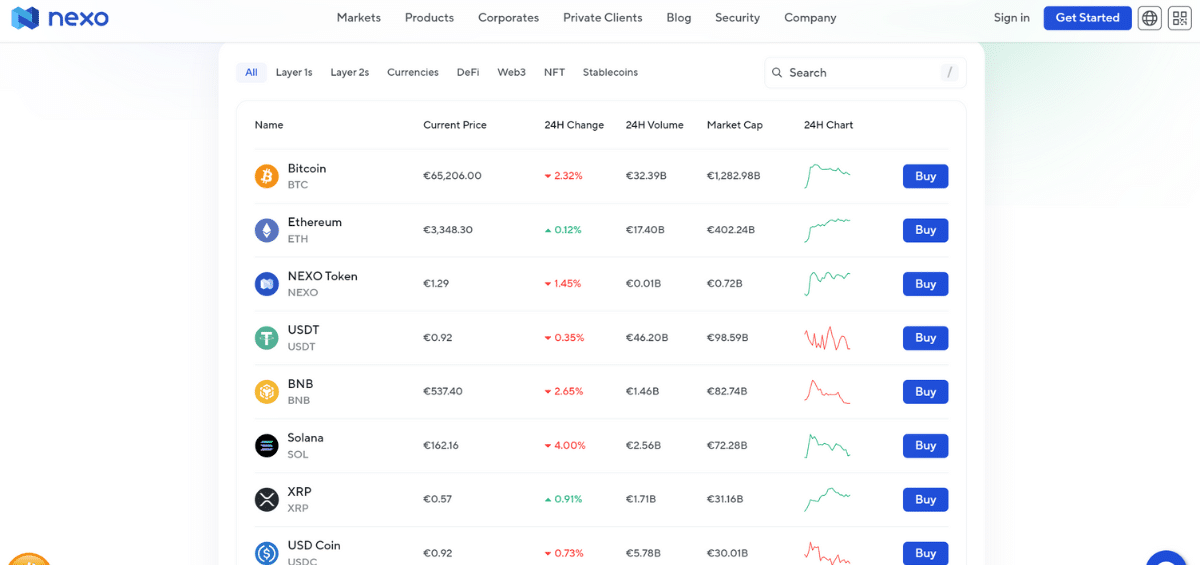

Nexo’s exchange lets you swap any supported crypto instantly, with no time wasted on confirmations. Effortlessly convert between fiat and crypto, or trade one crypto for another – all within the platform.

History Of Downtime

Nexo does not have much of a history of downtime except for an incident in 2022, where it experienced a real-time audit outage that led to rumors of insolvency. The incident was quickly resolved, laying those rumors to rest.

Customer Support

Their customer support gets a 7 instead of an 8 in our ratings because they lack a live chat feature. Users can get support through a ticketing system though, by clicking the chat icon at the bottom of the screen. They also have a comprehensive self-help section that addresses customer queries.

Alternatives

The platform has formidable competition from exchanges like Crypto.com, YouHodler and MyContainer. Here is how they compare.

| NEXO | YOUHODLER.COM | CRYPTO.COM | MYCOINTAINER | |

| Interest Rates | 2014 | 2016 | 2011 | |

| Assets Supported | 6 million | 80 million | 3 million | |

| Min. Amount | 100+ | 250+ | 100+ | |

| LTV Ratio | free ATM up to $250, free FX | free ATM to $200, 3% FX | no use fees U.S., $2.50 ATM, 3% FTX | |

| Signup | Nexo | YouHodler.com | Crypto.com | MyCointainer |

Conclusion

Nexo’s success is built on a trifecta of excellence: a user-friendly platform, a top-notch team, and industry-leading products. Unlike traditional banks, it lets you unlock your crypto’s value through lending, while offering decent APYs and a rewarding crypto cashback card.

Frequently Asked Questions

What Services Does Nexo Offer for Crypto Users?

Nexo operates as a centralized platform, offering a comprehensive suite of financial services specifically designed for the crypto world.

Users can buy and sell cryptocurrencies seamlessly, using either traditional fiat currencies or by swapping between different digital assets.

Beyond trading, Nexo empowers users to unlock the value of their existing crypto holdings by offering crypto-backed loans.

How Does Nexo Protect Its Users and Their Assets?

Nexo understands the importance of keeping your crypto safe. That’s why they prioritize user security with a multi-layered approach.

This starts with multi-factor authentication (MFA), an extra layer of protection that requires a second verification step beyond your password when logging in.

Nexo also leverages industry-leading cold storage solutions, ensuring your crypto assets are held offline and isolated from potential online vulnerabilities.

There is also a comprehensive crypto insurance policy secured by BitGo, a renowned custodian in the digital asset space.

This insurance provides additional financial protection in the unlikely event of a security breach.

What Are the Costs Associated with Using Nexo?

Depositing and withdrawing cryptos is free. Taker fees range from 0.03% to 0.20% for Nexo pro users.